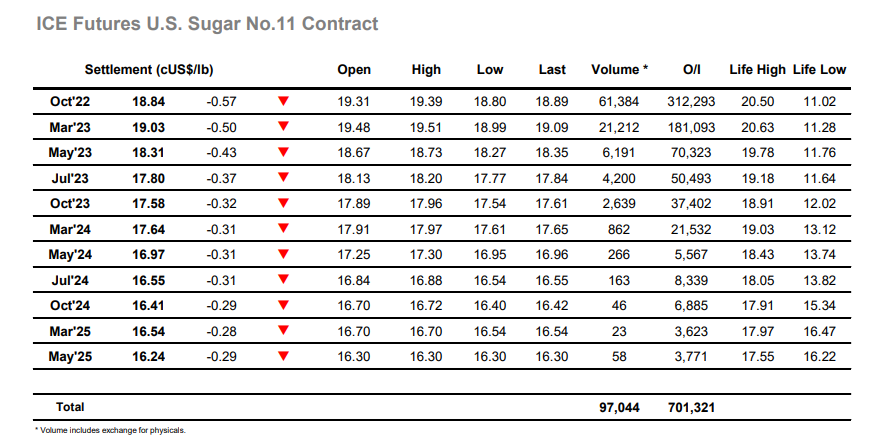

Last night we alluded to the fatigue being seen in the market following the gains of the past two weeks, and there were further signs of this as things got underway today with a marginally lower start soon leading prices to slip beneath 19.20. While this movement could also be attributed to a weaker macro picture there was seemingly little prospect of an immediate pullback with specs now liquidating their recent established longs as they swing around within the range once again, while consumers continue to have little interest at such elevated levels. In quiet conditions the trend continued lower as we moved through the afternoon, and while there was a brief hint of recovery later in the afternoon as other commodities erased losses it proved top be fleeting and Oct’22 soon dropped back beneath 19.00. Session lows were recorded at 18.80 as we reached the close with the Oct’22/March’23 having fallen back to -0.19 points, with settlement level at 18.84 negatively suggesting that further correction may be in the offing.

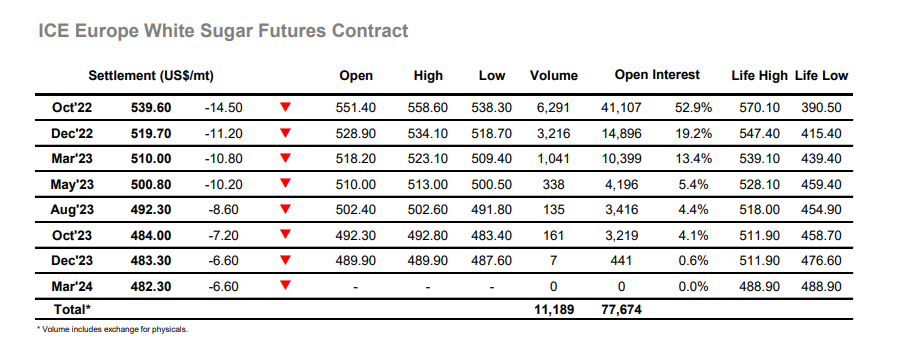

There was some volatile price movement for Oct’22 during the early part of today’s session as a lower start was quickly reversed with a push to $558.60, however movements elsewhere in the macro were negative and so we followed the trend by reversing back down through $550.00 before the situation calmed. With the specs not buying and the market some distance away from any substantial consumer interest the market was struggling to regain any ground with a flat period coming to an end early in the afternoon as more spec liquidation extended the Oct’2 range down through the $540’s. This placed white premium values under further pressure with Oct/Oct’22 trading down to $122.00 while March/March’23 eased slightly to $89.00. Progressing through the afternoon there was some macro recovery which encouraged a small degree of buying to bring prices up slightly from the lows, however it was remarkably short-lived with the recent fatigue outweighing the macro and new lows were recorded heading into the final hour. Oct’22 reached a low at $538.30 and settled only a small way above at $539.60 to conclude a weak performance with further struggle selling likely unless the macro produces significant strength.