Insight Focus

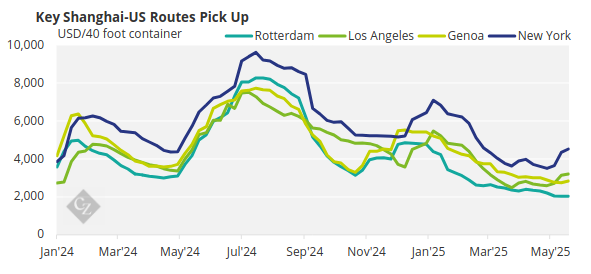

Freight rates have begun rising again. There has been a huge increase in temporary demand as importers and exporters seek to clear goods within the 90-day window during which tariffs have been drastically reduced by both countries. But a weakening US dollar and stubborn Chinese deflation is still weighing heavily on the economy.

Shipping Jumps Amid Tariff Pause

After a bumpy year when values tumbled from as high as USD 9,612 per 40-foot container to lows of just over USD 2,000 per container, some key routes have begun to pick up again. This has been attributed to the recent pause in US-China tariffs, which has prompted importers to rush through orders ahead of further potential volatility.

Source: Drewry

During the 90-day “pause” during which negotiations will take place, Chinese imports to the US will be subject to a 30% tariff, while US imports to China will pay 10%.

We should expect freight rates to rise in the coming weeks as importers and exporters rush to clear goods within the 90-day window. With potential 145% tariffs on the table after this point, it is highly likely that companies will be willing to pay a hefty premium for shipping in order to get goods cleared ahead of the deadline.

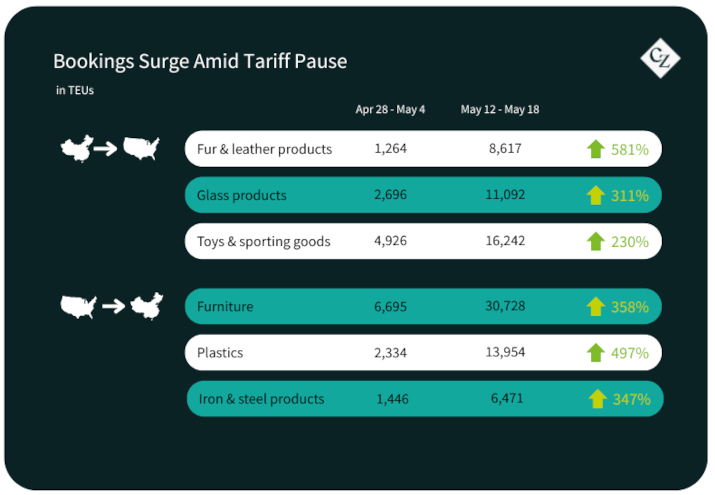

According to Vizion, certain products experienced huge surges between the week beginning April 28 and the week beginning May 12.

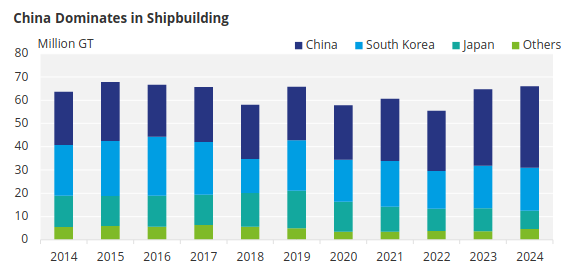

The New Look of Shipbuilding

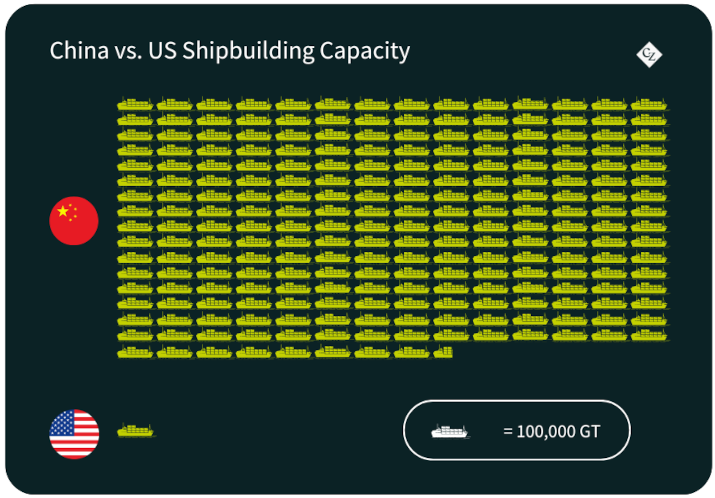

The US is trying to reshape the shipping industry with several pieces of legislation, but that may be easier said than done. Right now, China is the world’s major maritime giant, with 5,500 vessels taking part in international trade compared with the US’ 80. The Asian superpower is also the world’s largest shipbuilder and has a rapidly expanding naval fleet.

But with the bipartisan Shipbuilding and Harbor Infrastructure for Prosperity and Security (SHIPS) for America Act and the similarly named Building SHIPS in America Act sets the goal of expanding the US fleet by 250 ships by 2035.

In conjunction, the US wants to hamper Chinese growth by imposing fees on Chinese owned, operated or built ships that dock in US ports. Unfortunately for shippers, that’s a huge proportion of the global fleet.

Source: UNCTAD

China has become the leading shipbuilder globally in the past few decades, briefly competing with South Korea for the top spot before quickly eclipsing its neighbour. But these new US port fees could be the push South Korea needs to regain first place.

According to data from Clarkson’s, South Korea secured significantly more orders than China in March, with 820,000 gross tonnes ordered – or 55% of the total – compared with China’s 520,000 gross tonnes (35% of the total). It looks like shipowners are taking the US government’s new policies seriously and are planning for the long term.

But in the meantime, the shipping industry is trying to mitigate impacts from the extra port fees. Ship owners are planning to lobby the US Trade Representative to increase the size of the affected ships to 85,000 dwt. Currently, the limit is 80,000 dwt but the industry says many Aframaxes and Kansarmaxes are caught within this 5,000-dwt area.

Meanwhile, France’s CMA CGM is considering re-organising its fleet to avoid the fees. The box carrier’s CFO told Reuters that fewer than half of its 670 ships were built in China, meaning it has enough capacity to avoid the fees. Many of the company’s key trade routes are outside of the US.

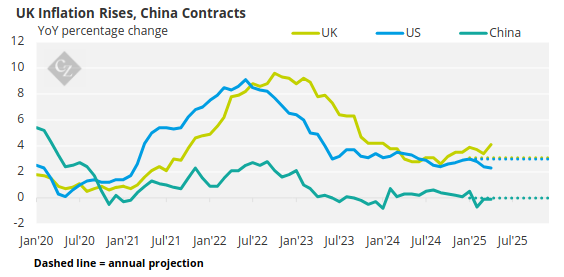

Economic Cracks Continue to Show

In a blow to UK households, food inflation was up again in May, according to data from the British Retail Consortium. Prices for food rose by 2.8% in May, up from 2.6% in April, the report said. Food prices continue to outpace wider inflation. New government policies such as a rise in Employer National Insurance contributions and Living Wage payments have been partially blamed for adding fuel to the fire.

Source: ONS, IMF, BLS, St Louis Fed

But China is still facing the opposite problem as the government tries desperately to stimulate domestic demand. Economic uncertainty seems to have dragged down already lagging demand as the country languishes in deflationary territory.

In an effort to provide some economic support, the People’s Bank of China cut the one-year loan prime rate and five-year loan prime rate by 10 basis points each to 3% and 3.5%, respectively. This marks the first cut since October, but it is seen by many as a measured move.

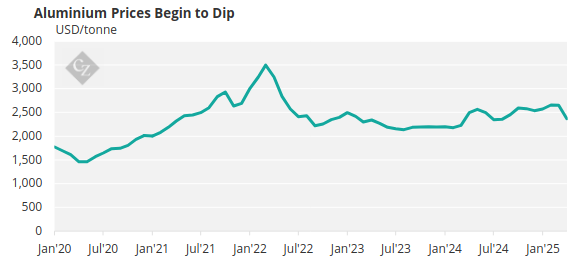

And in more signs of lagging demand, the country’s aluminium imports fell 3.8% year over year in April, according to customs data. For the first four months of 2025, imports were down 11.4% from the same period in 2024 to 1.32 million tonnes. Aluminium demand is seen as a key barometer of economic health given its applications in construction and manufacturing.

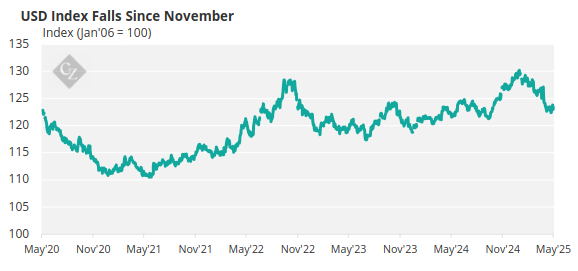

Source: St Louis Fed

It’s not looking rosy for the US either as the dollar continues to weaken. Concerns are rising because, unusually, the dollar’s decline is coinciding with a spike in interest rates in April. Wealth management firm Charles Schwab predicts that the dollar will continue to trend lower as the government continues to pursue its aggressive trade policy.

