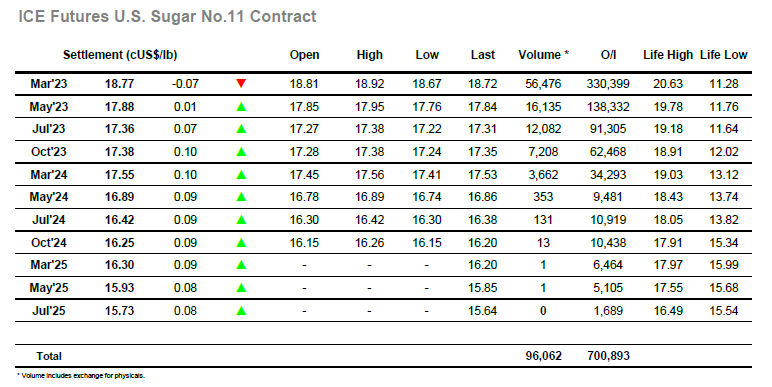

The market started the day with moderate losses, a neutral macro and limited spec interest contributing to a calm opening period. Friday’s COT report had shown the net speculative holding turn long for the first time since July, showing at 46,423 lots which represents buying on almost 57,000 lots over the week. With a further slide to 18.67 it seemed for a while that there was no interest in adding to this holding , however following a short period of stability the specs did emerge with a sharp push to take prices back into credit, an area at which we paused ahead of the US-day week getting underway. The afternoon drew some additional strength to the wider macro as the USD weakened, and this encouraged a degree of spec buying to return, although as with last week it was faced with a host of producer scale selling above 18.90, limiting its impact. Highs were recorded at 18.92 and with the new longs keen to maintain the strength as best they can the price continued within a few points of this level through until the final hour. With so little other activity taking place something had to give ahead of the close, and as long liquidation took place, so the market had a late tumble back towards morning lows. This also hit the nearby spreads with March/May23 trading back down to end the day at 0.89 points, while March’23 settled at 18.77 to suggest a continuation within the range unless the market can receive fresh news to enable the volume required to break through the overhead selling.

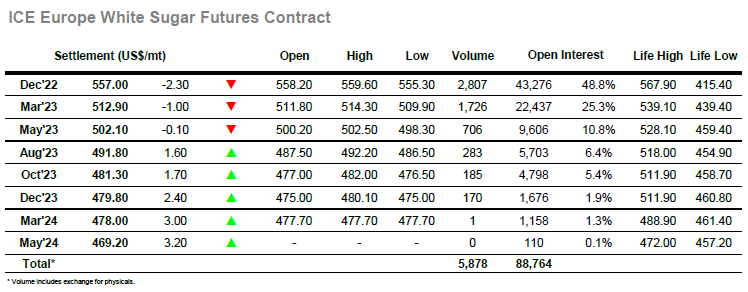

A choppy start to the week saw Dec’22 trading lower on limited volumes, the early stages seeing prices drop as far as $555.30 before re-gathering. Recent activity has been somewhat familiar day-on-day with the substantial spec long holding keen to protect their interests and maintain the market strength, and today saw the continue as buying during the later morning pushed prices back towards unchanged levels. The market then entered a consolidation pattern centred around $558.00 as longs looked to hold the price up without needing to add to positions, often a tricky task but in today’s low volumes a far simpler exercise. It was only during the final two hours that the price eased back into the morning range with some light liquidation taking place from day traders, in the process pushing the Dec’22/March’23 spread down slightly to trade $44.00. Closing values were to the centre of the range, Dec’22 settling at $557.00 to leave the picture unchanged for yet another day.