Sugar #11 Oct’21

The day commenced wither side of 20c as Oct’21 looked to continue on from the surging positive close of Friday, though in muted morning volume it in fact struggled to move very far in either direction. The COT report on Friday showed a net speculative long at 249,246 lots (as at Tuesday’s close) and while the subsequent action may well have taken the live position to the 260,000 lot area to be approaching the yearly high there remains capacity for the funds to further add should they so wish. There was little evidence of any desire to do so today however and as we moved into the afternoon though we widened the range out with a push to another in the series of contract highs at 20.18 all moves seemed to end rather quickly and on each occasion we would had back towards 20c. The reason for this was the expiry of the September serial option this evening with vested interest in the 20c calls driving sufficient activity to maintain this level as the focus, and in so doing it created the calmest environment for a few days. The final few hours saw the range tighten further towards that 20c mark and in the closing shenanigans we ultimately saw Oct’21 settle above 20c for the first time at 20.03. With the options now out of the way tomorrow should present a better view as to the attitude of the funds at these higher levels and how much desire they have to continue looking to push north given the overbought technical picture.

Sugar #5 Oct’21

Having regained technical momentum during the course of last week to charge ahead to new life of contract highs there was a sense that we may see further gains for Oct’21 as specs look to capitalise upon this strength and look to bring the price above $500 to join the middle months. Following a calm start we were soon on our way with the morning seeing Oct’21 climb onwards beyond $496.50 while the Oct/Oct’21 white premium continued its resurgence alongside to reach towards $55. There continued to be relatively limited movement by recent standards as we moved through into the afternoon and though Oct’21 extended further to make its new high at $499.40 it could not break away by any further with the No.11 seemingly anchoring things ahead of tonight’s option expiry. The final three hours were played out comfortably within the range and tomorrow will potentially provide more freedom for the market as we look to see just how much further the currently overbought environment may extend.

The continuing recovery of the white premiums presents a better looking set of closing values despite nearby value remaining historically quite cheap, with Oct/Oct’21 now at $54.70, March/March’22 at $64.90 and May/May’22 at $81.00.

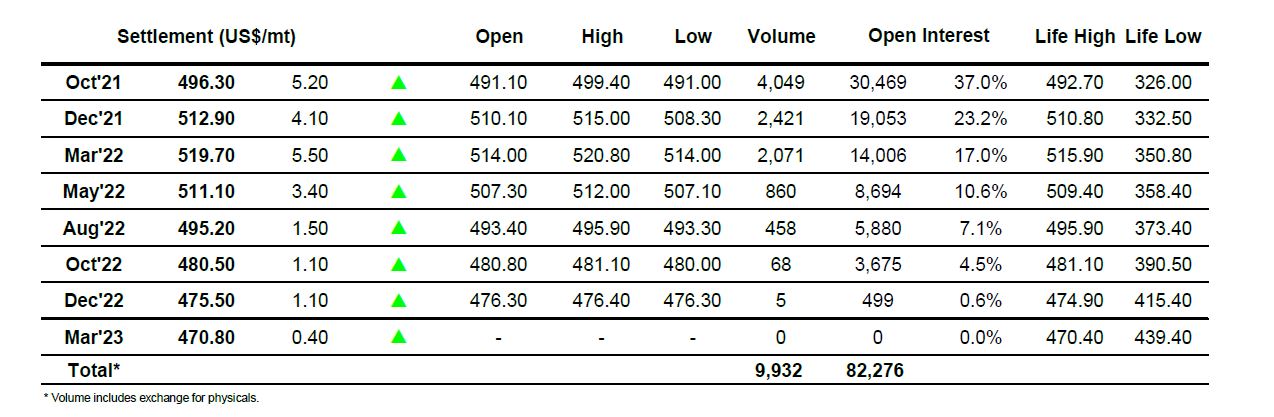

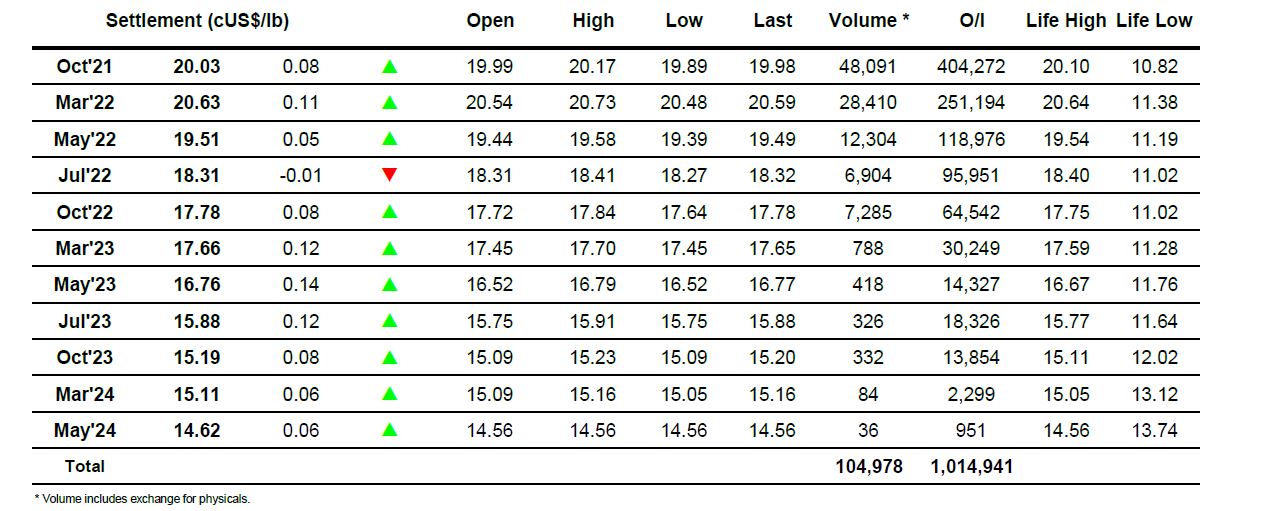

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract