Insight Focus

Narendra Modi has won a 3rd term in office. The cane industry continues to push for exports. The monsoon has started and should bring normal levels of rainfall.

Introduction

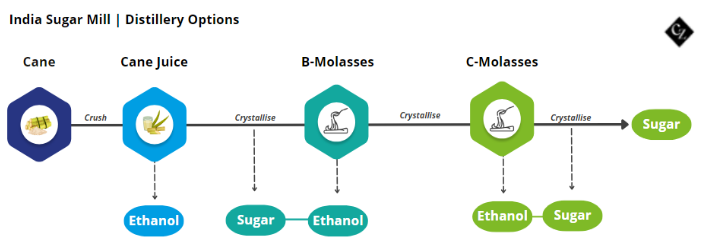

India, the world’s second-largest producer of sugar, aims to blend 20% ethanol in gasoline by 2025.

This ethanol will be made from sugar cane and various grain feedstocks, which means many Indian mills now have a choice about how they use the sucrose in the cane. We will show the choices they are making in this report.

Maharashtra Sugar Imports/Exports

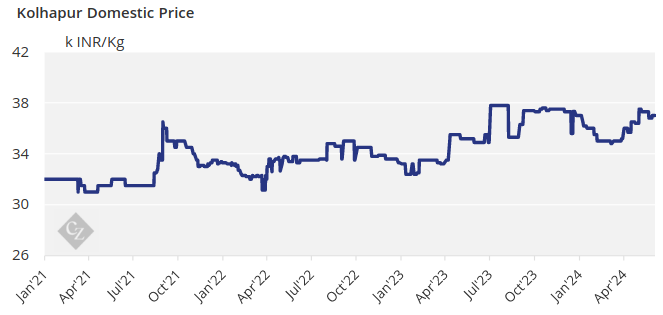

Domestic sugar prices have weakened slightly to 37k INR/kg.

The elections finished last week and India’s prime minister Narendra Modi, has secured his third term. As the government hasn’t changed, we expect the ethanol blending programme to continue as planned.

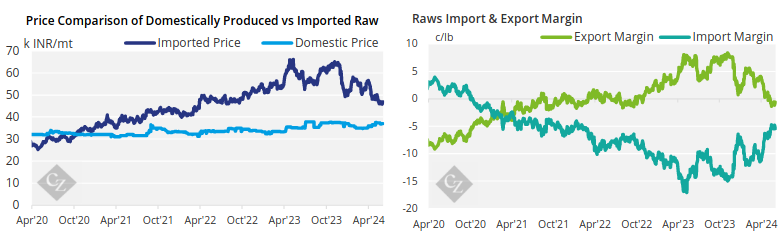

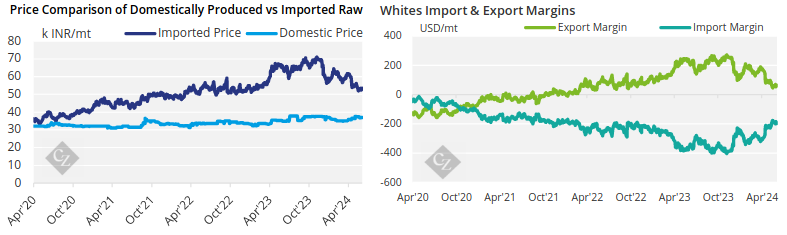

Sugar imports continue to be unviable, and production has been better than expected making imports unnecessary. The government may allow some sugar exports after assessing the final sugarcane sowing and output data, as the industry continues pushing for at least 1m tonnes of exports. However, export margins today are negative and the government is extremely unlikely to subsidise exports.

We expect that the earliest the government would allow for exports would be at the beginning of 2025.

Ethanol vs Sugar

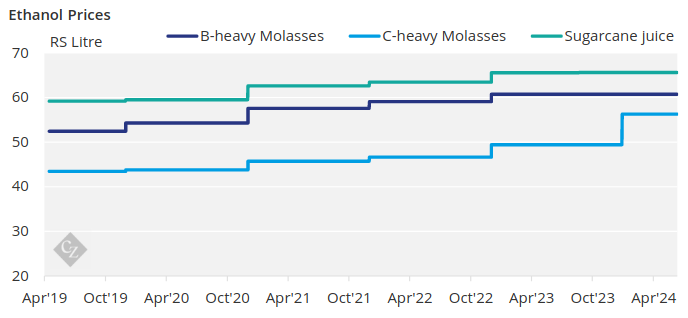

Many mills/distilleries have a choice over which feedstocks they use to make sugar or ethanol based on the relative prices of ethanol paid by the oil marketing companies.

The monsoon has arrived in India and is expected to bring normal levels of rainfall. Sugarcane diversion to ethanol is capped at 1.7m tonnes. The E20 blending mandate is approaching next year, and whether the government will increase the ethanol diversion for this season as well as next season is a question that remains.

Again, we will have to wait to hear more until after sugar production and monsoon spreads have been reviewed.

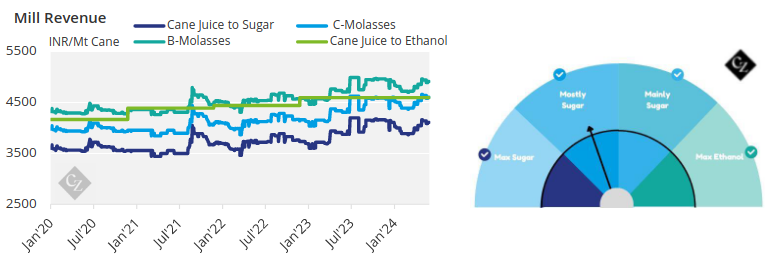

Mills are still being incentivised to use C-molasses instead of B-molasses and cane juice. The amount of sugar produced from C-molasses vastly outweighs ethanol production compared to using B-molasses and cane juice, resulting in less revenue generated by the mills as seen in the chart below:

Here are the current prices paid for ethanol by feedstock:

Appendix