Insight Focus

- PTA and MEG futures see marginal gains, upside constrained by high inventories.

- Polyester and bottle-grade resin demand improves on gradual recovery.

- PET resin export prices remain stable on tighter near-term availability.

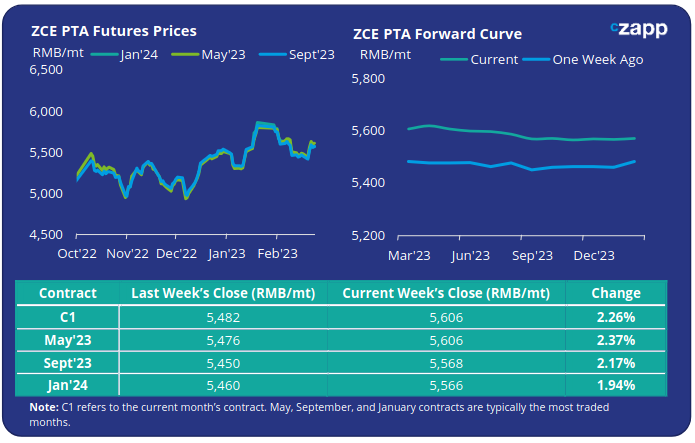

PTA Futures and Forward Curve

- PTA futures floated up marginally last week following upstream costs, further gains were constrained by ample supply availability.

- Inventories continue to grow as plants maintain high operating rates. Hengli Huizhou’s new 2.5 MMt/yr PTA plant is expected to come on-stream end of Feb/early Mar, adding to supply.

- However, with PTA margins now below traditional breakeven levels production cuts are expected; many PTA plants will also undergo turnarounds in Q2.

- Downstream, polyester demand is gradually improving, with a post-COVID recovery beginning to get underway.

- PTA forward curve remains flat, with the May’23 contract at the same level as the current month’s contract.

MEG Futures and Forward Curve

- MEG Futures also made gains, although similarly to PTA inventory accumulation continues to dampen trading sentiment, limiting upside potential.

- East China main port inventories increased a further 4.9% last week to 1.093 MMt, with port inventories approaching maximum capacity.

- Further production cuts at existing Chinese MEG producers are expected, with Chinese coal-based producers entering turnaround season in March.

- A series of Middle East shutdowns is also expected to see lower imports over the coming month.

- Fundamentals may see support from a steady improvement in demand through March and April, as downstream, recovery gains pace and polyester operating rates rise.

- The MEG futures forward curve remains in contango, the May’23 contract now at a RMB 96/tonne premium to the current month’s contract.

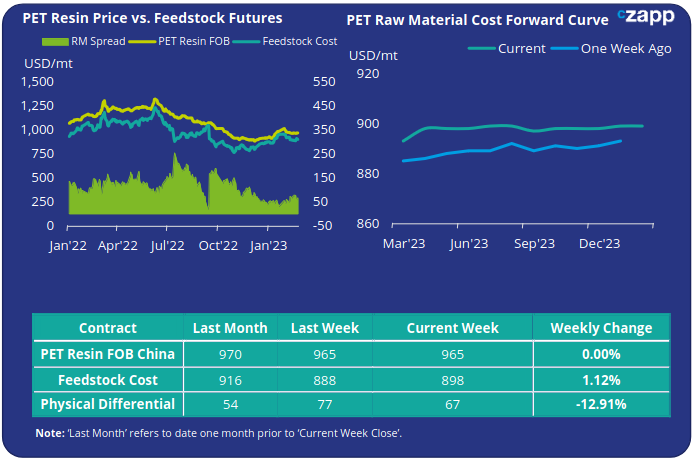

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices have remained flat and stable through the past couple of weeks, and averaged USD 965/tonne last Friday, the same as the previous week.

- The weekly average PET resin physical differential to feedstock costs declined breaking the upward trend, averaging around USD 64/tonne, down USD 13/tonne on the week. By Friday, the daily spread was USD 67/tonne.

- The PET resin raw material forward curve remained flat over the past week. At Friday’s close, the May’23 contract showing just a USD 5/tonne premium over the current month’s contract.

Concluding Thoughts

- Whilst the physical differential to raw material futures remains sluggish, there are signs that demand both domestically and for export is improving.

- Most major producers claim to be sold out for March but are still keen to look at April sales and beyond.

- Tighter near-term availability for prompt shipment is likely to support improved margins into March.

- However, upside to any forward premium for PET resin export prices is expected to come under pressure once the new capacities come on-stream in early Q2.

- Sanfame is expected to add its first 750kta PET resin line by early April, with the second 750kta line due early July 2023.

- Although further significant capacity additions are also anticipated through the rest of 2023, Chinese production is expected to remain profitable and competitive within the global market.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.