- Inflation is probably transitory and structural.

- Reduced globalisation will add to supply chain costs.

- A decade of low commodity investment will need to be fixed.

This article is adapted from the most recent World Sugar Market 5 Year Forecast, which is written to help sugar producers and consumers manage their long term sugar market hedges.

For more information on how to become a Premium Sugar Subscriber or a free Premium trial please contact Connor McGrath here.

Is Inflation “Transitory”?

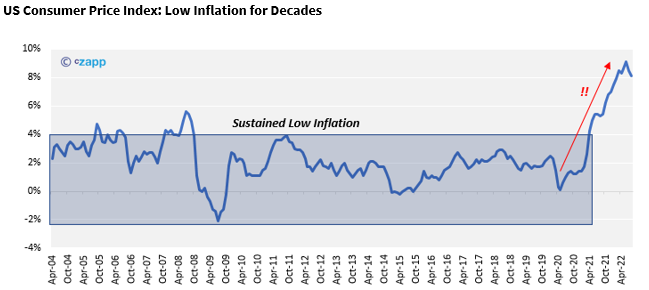

This time last year American officials believed that inflation would be temporary; “transitory” to use their own word. They maintained this belief even in the face of the huge rallies across almost all commodities in the previous 12 months as the world recovered from the shock of Covid.

It seems like a lifetime ago. Today we have persistent inflation: in the USA it’s been above 8% for the past six months; recall that the American inflation target is 2%. In response, Central Banks around the world have been aggressively increasing interest rates, even at the risk of a slide in equity markets and a recession.

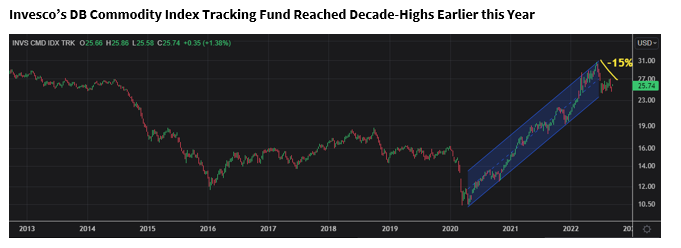

The twin effects of higher rates and a stronger US Dollar have been deadly for commodity prices. Many markets have finally rolled over and are a long way below their 2022 highs.

Source: Refinitiv Eikon

Does this mean inflation really was temporary? All it took was a hard push from officials around the world? Or will inflation prove to be persistent? I believe that inflation is both transitory and structural. Here’s why.

The Retreat of Globalisation and the Fracturing of Supply Chains

Since the fall of the Soviet Union the world has lived through 3 decades of low inflation. This was underpinned by:

- Cheap energy (deep sea/Arctic drilling, shale boom)

- Cheap goods (East Asian manufacturing boom).

East Asia, Russia, Europe and North America were intertwined commercially, financially and logistically.

This is no longer the case following the US/China trade dispute, COVID restrictions and Russia’s invasion of Ukraine. The world is drifting away from being globalised and into multipolar blocs. Conflicts between these blocs are both “cold” (The West has sanctioned Russian energy and Chinese technology, notably semiconductors), and “hot” (Russia has invaded Ukraine).

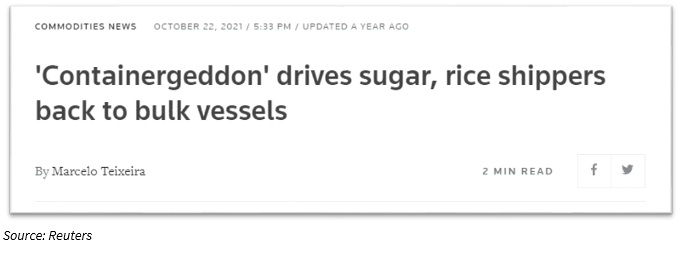

Supply chains start to break down during hot and cold conflicts. Consider, for example, shipping chokepoints: the difficulty in shipping grain from the Black Sea and China’s de facto blockade of Taiwan following Nancy Pelosi’s visit.

If this trend remains, drybulk and container shipping may become more constrained, insurance costs may increase, and import duties/sanctions may continue to spread.

As supply chains become disrupted, sugar users will need to move away from just-in-time logistics and build more security stocks. They will also need to develop multiple sources of supply across different transit routes and modes. This adds to costs and so will be inflationary for sugar prices in the long term.

The withdrawal of Russian energy supply from the West means that the recent era of cheap energy may also be over. New supply of liquid transport fuels and electricity generation will need to be developed quickly, especially in Europe.

This probably means a renaissance of nuclear energy and the development of fracking technology in Europe. But we could also see increased use of ethanol in gasoline in many countries if crude oil prices remain high: notably in India and Brazil. This could then reduce global sugar availability. There could also be increased interest in using biomass for electricity generation in Europe, erhaps giving a further export stream for overseas sugar mills unable to use their own bagasse.

Developing new sources of electricity generation and new supply chains capital and commodity intensive. Expect greater government borrowing and greater use of industrial commodities. After the outbreak of COVID I wrote that a major global crisis is often followed by huge infrastructure projects. This remains true, but on a bigger scale than I’d envisaged.

Source: Refinitiv Eikon

This means inflation is probably both transitory and structural. Commodity prices are falling sharply today, but this won’t be true across the next decade. We have just emerged from 10 years of depressed commodity prices and extremely low investment in commodity production. The lack of investment will need to be reversed rapidly, and applies as much to the sugar market as it does to any other commodity.