- First settlement for June’s PX European Contract Price (ECP) heard at EUR 1490/tonne

- Whilst PET resin prices stable through H1 June, spot prices set to move sharply higher.

- PET resin producers exposed to spot and market-indexed contracts face losses.

The first settlement for June’s PX European Contract Price (ECP) has now been agreed at EUR 1490/tonne, sources said Friday.

This represents an increase of EUR 250 over May’s settlement of EUR 1240/tonne, one of the largest-ever monthly increases in the PX ECP and follows last month’s EUR 75/tonne increase.

How Does the Affect this European PET Resin Market?

PX producers seem increasingly unwilling to accept loss-making margins, given demand from the gasoline market, leading to a disconnect between European PX CP prices and the Asian market.

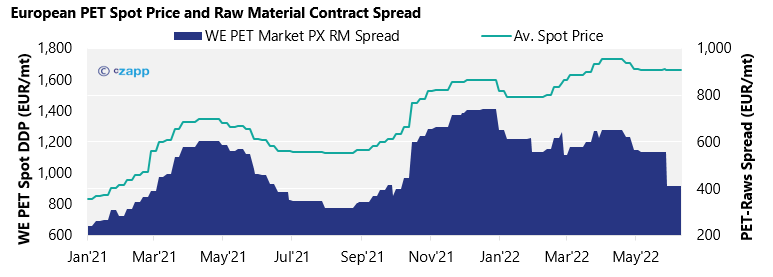

Whilst PET resin spot prices remained stable this week, averaging EUR 1660/tonne (see previous market view), June’s PX ECP increase will have severe repercussions for PET resin pricing in the coming weeks and into July.

Given the dramatic increase in PX CP, current spot prices seem unsustainable.

Whilst some producers will be able to pass increases onto customers via formula-based contracts, others will be left facing large losses on spot and market-indexed volumes, including early free-negotiated deals for June.

With European resin demand relatively weak at present, passing on the feedstock rise via spot price increases may be met with buyer resistance.

Buyers may be reluctant to accept such increases, unable to pass through costs to their own customers.

As a result, PET resin demand may shrink in the near term as buyers dip into stocks, denting an already floundering summer market, and reducing upward pressure on spot prices.

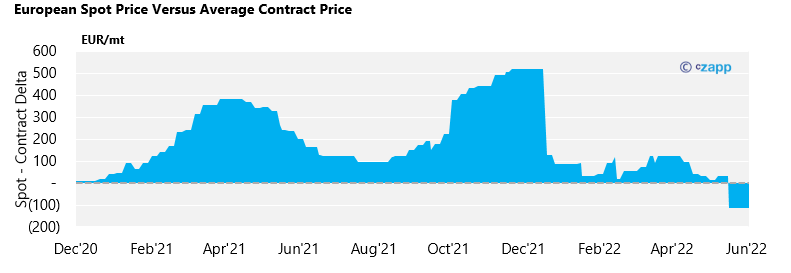

Spot–Contract Gap Widens, Awaiting Market Response

The latest increase in PX pushes average European raw-material-formula contract prices well above current spot values.

Average contract prices are now EUR 175/tonne above spot prices, although the latter is likely to be subject to upward pressure in the coming days.

Market Outlook & Concluding Thoughts

- Huge increase in first settlement for PX ECP in June is likely to catch many off-guard, with many producers expecting a lower settlement in the range EUR 1,350-1,450/tonne.

- Spot prices will see upward pressure in the coming days, producer margins face squeeze.

- Any increase in spot values would also open an opportunity for imports. However, given tight Asian supply and transit times, anything booked now would not be expected to arrive until Q4.

Other Insights That May Be of Interest…

European PET Market View: Will Revenge Spending Boost European PET this Summer?

PET Raw Material Futures Outlook: PTA, PET Producers Struggle to Pass on Feedstock Price Rises

PET Resin Trade Flows: EU PET Imports Surge Despite Chinese Export Constraints