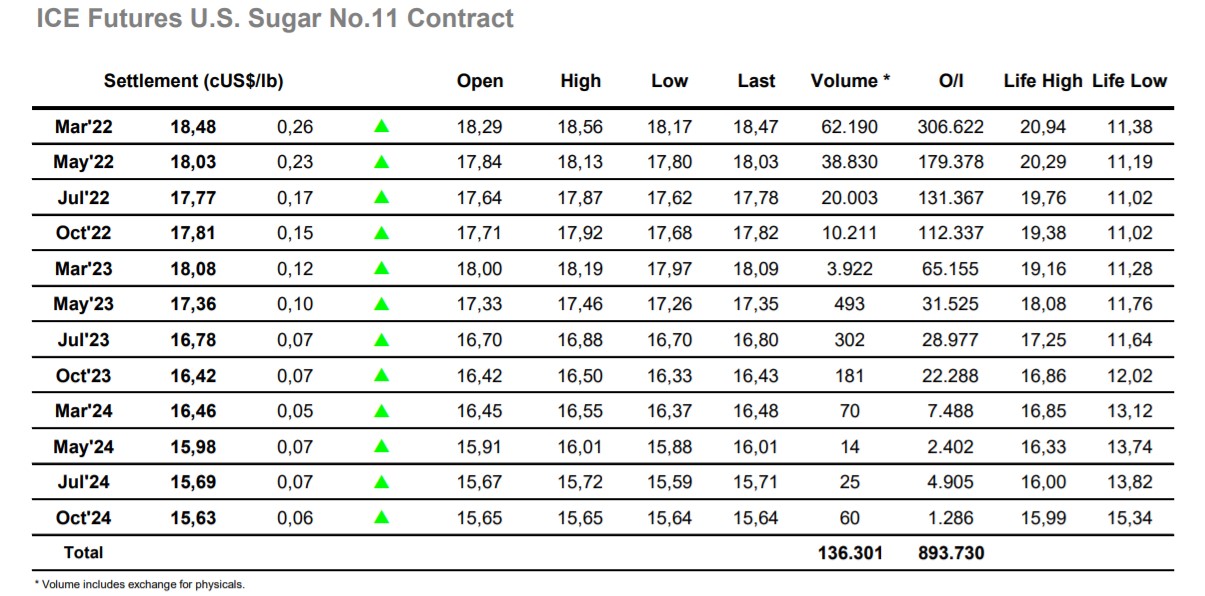

Sugar #11 Mar’22

The stunning resurgence seen late yesterday gave the market something to try and build upon for the first time in a while and though the opening stages saw mixed activity we generally remained above closing levels with March’22 then able to build a base around 18.30 as the morning wore on. Volume was calm with many nations celebrating the lunar new year while with larger funds having considerably reduced their positions over the past month the activity of smaller specs and algo’s may take on even greater short-term significance. It was this sector who pushed values up further during the early afternoon as new longs and short covering combined to take March’22 up through 18.50. While producers have been very quiet of late the area above 18.50 did draw out some moderate scale selling, and it was of sufficient size to temper progress and lead to a period of consolidation. For several hours the price edged either side of 18.80 as longs looked to try and hold onto the progress made, but despite their best efforts the March’22 contract could not progress beyond 18.56 on each occasion that a push was made. There were to be no fireworks to conclude today’s session with a remarkably calm closing call seeing March’22 end at 18.48, a positive conclusion which stems the tide lower and may lead to some calmer trading for the coming days.

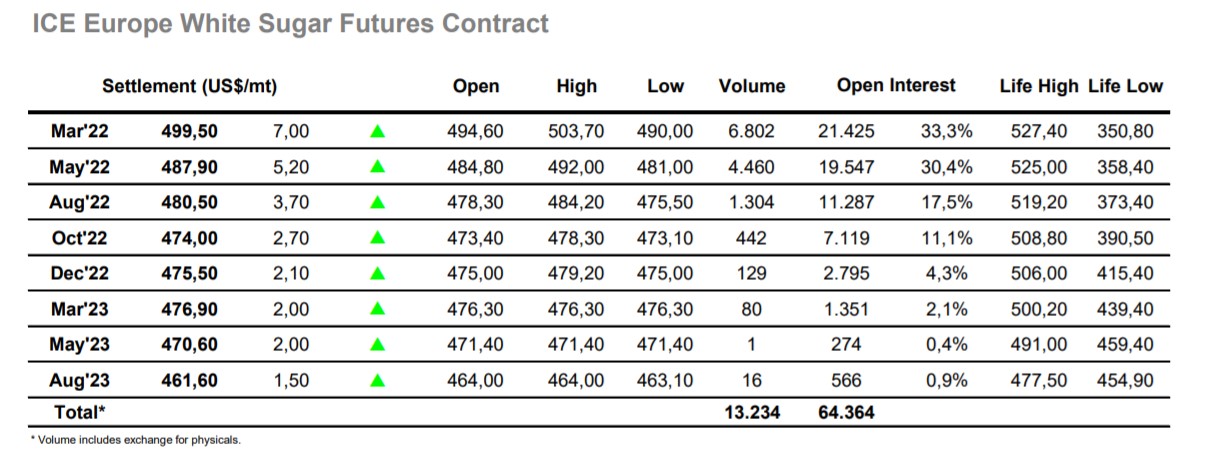

Sugar #5 Mar’22

The market commenced a touch higher but though No.11 values were looking to maintain their late rally from yesterday there was no such interest from the whites as price slipped back down towards $490 and further narrowed the March’22 white premium to $89, a $6 loss in just an hour of trading when combined with last night. Supportive action in the wider macro then encouraged light buying interest to pull away from these lows however there was no significant drive and the price stalled ahead of the opening highs where quiet consolidation followed. Continuing positive movement elsewhere drew some more buying in during the early afternoon and this drove prices slightly more aggressively through a relative vacuum to peek above $500 before encountering some profit taking from the very same specs who had driven it up. While this could have proved critical to the hops of a recovery on this occasion it did not and so we were able to maintain the higher values and move through the afternoon holding either side of $500. Much of this was down to spread buying where we saw March/May’22 out to $12, something which also aided the March’22 white premium in returning to $93. A high at $503.70 was only briefly seen and in calm trading the market eased back to end the day comfortably holding the $500 area once again. March’22 settled just beneath at $499.50, a solid finish as the market looks to build a base from which prices can try and hold.