Insight Focus

- PTA and MEG futures have fallen over the last week.

- PET resin export prices continue to decline in August.

- A further backwardated raw materials cost forward curve hints at further downside still to come.

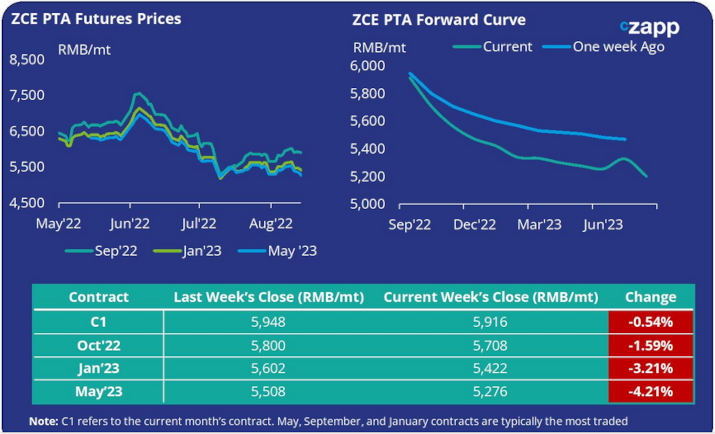

PTA Futures and Forward Curve

- Sept’22 PTA futures are down by 0.5% this week, closing close to 5900RMB/mt.

- Losses were heavier further down the board, with May’23 values falling more than 4%.

- A backwardated forward curve reflects supply reduction in near term as PTA plant operating rate falls to a two-year low.

- Downstream demand remains subdued but is expected to gradually improve through Q3 as polyester operating rates forecast to rise.

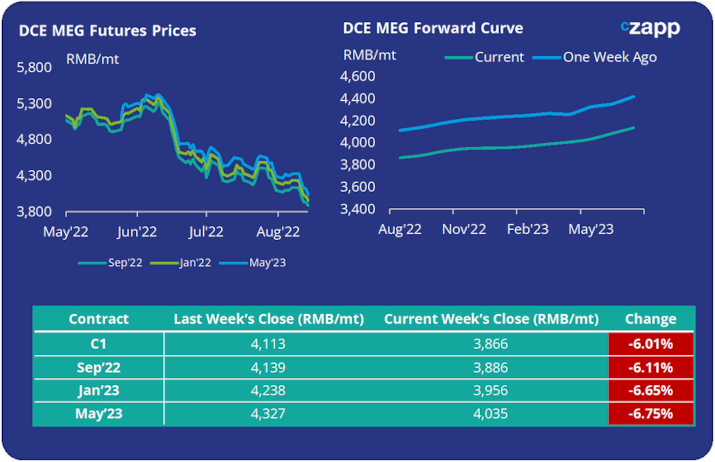

MEG Futures and Forward Curve

- MEG futures have weakened significantly to the 19th of August, with front month values below 3900RMB/mt, falling oil prices are a key factor in this.

- Values across the forward curve are down around 6% from the previous week, keeping the market in contango through Jul’23.

- This is indicative of the oversupply problem facing the market at the moment as decrease in inventory still sluggish.

- Likewise, downstream demand still expected to pick up through as we progress further into the year, improving prices into Q4 and 2023.

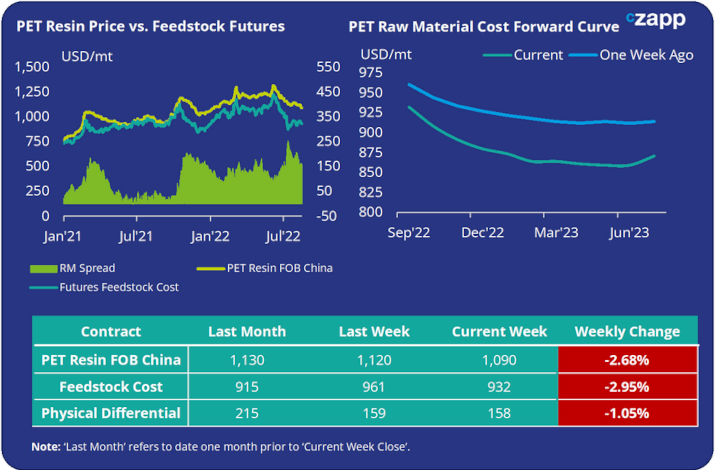

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices continue their decline, falling a further 30RMB/mt over the last week.

- The weekly average PET resin–raw material physical differential appears to have stabilised around 158USD/mt after a significant weakening in the previous update.

- The PET resin raw material forward curve has become increasingly backwardated in 2022, before flattening through H1’22.

Concluding Thoughts

- Oversupply problems in the raw material’s markets persist in general, however an increasingly backwardated PTA forward curve suggests a tighter market in the very near term.

- With feedstock costs down, and continuing covid lockdowns subduing demand, the PET resin export price has continued its downtrend in August.

- Additionally, steepening backwardation in the PET raw materials futures curve indicates there could more downside to come.

- However, increasingly muted export prices do further aid the competitiveness of Chinese exports to Europe compared to the gas crisis affected European converters.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

What Europe’s Deepening Energy Crisis Means for PET Resin

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs