Insight Focus

PTA and MEG futures continued to slump, despite improved fundamentals. China PET resin export prices also slide lower, as freight disruption impacts exports. PET resin lines move into maintenance following sustained low margin environment.

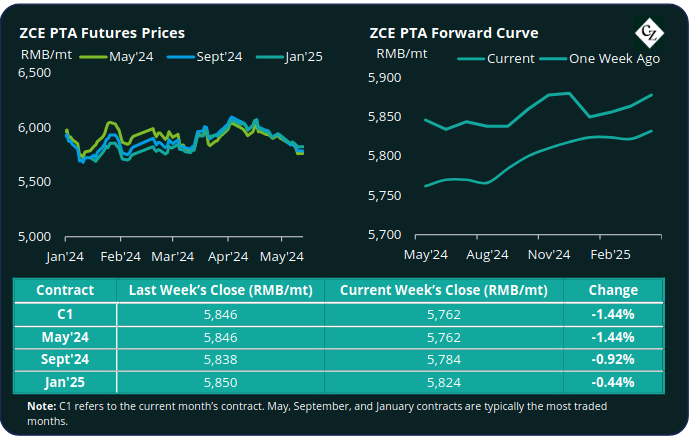

PTA Futures and Forward Curve

PTA futures continued to weaken as crude oil prices recorded another consecutive weekly loss; the main Sept’24 contract slipped around 1% driven in large by falling PX values.

Crude oil prices also weakened, through the weekend and into Monday, having inched higher at the back half of last week. Since the end of April, Brent crude oil prices have fallen by as much as 6%, with weaker crude oil demand sentiment dragging on prices.

The PX-naphtha spread recovered expanded marginally; whilst the PTA-PX CFR spread gained around USD 6/tonne to average USD 86/tonne last week.

This was reflective of a continued reduction in PTA inventories and slight improvement in overall market fundamentals.

However, whilst polyester operation rates remain high, recent polyester production cuts and the restart of several PTA units may weaken PTA market sentiment.

The near-term forward curve remains flat, moving into contango through Q3’24 and into 2025. The Sept’24 contract only holds a RMB 22/tonne premium over current month.

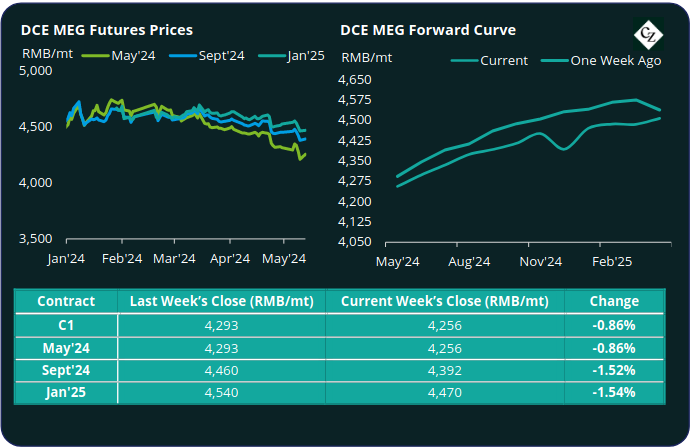

MEG Futures and Forward Curve

As with PTA, MEG Futures also continued to weaken, posting another consecutive weekly loss. The Sept’24 main month contract lost a further 1.5% last week.

Since the national holiday, East China main port inventories have declined by around 3.5% to 805k tonnes by last Friday.

Daily offtake has also risen sharply to the highest levels since Sept’22.

However, from a supply-demand perspective, sentiment is mixed with MEG plant restarts and recent polyester production cuts giving way to a more cautious outlook through to Sept’24.

The forward curve remains in contango, with the current month holding a RMB 136/tonne premium over the Sept’24 contract.

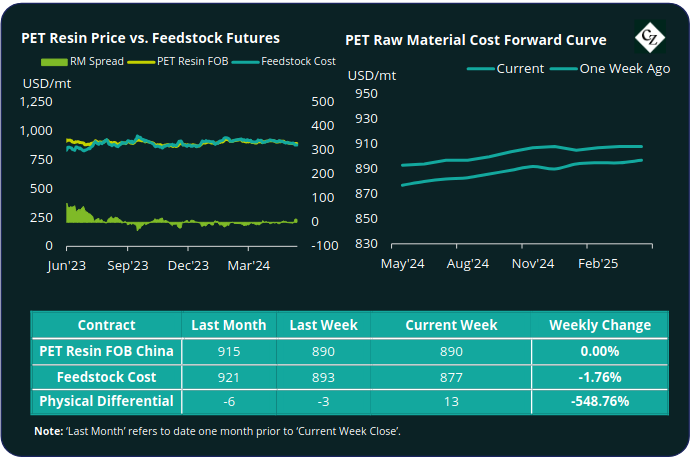

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices continued their post-holiday slide, with the average price moving down to USD 890/tonne, a decline of around USD 10/tonne since the end of April.

The PET resin physical differential against raw material future costs improved, increasing USD 3/tonne, to average USD 1/tonne last week. However, the differential jumped to USD 13/tonne Friday and followed over at a similar level on Monday.

The raw material cost forward curve remained relatively unchanged with a slight contango through to year end; Sept’24 contract premium over the current month increased slightly to USD 10/tonne, Jan’25 continued to hold an additional USD 10/tonne premium.

Concluding Thoughts

Since the May national holiday, lack of container space and availability out of China has impacted physical exports, with global shipments facing delays and cancellations across numerous routes.

Buyers have also experienced a shift in Chinese producer offers from CIF/CFR to FOB to avoid freight risk, presenting buyers with additional risk on container flows. Many are now turning back to breakbulk to resolve supply issues and bolster future security.

Although the physical differential to future raw material cost leapt on Friday, given the prolonged period of compressed margins, Chinese PET resin producers have moved lines into maintenance, and reduced operating rate since the end of April.

Early May has also seen new capacity additions from Anhui Haoyuan (300kta) and Xinjiang Yipu (120kta). Although producer stock levels are still healthy at around 15 days.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.