Insight Focus

- US soybean acreage to hit record high in 2022.

- Importers hope for lower prices.

- Faltering Brazilian expansion and heightened demand from China could keep prices high.

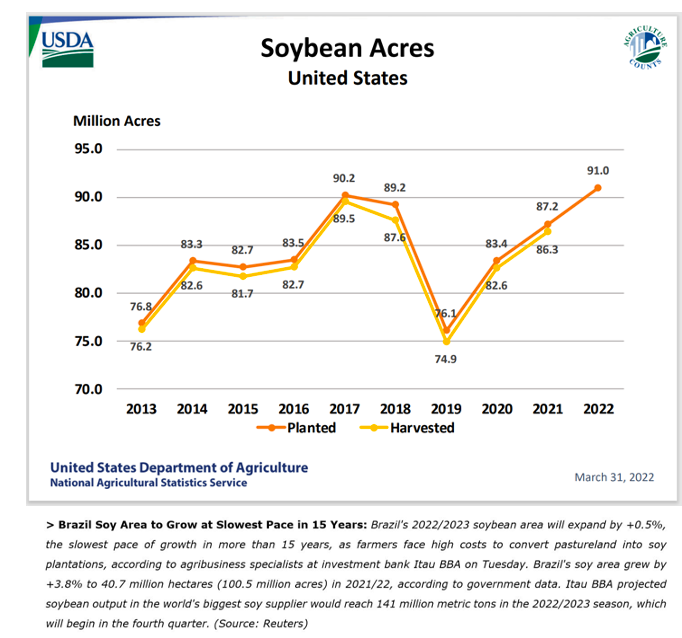

The USDA reported its farmer-surveyed acreage estimate last Thursday and, according to the survey inputs, this year’s US soybean acreage will hit a record high, resuming an expansive trend interrupted by US trade wars with the Chinese in 2018 and 2019.

I’m sure US soybean processors and the refiners of renewable diesel are pleased with the USDA’s forecast. The forecast points to the potential for more soybeans (acreage wise yes, yield wise still to be determined) to support an expanding domestic crush industry, and soybean oil to support an expanding renewable diesel industry.

What about the importers of US soybeans? Are they eager to see the expanded acres and hopeful for a record yield? Of course, they always want more supply and the lower prices that come with it. Will they have more supply on a global basis? The following story might suggest not.

Yikes!

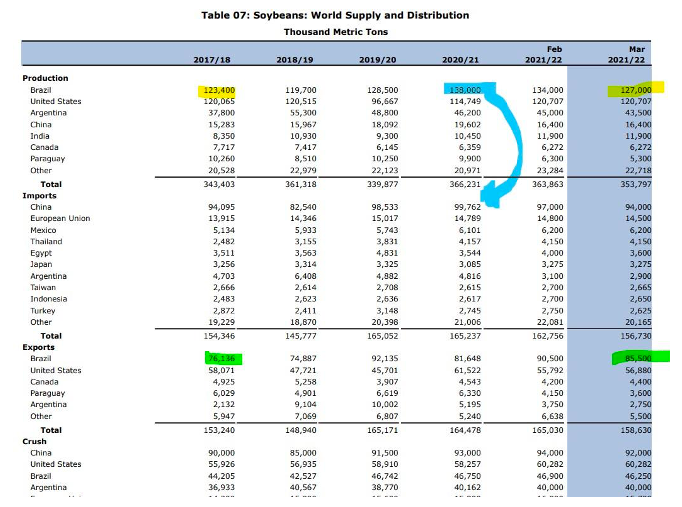

Brazilian soybean production expansion and Chinese soybean import expansion remain inextricably linked. Brazil has exported nearly all its recent production growth; Chinese has consumed half (blue arrow). The world’s largest producer and importer are symbiotic partners.

Keep in mind that the US will slowly but surely exit global markets over the next four years and process more soybeans domestically to support its expanding renewable diesel industry. Will the US export more meal? Yes. Will the Chinese import it? The probability of this increases dramatically if Brazilian soybean expansion stops. Is it good for the US soybean processor if US soybean acreage continues to expand and Brazilian acreage expansion stalls, forcing the Chinese to change policy and import US soybean meal? Umm…crazy good.

With reduced Ukrainian (and Russian?) sunflower production, the implications for a lack of Brazilian soybean expansion means greater resilience (and perfect execution) on the following in weighted order:

1. Optimal Weather Conditions

2. Optimal Seed Genetics

3. Optimal Fertiliser Application

4. Optimal Chemical Application (fungicides primarily in Brazil to battle rust)

5. Plenty of Diesel

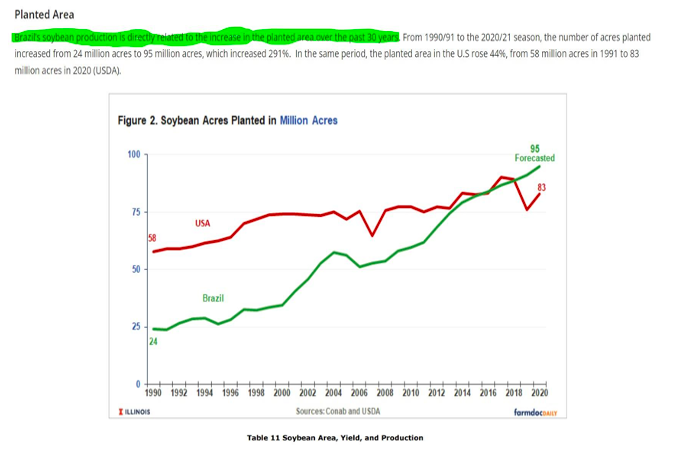

Are numbers 2-5 even possible in today’s supply and supply chain constrained world? Brazilian production expansion has occurred via both acreage and yield expansion. The former has been key.

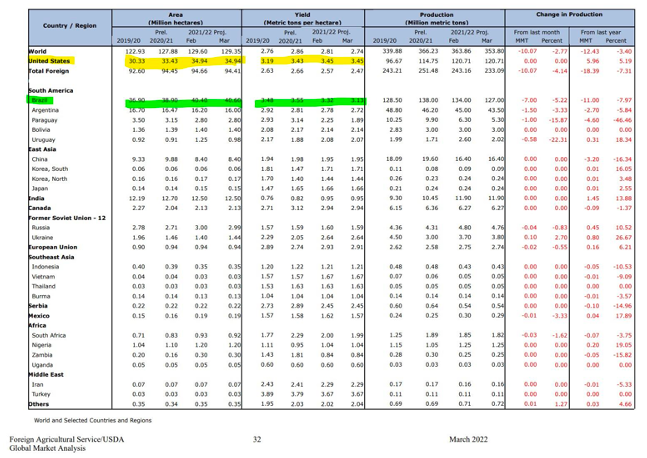

Brazilian soybean yields did not expand this year (as forecasted by the USDA below), but acreage did. Yields reduced the crop size from peak estimates by 7m tonnes as detailed below. A 3.32 tonne/hectare estimate in February became a 3.13 estimate in March with many private analysts’ estimates predicting lower yields coming in the April USDA WASDE report.

A growing reliance on optimal “everything” (numbers 1-5) for the Brazilian soybean farmer to grow an above average trend yield soybean crop will lead to high volatility in price movements and the potential for sharply higher prices.

Will potentially higher prices promote soybean acreage expansion this year by the time Brazilian farmers start planting in October? I think China (and the rest of the world’s soybean consumers) hopes so.

To repeat myself, YIKES!

For further information, please email waltercronin@msn.com.

Other Insights That May Be of Interest…