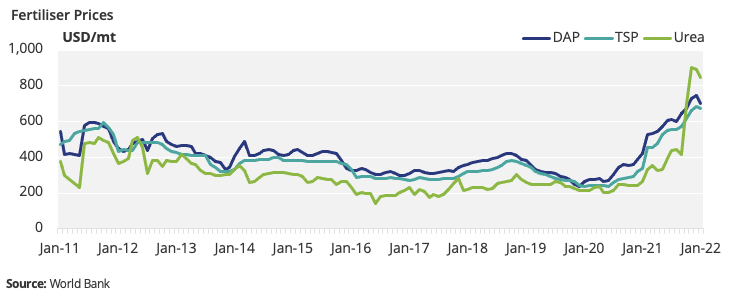

- Fertiliser prices have been especially volatile in recent months.

- This has pushed food prices up, exacerbating inflationary pressures.

- Farmers can reduce dependence on fertilisers by looking to alternatives, such as crop rotation.

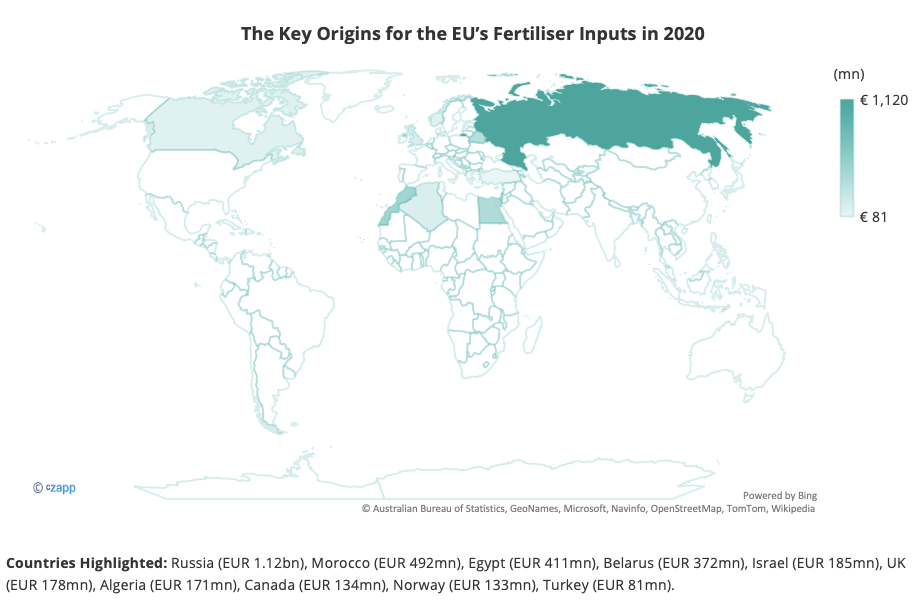

Energy price rises, dependence on imports from Russia and existing anti-dumping duties are creating the perfect storm for EU farmers as the prices of fertilisers continue to skyrocket. But at least some of the costs can be absorbed by reducing reliance on synthetic fertilisers and instead adopting some more organic practices, farmers tell Czapp.

Rising Energy Prices

After a devastating blow to demand in the Q2’20 caused by the COVID-19 pandemic, the benchmark Brent Crude Oil price has continued to climb.

The benchmark now exceeds 90 USD/bbl from a low of 9.12 USD/bbl in April 2020, and analysts believe it could soon break above 100 USD/bbl.

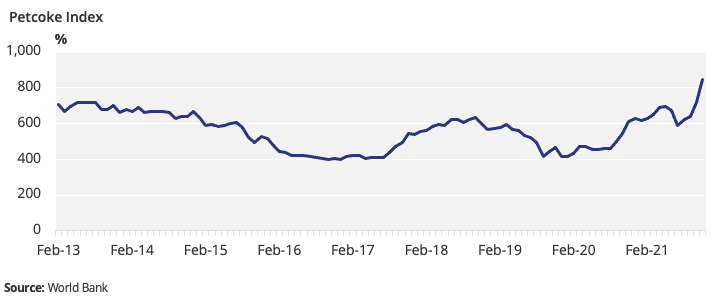

This is important for the agricultural industry for many reasons. One of these is that a key component of synthetic nitrogen fertilizer is ammonium nitrate, which is created using petroleum coke, a by-product of oil refining. Along with the rise in oil prices, there’s been a simultaneous rise in petcoke prices, meaning higher input costs for farmers.

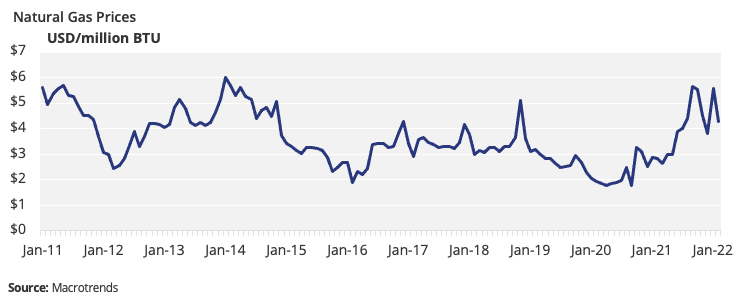

But another vital input in creating fertilizer is natural gas, which itself has experienced a volatile few years due to various geopolitical issues and its close link to the oil price.

The EU depends primarily on Russian natural gas, which is streamed via pipeline. The conflict between Russia and Ukraine has created political tension and risks EU energy security. These factors have created a huge increase in the price of fertilisers in the past few years.

Pricing pressures are being exacerbated by Russia’s ban on ammonium nitrate exports, given that it’s the EU’s largest fertilizer supplier.

