Insight Focus

EUAs have fallen back after reaching three-month highs. UKAs dropped as investors began to worry about the likelihood of the markets linking ahead of summit. EU carbon now tracking equities closer than gas.

Carbon Prices Stall Ahead of Summit

The recent run-up in European and UK carbon prices came to a screeching halt last week as EU prices came up against a strong psychological barrier, while UK levels reversed course amid a bout of pre-summit anxiety among traders.

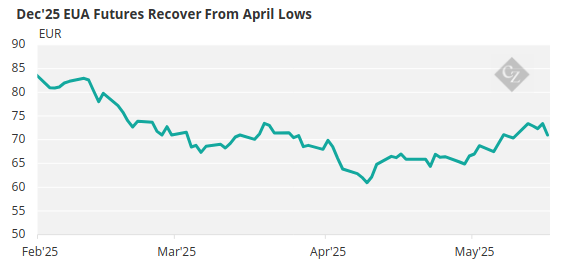

Both markets have been recovering strongly since reaching recent lows on April 9. The December 2025 EUA futures contract climbed 25% from a low of EUR 60.07 to reach EUR 75.02 on May 16, as speculative investors started to rebuild long positions after an eight-week sell-off saw their net long position shrink from 60 million EUAs to just 1.7 million.

Source: ICE

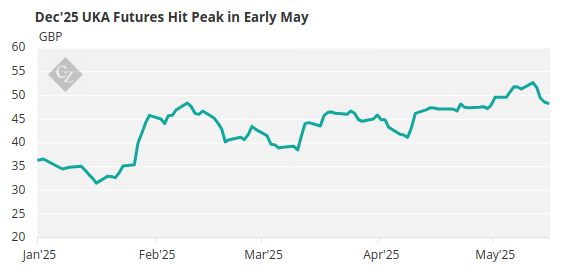

At the same time, the front-December UKA futures contract soared by 30% to reach a 22-month high of GBP 53.20 last week, fuelled by investment funds amassing the largest ever net-long position ahead of the May 19 UK-EU summit, at which the topic of linking the two carbon markets was set to be discussed.

However, the rally ran out of steam on May 12, with UKA prices dropping back as investors began to show signs of nerves ahead of the meeting.

Source: ICE

Some stakeholders suggested that this decline may have been prompted by some profit-taking ahead of the discussions, while others pointed to cautious forecasts among analysts and traders, many of whom suggested last week that the Starmer-von der Leyen meeting was unlikely to produce a firm commitment or even timetable for the EU and UK ETS to merge.

The result is that the air started slowly leaking out of the UK market at the start of last week, and anything short of a concrete plan to link the markets is likely to be seen as a bearish signal that would trigger a steep drop. At the same time, EUA prices bumped up against the psychological EUR 75 barrier, which has been identified as an upside limit for the market in the short term.

For most of last week, prices had stalled at around EUR 73.50, a level matching the highs reached in March as well as in August 2024. The brief foray to EUR 75 represented a level that was seen as a major trigger point for algorithmic traders to switch from short to long positions.

The EUR 75 mark also represented a significant options market strike price, where most call options open interest has been accumulating.

Daily price ranges became increasingly volatile as last week progressed, with Friday’s EUR 4.20 range being the second largest seen this year.

EU Carbon Tracks Equities Closer Than Gas

The influence of the natural gas market on carbon prices has declined in the last three or four weeks, but the correlation between the two commodities remains an important source of direction for EUAs.

And while gas prices have stabilised as traders perceive Europe’s storage refilling programme to be well on course to reach 90% by November, the region remains vulnerable to changes in demand from Asia in particular as well as production outages in the US Gulf.

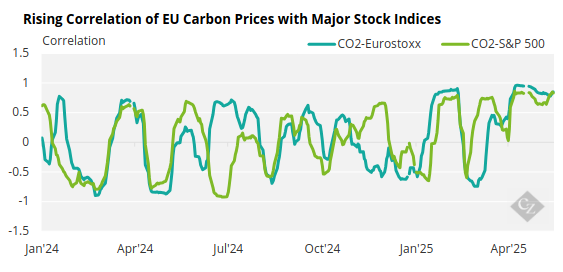

Numerous sources also highlight carbon’s increasing correlation with equity markets, with the front-December EUA contract showing a steadily rising correlation to both the Eurostoxx 50 and S&P 500 indices.

Source: ICE, Investing.com

This link suggests that carbon is now increasingly exposed to wider macroeconomic sentiment, particularly in the wake of the initiation of widespread import tariffs by the US.

After the first announcements of tariffs on April 2, EUA prices tumbled by 15% in just six days while the Eurostoxx 50 fell 13% and the S&P dropped 12%.

But as the tariffs were fine-tuned or rolled back, all three markets have recovered at a similar pace and are now back at pre-tariff levels.