Insight Focus

- European PET prices continued to strengthen following Alpek UK’s FM declaration.

- Weak consumer demand and additional supply likely to contain further upside.

- EU PET import market fragmented since Chinese ADD, Vietnamese resin key competitor.

Market Overview

The market has woken up following Alpek UK’s Declaration of Force Majeure, with EU producers experiencing a flurry of enquires from UK buyers.

According to its letter to customers, PTA shortage caused by Red Sea delays forced a hold period at Alpek’s Wilton plant (220kta). Since restarting Alpek has faced production issues and had,” no option but to shut down the plant…anticipate that the plant will be offline for 30 days”.

With buyers taking lower contract volumes in 2024, availability for spot demand has tightened enabling producers to force prices higher, and recoup margin going into March.

However, underlying downstream demand is still weak, and whilst some improvement in consumer demand is noted, buyer sentiment is pessimistic.

Demand uncertainty and less availability means stocks remain low; restocking is still limited.

Whilst supply/demand dynamics currently supporting upward price pressure, the restarting of additional PET resin production lines on late February/early March is expected to keep the market balanced.

European PET Resin Prices Strengthen as Alpek FM Tightens Supply

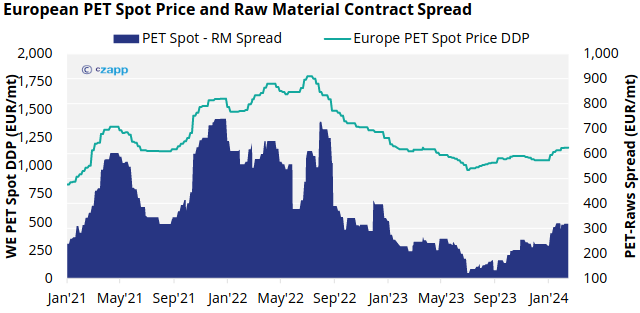

European PET resin prices have firmed over the last month, with sub-EUR 1100/tonne prices surrounding JBF’s initial restart disappearing from the market in February.

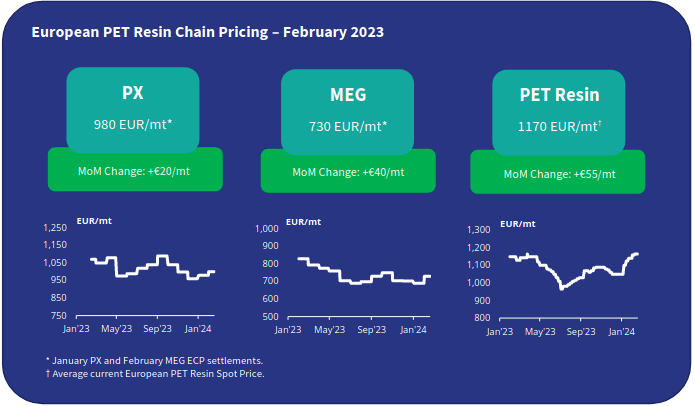

The current full market price range is assessed at EUR 1135 to EUR 1200/tonne, with an average price of EUR 1165/tonne, representing an increase of around EUR 55/tonne over the last month.

Since Alpek UK’s FM declaration, PET resin prices have continued to firm, with lower prices less available, instead offers were consolidating between EUR 1150-1200/tonne.

The January PX European Contract Price settled at EUR 980/tonne, representing a EUR 20/tonne increase from the previous month.

The MEG ECP corrected downwards in January to EUR 690/tonne before increasing EUR 40/tonne for an initial February settlement of EUR 730/tonne.

As a result, European producers continue to experience a steady margin improvement, on a spot and index-linked basis, with spreads reaching a 12-month high.

Even with Alpek UK announcing a 30-day shutdown, removing 220k tonne of effective capacity from the market, up to 735k tonnes of dormant lines are poised to come back on-stream over the next month.

Therefore, whilst prices look to move closer towards the EUR 1200/tonne mark in the short-term, expectations are the market to come into a more balanced position as we enter the pre-season, with both further upside and downside potential constrained.

EU Block Posts Record PET Resin Import Year Despite Chinese ADD

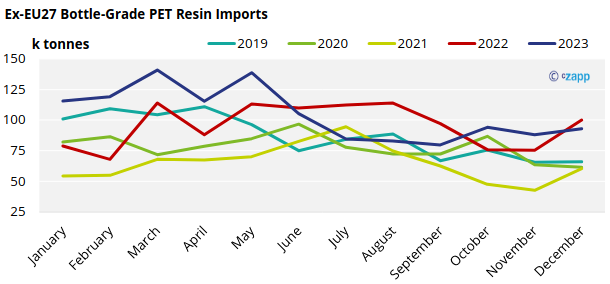

According to the latest PET resin trade data (HS 390761), the EU27 block of countries kept imports relatively steady at around 93k tonnes in December, increasing 6% on the previous month.

Compared to previous years, Q4’23 imports remained elevated surpassing even 2022 levels despite the sharp decline in Chinese resin imports.

For the full-year 2023, extra-regional imports into the EU27 trade block totaled over 1,257k tonnes, a 9% increase on 2022 levels.

Whilst the current Red Sea crisis occurred too late in the year to derail 2023 volumes, delays to Asian imports are likely to have impacted January figures; Lunar New Year will also have a knock-on effect for Q1’24 imports.

Vietnam was the largest origin in December with 37.5k tonnes; then Egypt on 16.7k tonnes, and Turkey at 15.4k tonnes.

Vietnamese imports have recorded strong increases through Q4’23 off-the-back of highly competitive pricing.

Monthly imports from Egypt kept relatively steady, but Turkish volumes were impacted by increased raw material costs due to the red sea crisis and high domestic inflation.

Is it cheaper to import?

Asian PET resin export prices have remained relatively flat after the Lunar New Year start, even though PET resin export margins have experienced a modest recovery.

At the time of writing, average Chinese resin export prices averaged USD 915/tonne, down USD 5/tonne versus mid-January levels. (Please read our Asian Weekly report for further insight)

Vietnamese PET resin export prices remain competitive versus domestic European prices, even though they have increased around USD 50/tonne over the last month; Turkish prices lacked competitiveness.

Indicative import prices typically range EUR 1010-1040/tonne CIF duty paid NWE, equating to around EUR 1085-1110/tonne DDP.

On average, import prices from duty advantaged origins are between EUR 55/tonne and EUR 80/tonne lower than the average European domestic PET resin price, depending on origin.