Farmer Response

Understandably, EU farmers are feeling the crunch. Copa-Cogeca represents EU farmers and agri-cooperatives and told Czapp that the recent price increases have been “very difficult to absorb” for the EU agriculture sectors. Not only is the cost of diesel used in tractors rising, but price pressure is now being felt in electricity for milking, as well as heating for fruit and vegetables in greenhouses.

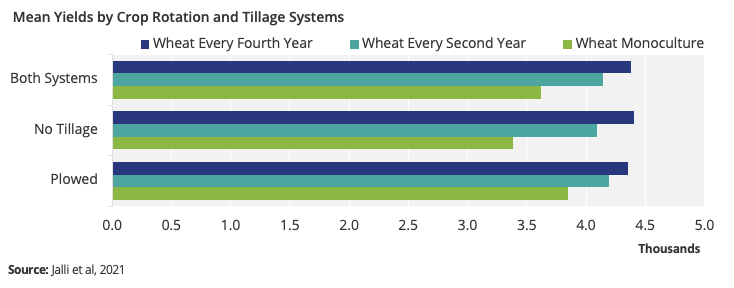

But there are some alternative options. Crop rotation has been found to increase yields while limiting damage to soil. In a study of wheat crops, the best results were seen with planting every fourth year with no tillage.

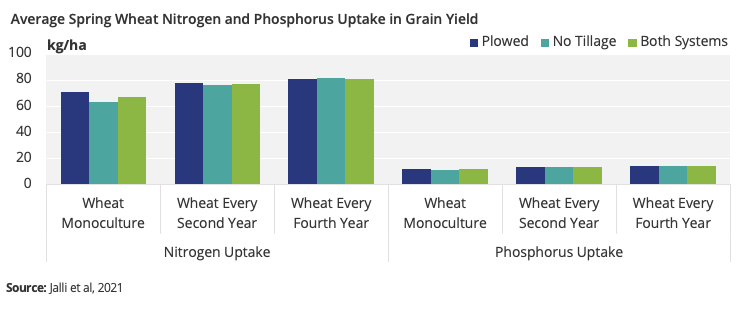

The presence of nitrogen and phosphorus in the soil increases with crop rotation, reducing the need for fertilisers. In terms of nitrogen content, again, the best results were seen when wheat was rotated every fourth year using no tillage systems, although there was very little change in phosphorus uptake.

To address nitrogen fertiliser price rises, farmers can also opt for less nitrogen-dependent crops such as sugar beet, oilseeds, or malting barley, Copa-Cogeca said. This is because “protein contents are not the main drivers of the output quality,” a spokesperson for the organization told Czapp.

Organic fertiliser is another potential option for farmers in Europe, and one potential feedstock for organic fertiliser is food waste. We wrote about the EU’s ambitions to reduce the amount of waste it produces – an eyewatering 129m tonnes per year.

Copa-Cogeca added that “in some cases of mixed farms with both arable and livestock, some consequences [of price rises felt by members] may be offset using organic fertiliser and manure.”

According to the European Commission, just 5% of organic waste is currently recycled for use as fertiliser each year. However, recycled biowaste has the potential to substitute up to 30% of inorganic fertiliser.

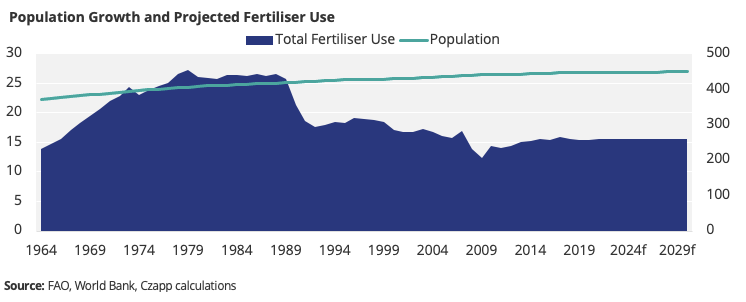

The EU currently uses around 15m tonnes of fertiliser each year (roughly 34.6kg per capita). If fertiliser use continues to grow with the population, it could reach 17m tonnes by 2030.

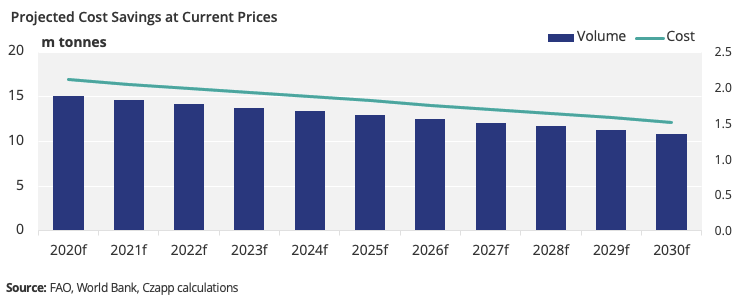

If fertiliser use is addressed now and a cut of just 30% at current price levels was made, this could eliminate 4.6m tonnes of fertilisers, saving farmers 592m USD, assuming they use organic fertilisers sourced at no additional cost.

Duties are placing an additional burden on farmers. In 2019, the EU imposed anti-dumping duties on urea and ammonium nitrate originating from Russia, Trinidad and Tobago and the USA. For Russian companies, the dumping margins add between 20% and 32% of the price for the product, plus insurance and freight. Trinidadian duties reach 55.8%, while US duties were set at 37.3%.

As well as elimination of these duties, Copa-Cogeca is calling for “a more dynamic, more competitive EU fertiliser market, to the benefit of the whole EU agri-food chain.”

Other Insights That May Be of Interest…

The EU Pivots to Sustainable Agriculture