Source: St Louis Fed

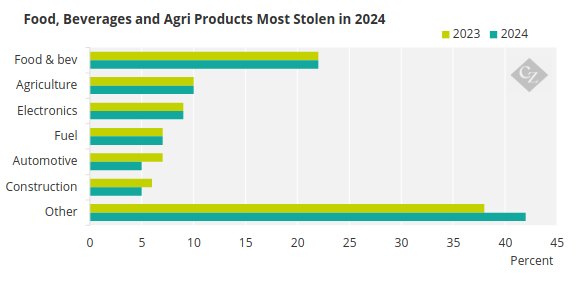

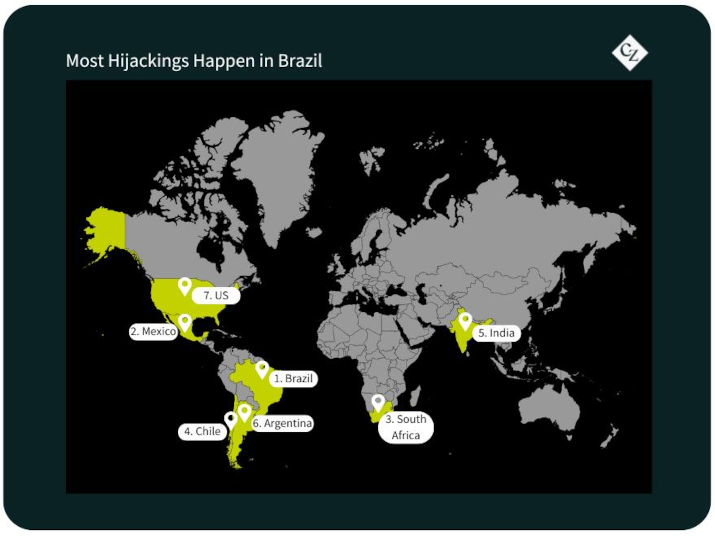

As food inflation continues, new analysis from BSI Consulting shows that food and drink sectors experienced a spike in thefts in 2024. The increase in thefts highlights vulnerabilities in the global food supply chain.

Source: BSI Consulting

The report showed that Brazil was the number one location for thefts, followed by Mexico, South Africa and Chile. India, Argentina and the US also made the top 7 for theft hot spots.

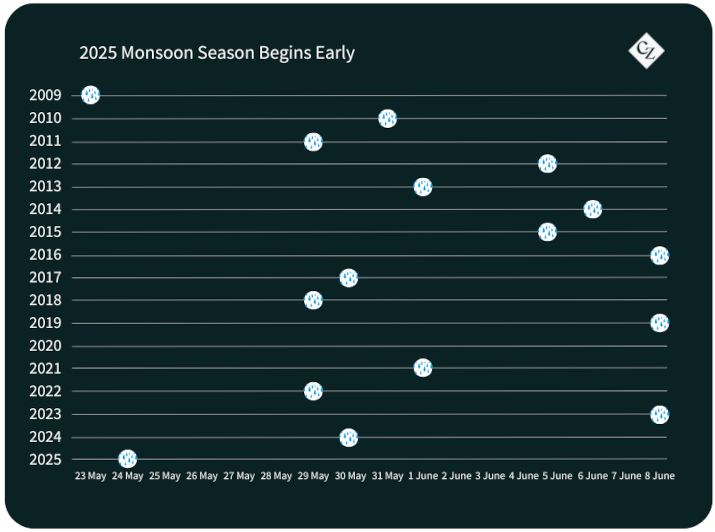

India’s Monsoon Season Arrives Early

In India, the annual monsoon season has arrived – about 16 days early by some estimations. In Kerala, the 2025 monsoon season started on May 24 – the earliest date since 2009. As a massive agricultural country, India’s farmers depend on the rains, but abnormal rainfall can lead to chaos for crops.

In Maharashtra, United News of India reported that heavy rains have caused damage to farms, with reports that about 35,000 hectares of crops, vegetables and orchards have been affected.

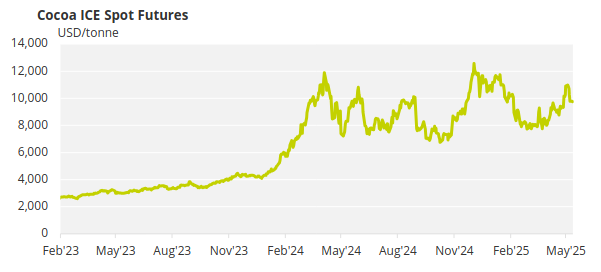

This is just the latest weather event that is likely to be influenced by a changing global climate. Major crops affected by climate change include cocoa and coffee. A series of factors, including vulnerable supply chains, ageing infrastructure and unpredictable weather have contributed to pushing the price of the commodities up in the past year.