China’s PET resin export prices physical differential to feedstock costs has become more negative. PTA futures have strengthened slightly, whilst MEF futures remain flat over the previous week. East China’s main port MEG inventories declined again following strong increase the week before.

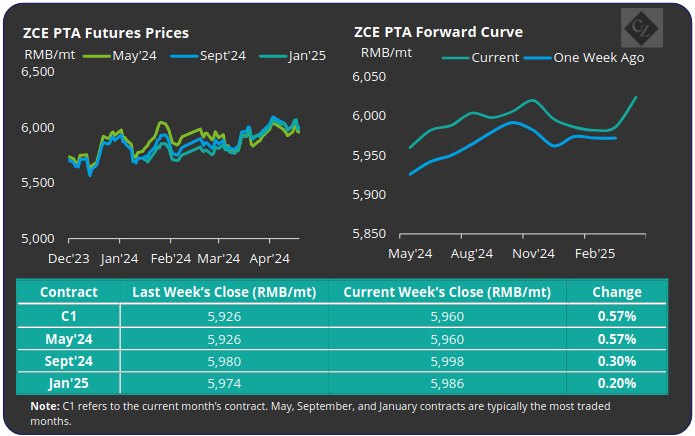

PTA Futures and Forward Curve

May’24 PTA futures strengthened almost 0.6% over the last week, closing on Friday at RMB 5,960/tonne.

This is despite crude oil prices falling sharply back below USD 90/barrel on Friday. Any further weakness will likely be reflected in the PTA futures in the coming week.

This slight price strength was replicated by contracts further down the board, lifting the PTA futures forward curve.

Despite improving supply/demand fundamentals, higher inventory pressure continues to squeeze PTA margins with the forward curve maintaining an upwards slope to Q3. The Sept’24 contract ended the week at a RMB 38/tonne premium to the front month.

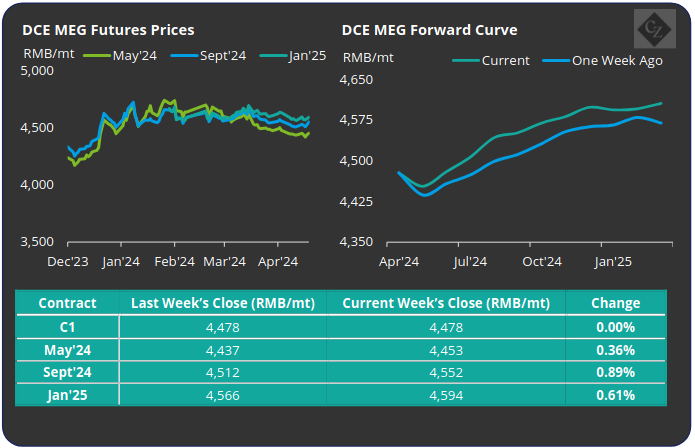

MEG Futures and Forward Curve

MEG Futures front month contracts remained rangebound over the last week, closing flat on the week before by Friday.

By contrast, contracts further down the board saw some strength, with the Sept’24 contract gaining 0.36% from the week before, the Jan’25 contract climbing by almost 0.9%.

This means that after the front month contract the MEG futures forward curve remains in contango through to at least March 2025.

East China main port inventories declined by around 3.72% from the previous Friday after a strong increase from the week before. Total inventory now stands at 811,000 tonnes.

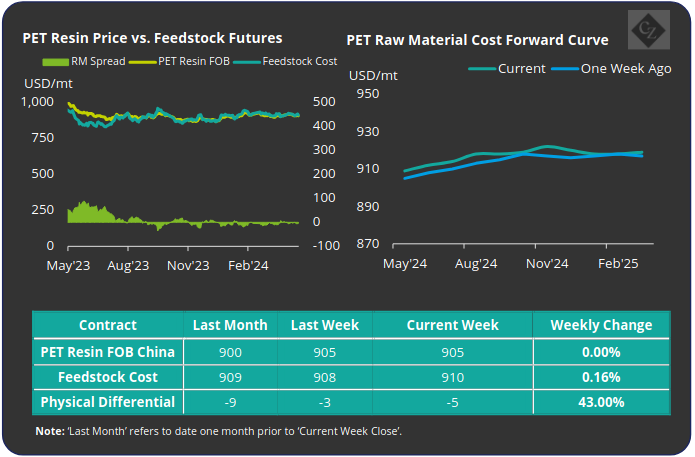

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices strengthened slightly during the previous week before closing on Friday back at USD 905/tonne, the same level as the week before.

However, with feedstock costs rising by USD 3/tonne to USD 910/tonne over the week, the physical differential has widened and now stands at negative USD 5/tonne.

The raw materials forward curve generally lifted slightly but remains in contango. The Sept’24 contract has around a USD 9/tonne premium over the current month.

Concluding Thoughts

Pressure is likely to remain on the physical differential for the remainder of April and into May as new capacity comes online. This is in combination with new trade barriers coming into force across key markets is likely to impact Chinese export demand.

Further constraints to Chinese PET resin producers come from tight container available and space on some shipping routes to Latin America.

All in, current forward PET resin export offers match with the raw material forward curve, which only offers around USD 10-20/tonne for Q3’24.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.