Insight Focus

- EU approves additional carbon permit supply worth €20 billion by 2026.

- Funds from sale will be used to boost the roll out of renewable energy.

- Short term carbon permit prices remain supported.

EU Parliament vote sets up additional supply of 270 million EU carbon permits by 2026

The European Parliament on Tuesday morning approved a proposal to raise funds to help the bloc transition away from Russian fossil fuels and speed up the energy transition, which involves bringing millions of additional EU carbon permits to market and could depress carbon prices for up to three years.

Source: Shutterstock

The REPowerEU initiative seeks to boost the roll-out of renewables by increasing the bloc’s target from 40% to 45% of total energy supply by 2030 and cutting fossil fuel use in industry and transport, which the European Commission says will require investment of €210 billion between now and 2027.

The Commission is to draw funds from a variety of sources to support these measures, one of which will be the EU Emissions Trading System.

A total of €20 billion worth of EU emissions Allowances (EUAs) are to be sold to the market between 2023 and 2026, according to the proposal, which now goes to the European Council for approval before it enters into law later this spring.

Up to €8 billion worth of EUAs will come from bringing forward scheduled auctions by EU member states between 2027 and 2030, while €12 billion will be sold from the Innovation Fund, a 400-million-EUA reserve that was set up to support new low-carbon technologies and processes.

The proposal offers no details of a specific volume of EUAs to be auctioned, but market sources have estimated around 250-270 million EUAs may need to be sold to raise the €20 billion, assuming a carbon price of around €74/tonne.

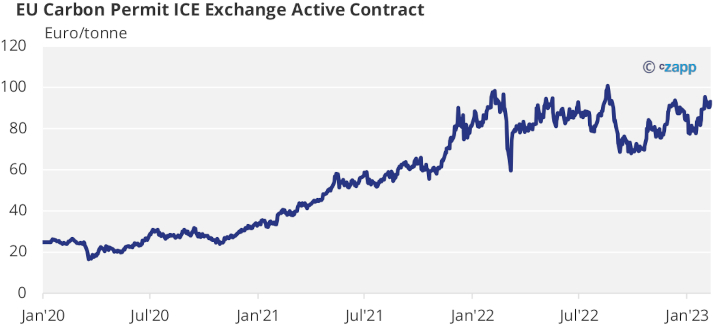

The proposed sale of additional EUAs comes as Europe’s carbon market is dealing with the conflicting influences of rising demand due to the increase in coal use, and a decline in industrial output amid a near-recession across the EU’s member states that is expected to depress EUA demand from non-power industries.

The addition of as many as 60 million EUAs to annual supply between 2023 and 2026 is expected to depress EUA prices, as the increase in supply comes on the back of a decline in demand.

Most analysts expect industrial emissions to have fallen by 30-50 million tonnes in 2022, while power sector CO2 will have risen by 12 million tonnes, for example.

A recent poll of more than ten sector experts concluded that EUA prices will average around €80 this year, after averaging just over €81 in 2022.

Source: Shutterstock

In the short term, carbon prices are expected to remain close to their current €90 level, as investors and speculative traders are widely said to be focusing on the March options contract, where the €90 strike price holds the most open interest on the main ICE Index exchange.

The short term picture is also supported by the start of the annual compliance cycle, when industrial plants around Europe need to surrender EUAs matching their 2022 verified emissions. This will force a number of companies into the market to buy additional EUAs.

The supportive outlook is enhanced by expected delays to the issuance of free 2023 EUAs to many industrial plants this year.

Increasingly complicated calculations processes mean that many member state governments missed the February 28 deadline to hand out free EUAs in 2021 and 2022, and there is no reason to expect any different in 2023.

And because some industrials have previously used freshly-issued EUAs to pay off their previous year’s compliance, the delays are forcing more companies to buy EUAs that they would have previously “borrowed” from their next-year allocation.

In 2024 however, the entire issuance and compliance cycle will be shifted to the period from June to September, giving governments more time to calculate their free allocations and relieving pressure on industrials.