Insight Focus

EUAs have recovered their tariff-induced losses since April 1. Carbon is shrugging off continued weakness in natural gas. Traders are already eyeing end of REPowerEU auction programme in 2026.

EU Carbon Prices Rebound

European carbon allowance prices have rallied over the past two weeks, driven by a gradually calming macroeconomic environment and a steady improvement in market sentiment. Analysts suggest that prices may be heading for a sustained rally in the second half of the year.

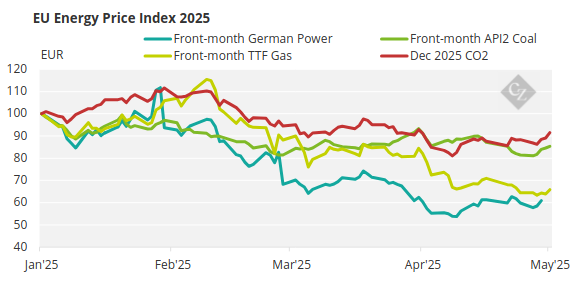

The EU ETS, along with the major European energy markets, were thrown into turmoil in early April by the White House’s announcement of wide-ranging tariffs on imports from all major trading partners.

This triggered steep selloffs in equity markets, with the Eurostoxx 50 index plunging 13% between April 1 and April 9, while the US S&P 500 index dropped nearly 12%. Energy prices also declined over the same period, with Brent crude oil sliding 12% and TTF natural gas falling 12%.

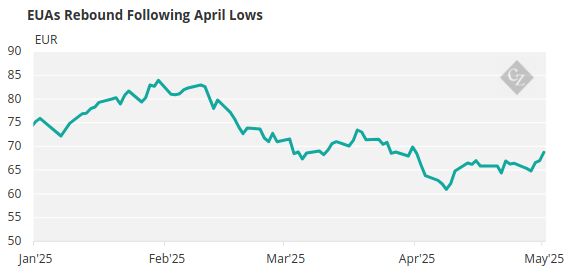

EU Allowances retreated by 13% over that same April 1-9 stretch, reaching a six-month low of EUR 60.07 on April 9. Since then, however, the market has slowly recovered and, as of May 2, was trading around the EUR 69 mark. This recovery was chiefly bolstered by demand from compliance buyers who took advantage of the long-term low prices to top up their holdings for 2024 and beyond.

Source: ICE

EU Auctions Boost Supply

At the same time, market participants have reported a gradual improvement in sentiment, while analysts have also suggested that prices are set for a period of consolidation and increase as the supply outlook tightens.

Current market supply is being boosted by the injection of additional EUAs to help fund the EU’s transition away from Russian fossil fuels. This EUR 300 billion REPowerEU initiative is being funded chiefly by borrowing, but around 8% of the funds are being raised by the sale of 250 million additional EUAs.

These allowances are in part being brought forward from member states’ auction reserves for the period 2027-2030, and this means that auction supply is set to drop sharply in the last three years of the current phase.

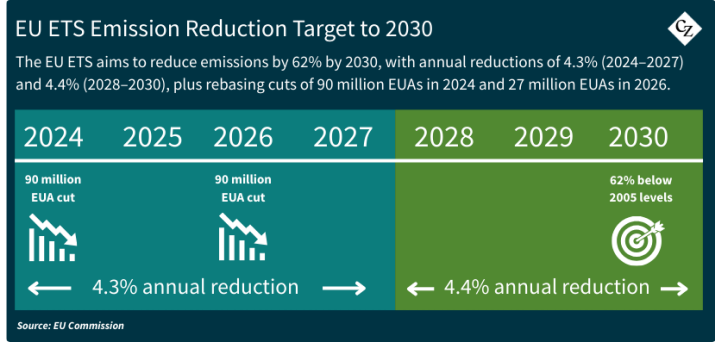

Combined with this reduction in auction volumes, the annual cap on emissions is being adjusted downwards – by 4.3% from 2024 to 2027, and by 4.4% from 2028 to 2030 – with a one-off reduction of 27 million EUAs in 2026.

The sale of additional EUAs under REPowerEU began in the summer of 2023 and is set to run through mid-2026. So far, these sales, totalling 152 million EUAs, have raised just over half of the intended EUR 20 billion.

Trading sources have pointed out that a jump in EUA prices is widely anticipated for 2026 when the REPowerEU sales come to an end, and that some speculative traders may already be positioning themselves for that price rally.

Analysts at Energy Aspects said last week that the EUA market will go “from being more or less balanced in 2024 and 2025 to a very, very short” in 2026 onwards. Already, they said last week, “we have started to see both in 2024 and 2025 a little bit of a recovery in hedging”.

Indeed, it’s possible that the run-up in prices between December and January, when EUAs rose from EUR 64 to nearly EUR 84, may have reflected a period of early investment fund accumulation in anticipation of this rally.

Gas Imports Ease Pressure on EUAs

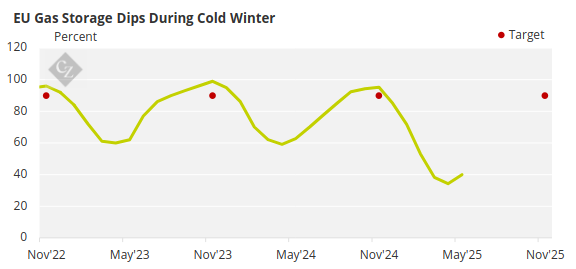

EUA prices have also tended to reflect the changing fortunes of the natural gas market. TTF gas prices climbed to year-to-date highs in early February as the winter season saw gas storages depleting faster than expected.

Source: AGSI

With Russian pipeline gas no longer coming to Europe, the bloc is importing larger quantities of shipborne liquefied natural gas (LNG), and competition between buyers in Europe and Asia maintains the two markets in close correlation.

In recent weeks demand from Asia has declined, and this has encouraged more vessels to divert to European ports, lowering prices in the region, and TTF is now trading near its lowest in 10 months.

Typically, cheaper gas also drags carbon permit prices lower, but in recent weeks EUAs have been relatively resilient.

Source: ICE

In technical terms, analysts see a key price resistance level at just below EUR 71, where the market peaked ahead of the US tariff announcements and where the 200-day moving average currently sits. Overcoming this key level is the market’s immediate task.