Insight Focus

- European PET resin producers grow optimistic for Q2 demand, await ADD notice.

- Importers move away from Chinese resin, towards other origins instead.

- Last week’s price rally dampened by global market turmoil and crude drop.

Hot Topics from the ICIS PET Value Chain Conference

Last week the European PET industry converged in Vienna for the ICIS PET Value Chain Conference.

Whilst many of the presentations focused on longer-term scenarios, supply/demand dynamics and chemical recycling technologies, on side-lines conversations between industry shareholders focused on the now, and the current crisis the European PET resin industry finds itself in.

Production Cuts and Losses

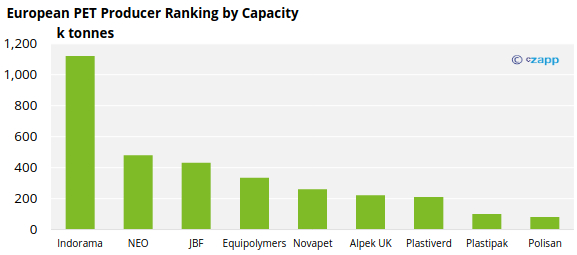

One key talking point was the shocking scale of production cuts the European market has seen lately amid weak domestic market conditions.

Since January, European PET resin producers have run at severely diminished operating rates. With several lines at various sites out of operation.

However, optimism is now growing for a recovery in Q2’23 and green shoots are already apparent. Several producers report reduced inventory levels and have increased rates on lines that are in operation citing improving demand in Central Europe.

Elsewhere the atmosphere is more sanguine, and demand flat, particularly within the thermoform segment. One key producer was also heard to be running at minimum levels on a single line, having experienced a major contract loss.

Whilst domestic producers are beginning to see demand improve, benefitting from seasonality, many still face low margins, even losses. And although European prices have reached import parity, buyers will continue to question regional supply security given recent cuts and outages.

For now, the European industry remains in a holding pattern, awaiting potential antidumping measures, which producers hope will change fortunes and determine the future landscape for European PET.

Potential EU Antidumping Petition Against Chinese Imports

Whilst nothing has officially been published, many within the industry expect that an announcement from the European Commission will be forthcoming.

If an investigation is opened, potentially within the next month, the European Commission’s track record is heavily weighted towards the imposition of measures once a case has been initiated.

Appetite for Chinese imports into the EU has already slumped and is expected to fizzle out almost entirely come Q2’23. Few are willing to take the risk of Chinese imports into the EU after Q1’23. However, as previously reported, some buyers have already stocked up on low priced imports, buying in Q4’22 and arriving in Q1’23 ahead of the opening of any potential ADD investigation.

These imports are now warehoused within region for prompt delivery, and for some, typically larger brand buyers, these reserves will offer ample coverage deep into the season.

European stock levels are far from uniform; as peak season begins and existing stocks are whittled down, European producers are hoping that in the absence of Chinese resin within the EU, demand will pivot towards domestic supply and prices will strengthen.

However, imports from other origins are already beginning to fill the void, with volumes for Turkey, Oman, Pakistan, and South Korea expected to replace lost Chinese volumes.

And whilst landed prices from other origins may be slightly higher than Chinese resin at present, substantial new Chinese capacity additions likely to increase export price competition softening prices at a global level.

European PET Spot Prices Rebound from Lows, Momentum Slowed by Crude Crash

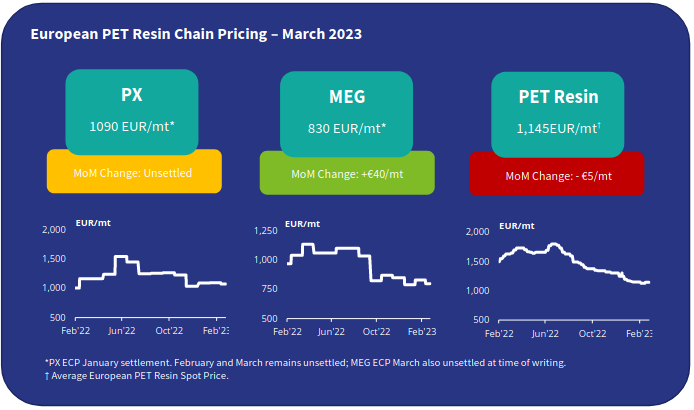

Having dipped towards the EUR 1100/tonne mark at the end of February, European spot prices regained ground back to the EUR 1130-1140/tonne range in early March.

