Insight Focus

- Despite improved PTA fundamentals, futures hit by rout in crude markets.

- PET resin export prices hold flat, price sets to move lower if crude fails to rebound quickly.

- With ample availability, new capacity additions due April may constrain export prices.

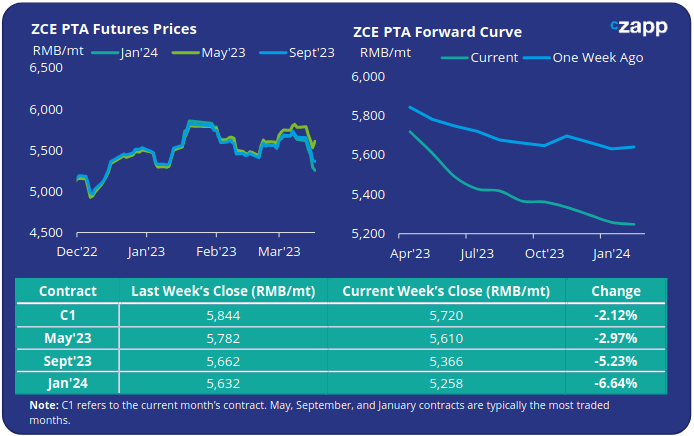

PTA Futures and Forward Curve

- PTA futures were at the mercy of falling oil prices after fears of another financial crisis reared its head following the collapse of the Silicon Valley Bank and further issues at Credit Suisse.

- Crude prices posted their worst week of the year so far with Brent Oil down 10% on the week; PTA futures faired a little better but major contracts were 3-6% on the week.

- The direction next for PTA Futures will largely be determined by the macro picture rather than market fundamentals. Whilst financial instructions try to calm the markets, many will be looking for signs of contagion, something that may take weeks or months to play out.

- Oil prices may move lower based on central banking decisions over the coming days, equally oil prices could quickly recover after the dust settles.

- Therefore, whilst PTA supply/demand fundamentals have improved, expect increased price volatility throughout the PET value chain over the coming weeks.

- PTA forward curve has moved into steeper backwardated, with the May’23 now at a RMB 110/tonne discount to the current month’s contract; Sept’23 RMB at a 356/tonne discount.

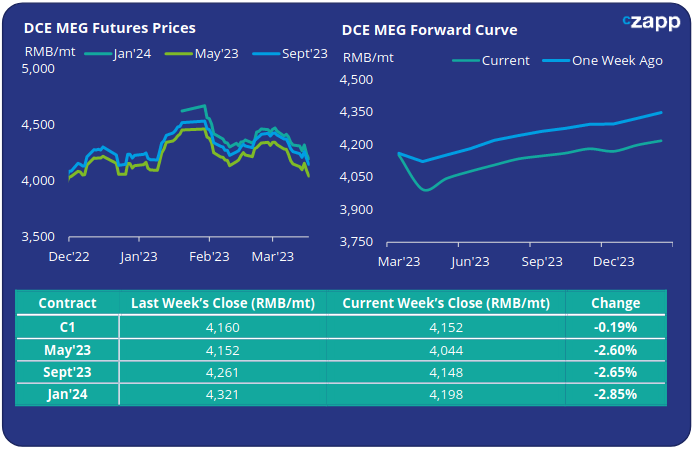

MEG Futures and Forward Curve

- Having faced a sharp decline the previous week, MEG Futures sunk by a further 2-3% last week reaching their lowest levels this year, following the wider commodities sell-off.

- Despite polyester operating rates remaining high, buyers sat on the side-lines watching the rout, as trading sold-off into an already over-supplied market.

- Whilst East China main port inventories continued decline, down a further 2.7%, port inventories remained high, above the 1Mt level.

- Recent start-ups and upcoming plants will also continue to weigh on sentiment even with turnarounds in March.

- MEG futures remains in contango, rising through the later part of the year, although near-term weakness in the May’23 contract is apparent; falling to a RMB 108/tonne discount to the current month.

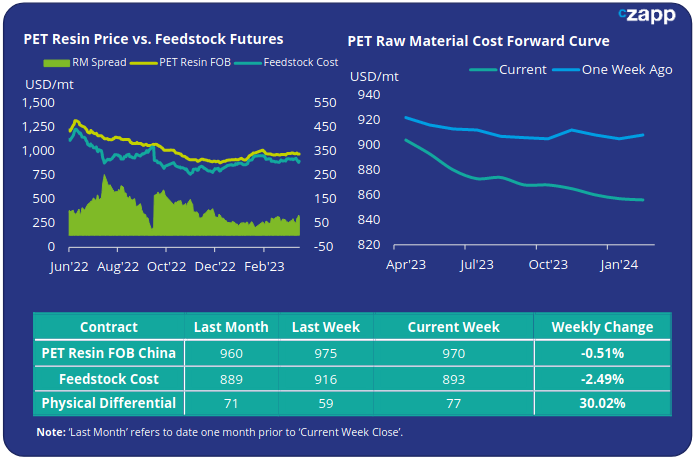

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices closed the week relatively flat, averaging USD 970/tonne last Friday, down just USD 5/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs saw a modest increase of around USD 9/tonne to average USD 72/tonne for the week. By Friday, the daily spread had increased to USD 77/tonne.

- The PET resin raw material forward curve steepened in backwardation last week. At Friday’s close, the May’23 contract trading at a USD 13/tonne discount to the current month’s contract, whilst Sept’23 was running at a USD 36/tonne discount.

Concluding Thoughts

- Whilst the physical differential between PET export prices and raw material futures improved, it’s also clear that the volatility in upstream costs has not yet filtered through into PET spot prices.

- Some Chinese PET producers report being sold out for April, due to large domestic orders, others can still offer for April export orders.

- This level of availability just one month forward, particularly in the run up to peak-season, indicates comparative length in the market, although margins remain healthy.

- Combined with the collapse in crude and falling raw material prices, some producers began to price aggressively last week.

- January and February trade data, expected to be released next week, will give a clear view on order flow and export demand levels coming out of Q1’23 (see future Czapp report).

- All eyes are also on how the market begins to react ahead of any new capacity additions expected in early Q2’23.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.