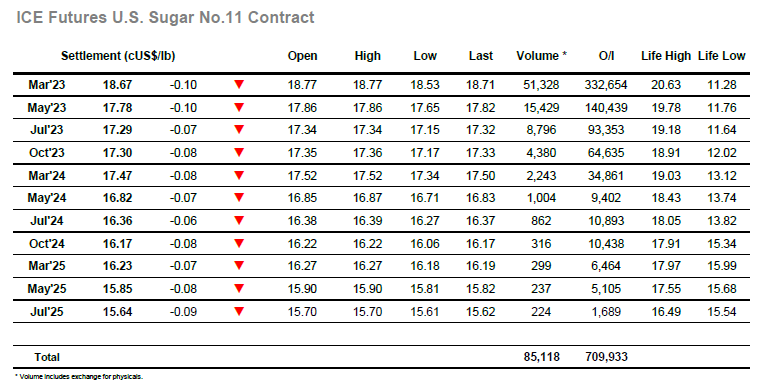

Opening prints at unchanged were fleeting and the market soon settled into a range either side of 18.70 to calmly consolidate as traders look to continue to hold the market and challenge 19c. Pressure being applied at the front of the whites board was having little impact until we saw an early afternoon delve down to 18.58, however such was the low volume nature of the move that any selling was being mopped up to leave the market broadly sideways. There has been some greater macro correlation during the last couple of weeks however today saw a fresh detachment when following marginal new lows at 18.53 the market turned back upward to the low 18.70’s, despite crude values losing around $3 across the same period. With spreads flat on the day, it was left to day traders to continue padding around during the final two hours to see the market heading quietly into the close to the upper end of the range. A little late selling didn’t influence settlement as March’23 closed at 18.67, concluding another quiet day with moderate losses which raise further questions as to the capability to move and sustain beyond 19.00, something which seems unlikely unless the larger funds find reason to re-enter to the long side.

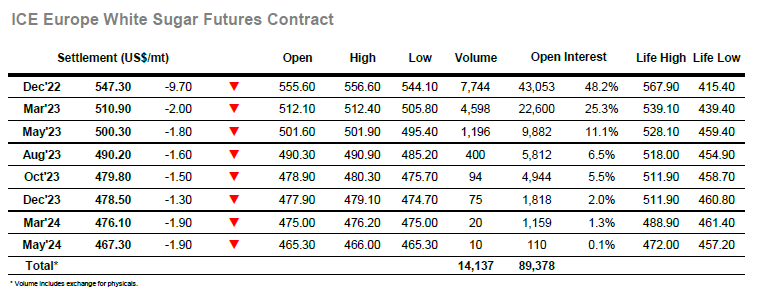

The market was immediately on the back foot this morning as selling emerged to send Dec’22 quickly down beneath $553.00, and at the same time impacting the Dec’22 spread values. Macro values were leaning toward the negative although the energy sector was holding moderate gains, and so discounting any significant outside factors one had to assume the move was being driven by spec liquidation with recent activity having likely taken their holding toward its maximum limits. Efforts to hold the market gradually faded due to the limited interest from trade/consumers and having reached the $550.00 area soon after noon a bundle of sell stops were triggered which sent the front month tumbling to $544.10. Spreads were also severely impacted with Dec’22/March’23 trading down towards $37.00 though such was the apathy outside of the front month that losses for 2023 positions were confined to a few dollars only. The afternoon proved to be far calmer with a base provided through consumer buying as the lower levels drew out some opportunistic pricing at the front of the board, allowing Dec’22 to hold in front of the lows. An effort to push prices back up lat6er in the day faltered just shy of $550.00, with this failure leading to day trader liquidation to send prices back towards the lows as we approached the call. Reaching the close Dec’22/March’23 had made new lows at $35.70, and while there was some defensive buying into Dec’22 on the call the closing level at $547.30 presents a weak close and leaves the market vulnerable to further losses in the near term.