Insight Focus

PTA and MEG futures see first rises in weeks, lifted by lower inventories and higher upstream costs. Volatile freight rates and fight for container space is impacting PET resin exports out of Asia. PET resin export prices static, forward curve shows modest upside on feedstock costs.

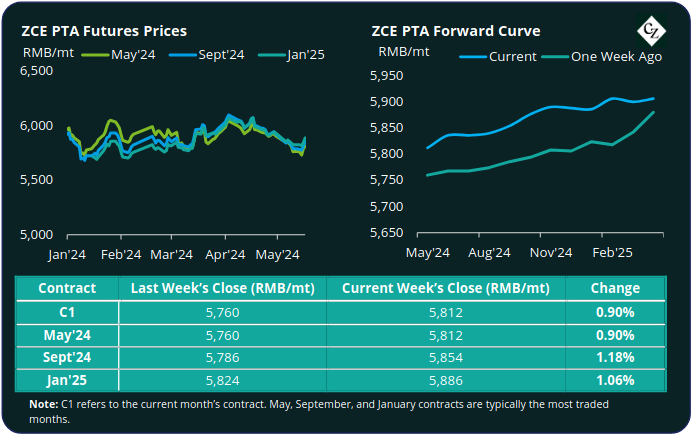

PTA Futures and Forward Curve

PTA futures bounced, lifting around 1% last week, following a steady downward trend since mid-April.

Brent crude oil prices also posted the first weekly gain since mid-April on stronger Chinese industrial data and signs US consumer price inflation continues to ease.

That said, crude prices continue to trend within a very narrow range, with Brent confined within USD 82/bbl and USD 84/bbl since the beginning of May.

Both PX-N and PTA-PX spreads remained stable last week; PTA-PX CFR spot spread averaged USD 85/tonne for the week.

However, with fewer PTA maintenance plans in June supply, supply and operating rates are expected to increase. Faced with decreasing polyester operating rates and expected weaker demand from downstream textiles, PTA fundamentals may weaken in June.

After the recent price weakness, the forward curve has moved into a slight contango through 2H’24 and into 2025; Sept’24 contract premium over the current month increased to RMB 42/tonne.

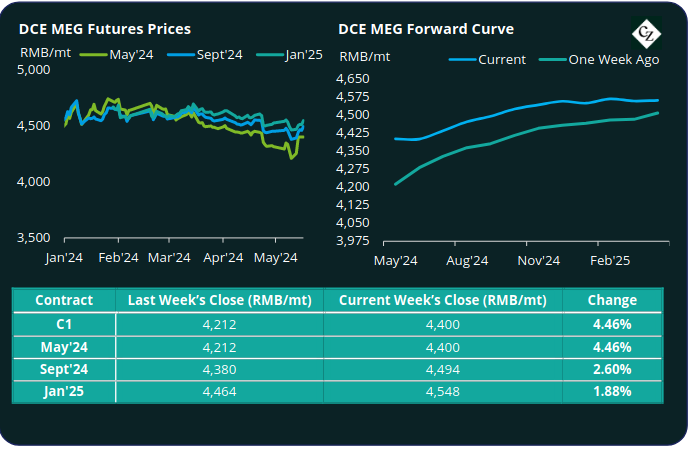

MEG Futures and Forward Curve

MEG Futures rallied last week, jumping by around 4.5% as destocking fuelled bullish market sentiment.

East China main port inventories decreased by around 4.4% to 769k tonnes last Friday.

Whilst May continues to see destocking, plant restart and higher average operating rates with short-term bullishness dissipating into June.

Weaker demand resulting from lower polyester production rates may is also expected to lead to weaker fundamental support.

Whilst the forward curve remains in contango, the curve is slight, with the Sept’24 premium over the current narrowing to RMB 94/tonne.

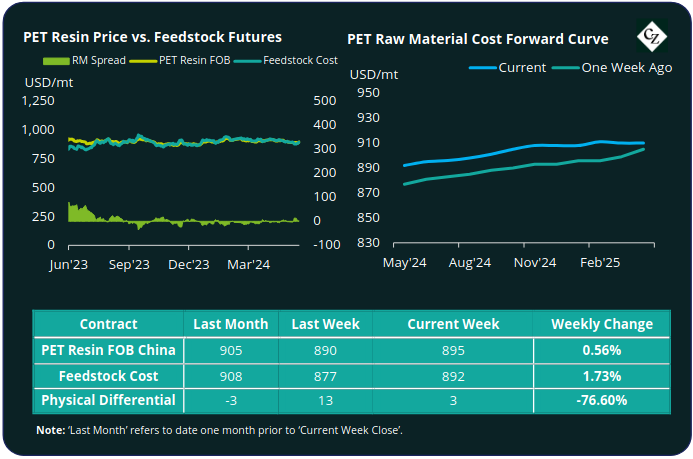

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept relatively flat last week, with the average price at USD 890/tonne last Friday.

The PET resin physical differential against raw material future costs improved, increasing USD 3/tonne, to average USD 5/tonne last week. By Friday, the differential was USD 7/tonne having receded from the USD 13/tonne daily spread seen last Friday.

The raw material cost forward curve kept a slight contango through to year end; Sept’24 contract premium over the current month was USD 9/tonne, Jan’25 held an additional USD 7/tonne premium.

Concluding Thoughts

The current freight crisis out of China, impacting all global routes, continues to escalate. Container space is limited and spot rates volatile, with expectations the current situation may persist through the summer.

The market is seeing a mixed response, whilst the ability to export containers is heavily constrained; some foreign buyers are taking a wait-and-see approach, others are shifting back to breakbulk movements for key routes.

At present, factory stock levels are healthy at around 15 days. However, stock in ports and in the logistics system, although opaque, must is likely to be building, given the slowdown in port throughput.

Latest Chinese PET resin trade data shows around 458k tonnes of bottle-grade resin was exported in April. Expectations are to see volumes slow in May.

However, depending on total volume migrated to breakbulk, PET movement from June onwards may accelerate despite the wider freight disruption.

The physical differential to future raw material costs has retrenched back into the previous range, the forward curve holds a limited forward premium on raw materials costs. Equally, PET resin export prices are expected to also remain rangebound through H2’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.