In recent days, producers have sought to push prices higher still, with offers heard at over EUR 1170/tonne.

Whilst the upper end of the offer range has increased by EUR 10-20/tonne, several preformers and brand buyers have noted that these increases have not been widely accepted.

Any upward momentum in prices may have been stymied by this week’s crash in crude prices and turmoil in the financial markets.

WTI is now off 13.2% in a week, while Brent has shed 10.7% in the same time period.

As a result, the current market price range is assessed at EUR 1130 to EUR 1160/tonne, with an average price of EUR 1145/tonne, down EUR 5/tonne versus mid-February.

The chaos also continues in the raw material markets, with both PX and MEG European Contract Price (ECP) remaining unsettled for March, and the PX ECP also remaining unsettled for February.

There were rumours of a February PX ECP settlement having been agreed, only then to be cancelled following the fall in crude prices over the last week.

Are we witnessing the slow and painful demise of the PX ECP?

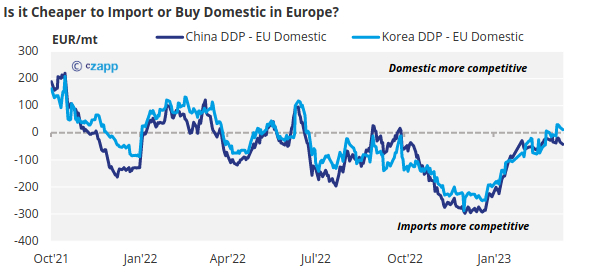

Is it cheaper to import?

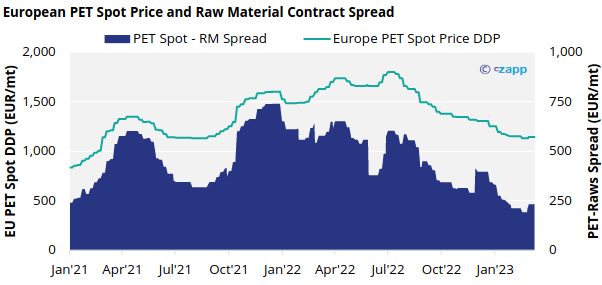

Even with a continuing energy price disparity between Europe and Asia, European PET producers were keen to highlight that despite poor margins, even losses, PET prices have regained competitiveness against imports.

China PET resin export prices currently average around USD 970/tonne. Similarly, to European prices, Asian export prices had shown some upward movement before the shock drop in crude sent prices into reverse.

Whilst European producers have managed to close the price gap on imports, the sudden drop in crude may see PET prices diverge once again.

Asian markets are typically much quicker to respond to sudden upstream price movements, due to future markets and greater liquidity.

Meaning European producers are often playing catch-up and slower to adjust prices needed to maintain a competitive price level against Asian resin.

Starlinger Site Visit

Whilst in Vienna I also took the opportunity to visit Starlinger, the leading global supplier of machinery for producing food-grade PET resin.

Nestled deep in Austrian farming country, Starlinger’s research site could not be further removed from the grey industrial and chemical complexes littering the outskirts of Vienna, the epitome of green tech.

According to Starlinger, the company has sold around 110 bottle-to-bottle rPET lines globally, taking between 50-60% market share in this category.

Amongst the most recent sales, is Kenya’s first bottle-to-bottle line, ordered by T3 (EPZ), a member of the Megh Group.

Starlinger have also recently unveiled its newest rPET bottle-to-bottle line, the recoSTAR PET art, an upgraded and reconfigured version of their recoSTAR unit.

The changes in the recoSTAR line have boosted capacity from 1.8-2.1 ton/hour, whilst cutting energy consumption by 25% versus the previous model.

Market Outlook & Concluding Thoughts

- With European PET prices clawing themselves back to import parity, domestic resin demand is showing some signs of improvement.

- However, beverage brands continue to report relatively flat demand in most markets. With large volumes of imports having arrived over the last 6-months, how long will it take to work down some of this overhang?

- For producers and buyers alike, the market finds in a waiting game looking for clear indication on future demand and notice on potential antidumping measures.

- Even if ADD excluded Chinese resin for the EU market, new Chinese capacity additions beginning Apr’23 are likely to increase global export price competition softening prices.

- Turbulence in the financial markets and the dramatic fall in crude prices may also provide another bump in the road for European PET.

- Therefore, even though producers have closed the import price gap, maintaining parity may well be the fight to come.