Insight Focus

- Improved PTA fundamentals helps futures weather downturn in crude prices.

- PET resin export prices end week flat, buyers resistant to chasing prices higher.

- Whilst sales volumes expected to lift, margins look constrained by future supply additions.

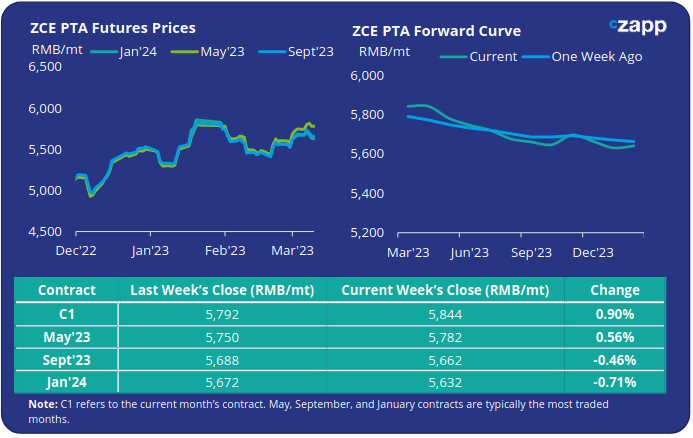

PTA Futures and Forward Curve

- PTA futures closed relatively flat versus the previous week, despite declining through the back-half of last week, as crude prices experienced their largest weekly loss since early February.

- Friday’s US jobs report is likely to provide additional direction to crude and upstream pricing, from which PTA futures may take their cue come Monday.

- However, several PX and PTA producers have entered turnarounds. With PTA operating rates declining over the past week, and high downstream polyester operating rates, spot liquidity tightened.

- Whilst supply/demand fundamentals have improved, margin is expected to stimulate higher PTA operating rates; new PTA capacity will also allow for ample supply.

- PTA forward curve remains slightly backwardated, with the May’23 now at a RMB 62/tonne discount to the current month’s contract.

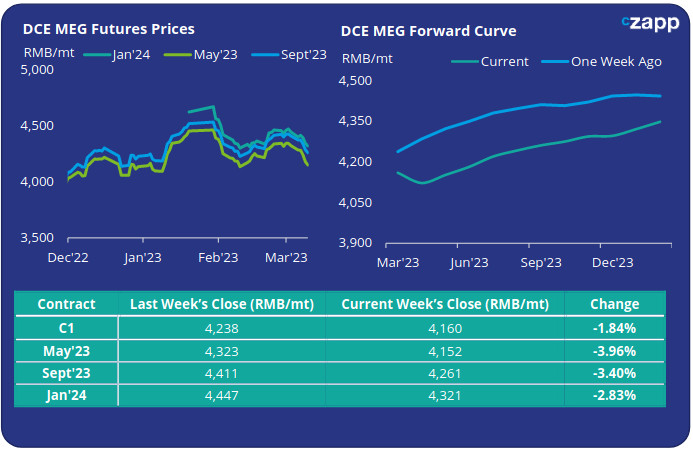

MEG Futures and Forward Curve

- MEG Futures declined sharply through the later part of the week, with supply still exceeding demand MEG prices were fully exposed to the fall in crude.

- East China main port inventories fell again last week, for a second week running. Although down a further 1.8%, port inventories remained high at 1.037 MMt.

- However, with such poor margins further production cuts at Chinese MEG producers are expected, with Chinese coal-based producers entering turnaround season in March.

- Higher domestic polyester operating rates may lend support to MEG demand. However, recent start-ups and upcoming plants continue to weigh on sentiment.

- The MEG futures forward curve remains in contango, rising through the later part of the year, although the May’23 contract is on-par with the current month’s contract.

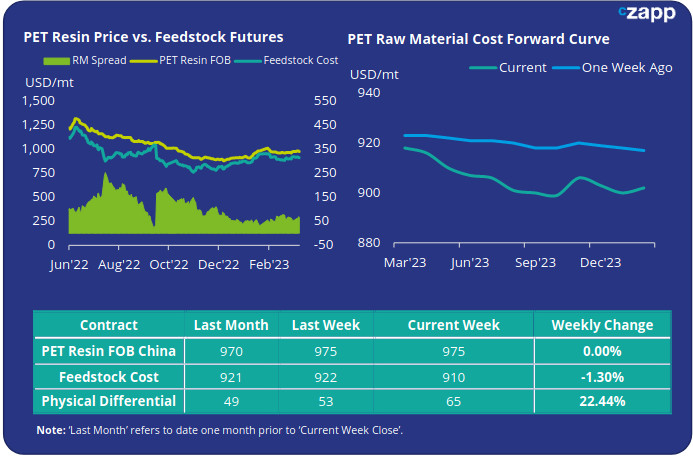

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices were once again at a standstill, averaging USD 975/tonne last Friday.

- The weekly average PET resin physical differential to feedstock costs saw a modest increase of around USD 5/tonne to average USD 63/tonne for the week. By Friday, the daily spread was just USD 65/tonne.

- The PET resin raw material forward curve moved into contango last week. At Friday’s close, the May’23 contract trading at a USD 8/tonne discount to the current month’s contract.

Concluding Thoughts

- Despite the small weekly increase, the physical differential between PET export prices and raw material futures remains constrained.

- Although both domestic and export PET resin demand has shown improved in recent weeks, with buyers and traders working/selling off stocks purchased at lower levels before the Spring Festival.

- As a result, there is little enthusiasm to chase prices higher.

- In terms of volume, export orders are reported to be at good levels and are expected to improve into key regions in the run up to peak season.

- Tighter Indian export availability has also boosted demand for Chinese resin into the Middle East and other markets.

- However, European buyers and traders are moving away from Chinese resin due to an increased risk of a potential anti-dumping case against Chinese producers being opened in Q2’23.

- The market now plays a waiting game ahead of new Q2’23 capacity additions; margins are projected to remain relatively rangebound through March.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.