Insight Focus

- Crude rallies on Friday as US debt ceiling bill passes, lifting PTA futures.

- PET resin export prices keep stable, all eyes on Sunday’s OPEC+ meeting for price impact.

- Sanfame begins trials on its new 750kta production line, commercial volumes expected soon.

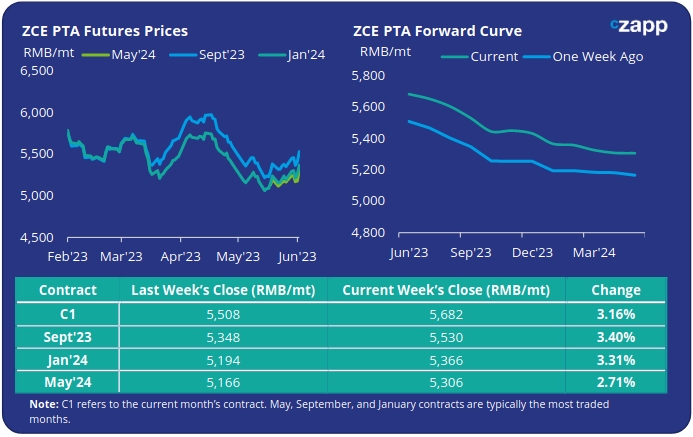

PTA Futures and Forward Curve

- PTA Futures rallied Friday as the US Senate passed the debt ceiling bill, pushing oil prices higher; Sept’23 contract prices leapt 2.6% on Friday alone.

- The rebound comes as another US inventory build put pressure on oil prices mid-week. OPEC+’s meeting on Sunday in Vienna, adds uncertainty and potential volatility if further production cuts are announced.

- Demand from polyester remains high, with polyester and textile mills continuing to lift operating rates, with inventories of polyester fibres and yarn hitting a yearly low. Despite being the traditional low season.

- However, as more PTA producers return following maintenance shutdowns from mid-June onwards, PTA production may outstrip demand with inventory accumulating once again.

- Polyester rates may also come under pressure to reduce rates into July due to weak macroeconomics conditions, shifting the overall supply/demand balance.

- As such, PTA margins are expected to be constrained, pricing driven more by crude and upstream costs in the coming months.

- The forward curve remains backwardated, particularly through Q3’23. By Friday, the Sept’23 contract was trading at a RMB 152/tonne discount to the current month.

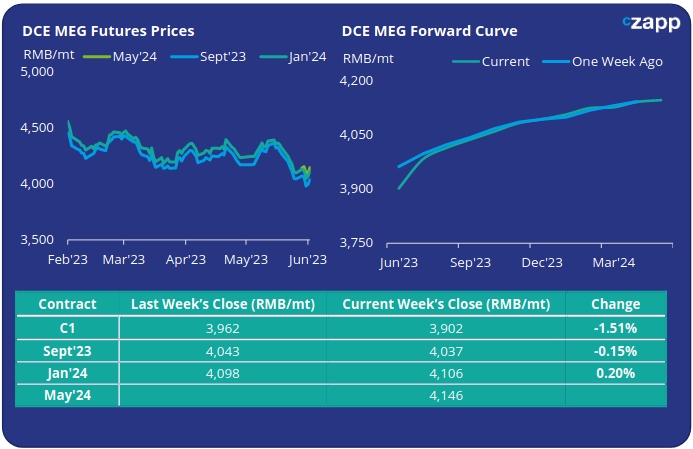

MEG Futures and Forward Curve

- MEG Futures on the other hand were immune to crude’s turnaround, instead the main Spet’23 contract ended last week flat-to-negative.

- Despite port inventory levels declining 5.6% last week to 945k tonnes, market sentiment was weak concerned with increasing domestic supply and an expected increase in imports in June.

- Sanjiang Chemical successfully started its 1Mmt/yr MEG unit with high run rates expected in June. Whilst US and Middle East producers are exiting turnarounds, which is anticipated to result in a gradual increase of MEG imports.

- Falling coal prices may also result in higher MEG production from domestic coal-based producers adding to oversupply concerns.

- The MEG forward curve shows a steady increase over the next 12-months. By Friday the Sept’23 contract was holding a RMB 135/tonne premium to the current month.

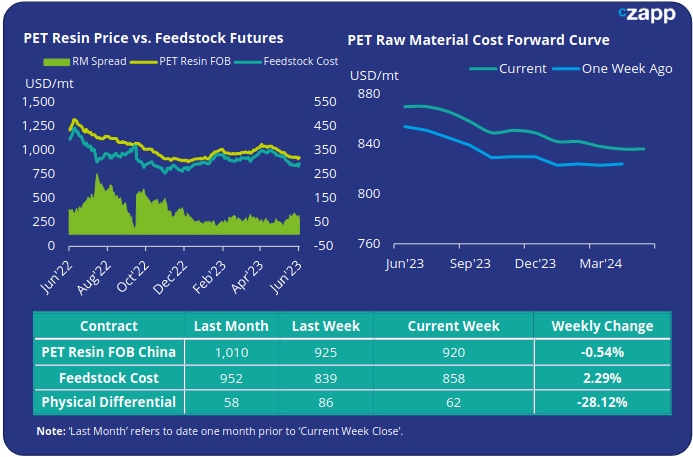

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET export prices remained relatively stable last week with prices averaging USD 920/tonne on Friday, down by just USD 5/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs has however contracted by USD 10/tonne to average USD 73/tonne for the week. By Friday, the daily spread had narrowed further due to the rebound in PTA prices, to USD 62/tonne.

- The shape of the current PET resin raw material forward curve whilst backwardated into Q4’23, is showing some near-term stability though June-July.

- At Friday’s close, Sept’23 raw material costs were trading with only a USD 12/tonne discount to Jun’23.

Concluding Thoughts

- Friday’s rebound in crude prices is expected to prompt a firming of PET export prices early next week, and a partial recovery in the physical differential. However, uncertainty abounds as we wait to see the latest twists and turns from OPEC on Sunday.

- If further crude oil production cuts are announced, bargain hunters holding out for further discounts may face higher costs, even if PET margins remain subdued.

- Although domestic demand has shown signs of improving, PET export demand has been much weaker during the last few weeks.

- Some Chinese PET resin producers also report experiencing greater competition from other origins, including India.

- New domestic capacity is also set to hit the market in June, keeping margins suppressed.

- Sanfame started trialling its new 750kta bottle grade PET resin production line last week. Trails of both the CP and SSP stages are expected to be completed over the next week, ready for full commercial production soon after.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.