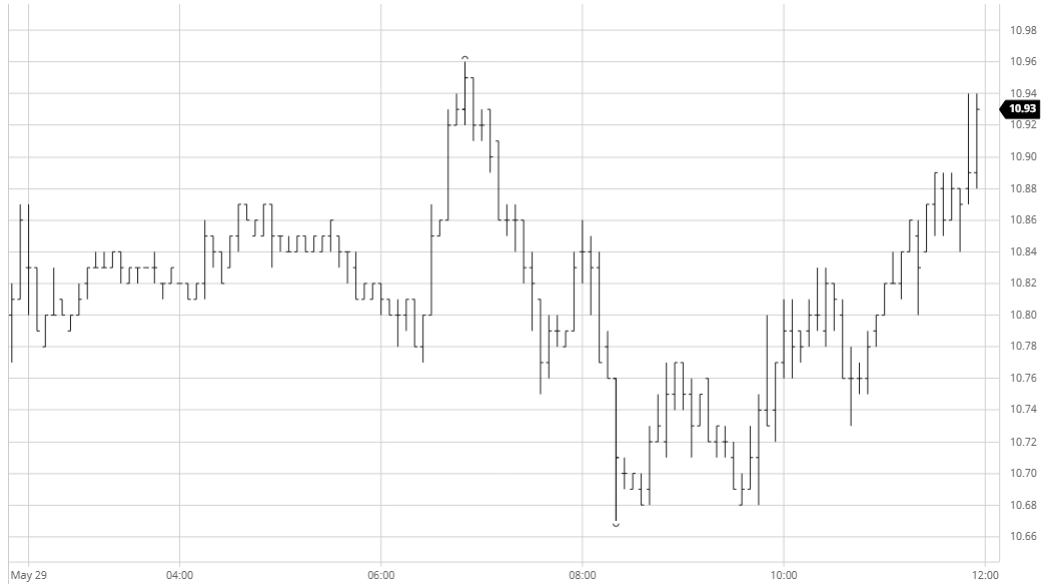

Yesterday’s largely slow performance was maintained throughout an even slower morning with Jul’20 holding to a mere 9 point range across the first four hours of trading. The monotony was only broken as specs gave a light push higher ahead of the US morning although the move had no substance and soon stalled having reached a new daily high at 10.96 before quickly giving back the gains on some long liquidation. Using a theory that it if the market can’t go one way then surely it must go the other we then saw a push down to 10.67 however despite rolling along near the lows for a while the market then gravitated back towards unchanged levels once more. The USDBRL retreated back beneath 5.40 to give back some of the recent gains however that made no difference to the producers who remain detached from the market currently. Specs drove Jul’20 back into credit during the final hour to ensure that we end the month with a positive settlement, however with the COT anticipated to show a rather flat net fund position and the macro rather quiet there is nothing currently to suggest that next week will bring much greater excitement.

N.o 11 Futures

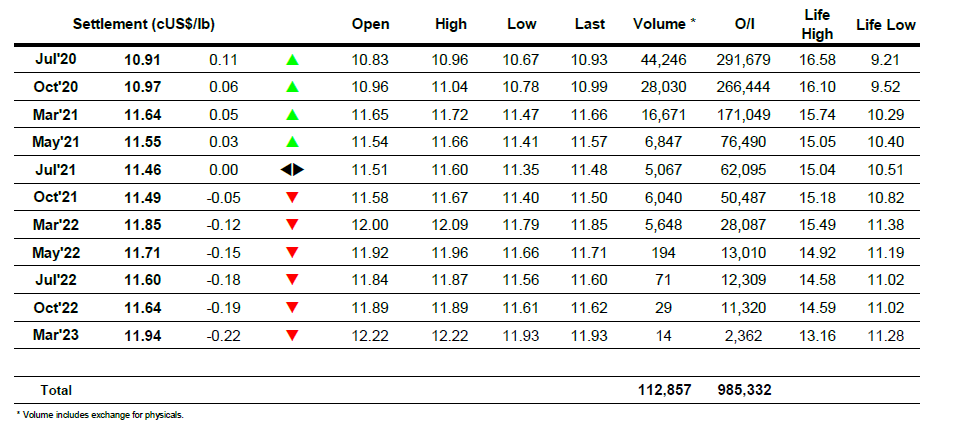

ICE Futures U.S. Sugar No.11 Contract

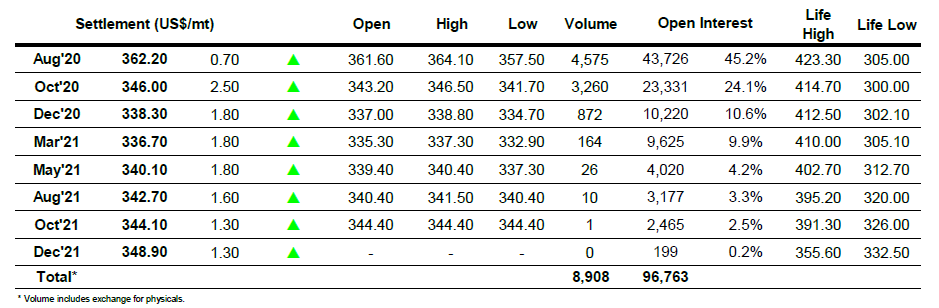

ICE Europe White Sugar Futures Contract