Insight Focus

- PTA prices decline on weaker upstream costs, PTA fundamentals stable.

- China PET resin export prices ebb lower; raw material spread show upward trend.

- Whilst export sales are robust, slower domestic sales, new capacity, and trade barriers threaten.

PTA Futures and Forward Curve

PTA Futures weakened by just over 1% last week, despite signs of a recovery in crude prices towards the end of the week.

Having retreated from the low-90s into the mid-80s, last Friday, oil price benchmarks posted their first weekly gain in three weeks, rising to over USD89/bbl.

Crude prices rose as Israel prepared for the next stage of its Rafah offensive, heightening tensions around the Middle. A strong draw down on US crude oil inventories, and critical US economic data supporting a view towards rate reductions also bolstered crude prices.

As a result, the PX-N spread narrowed further, with naphtha prices rising with crude, and PX prices falling on increased supply, as plants restart.

The fall in PX prices were the main driver for lower PTA values, as the PTA-PX spread showed a slight increase.

Whilst PTA inventories remain elevated, expectations are for destocking through the summer months, and an improvement in supply/demand fundamentals, with polyester operating rates keeping high.

The forward curve has flattened out in recent weeks, with the Sept’24 contract having just a RMB 16/tonne premium over current month.

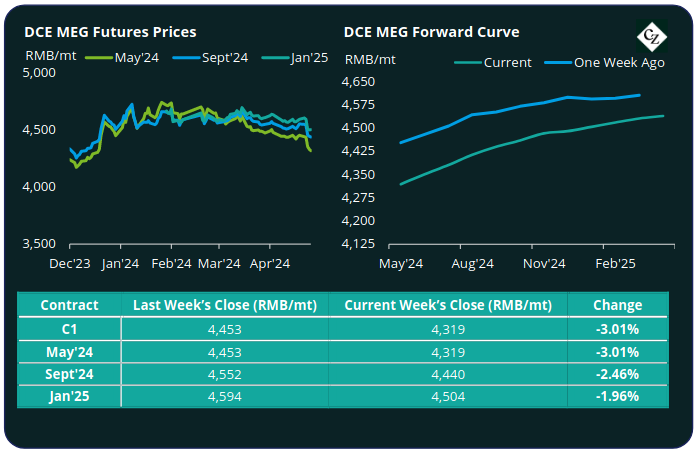

MEG Futures and Forward Curve

MEG Futures fell sharply with main month contracts averaging declines of between 2.5-3% last week, with spot prices hitting their lowest levels so far this year.

East China main port inventories increased again last week, up around 7.4% to 871k tonnes by Friday.

Although daily offtake has increased modestly since the beginning of April, with some buyers restocking, import arrivals remain relatively high, and are expected to remain so into early May.

The forward curve remains in contango, however, the premium shown by the Sept’24 contract over the current month has increased to RMB 121/tonne, with the recent drop in near-term pricing.

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices continued to soften last week, with the average moving down to USD 900/tonne on Friday, a decline of around USD 5/tonne on the previous week.

Spot offers in the USD 890s/tonne were once again being heard from some producers.

Conversely, the weekly PET resin physical differential against raw material future costs has continued to improve, up by USD 8/tonne, to average USD 4/tonne for the week; by Friday the differential was USD 8/tonne.

The raw material cost forward curve continues to be in slight contango; Sept’24 contract has around a USD 8/tonne premium over the current month.

Concluding Thoughts

Whilst the raw material physical differential to spot PET resin prices has seen some improvement, spreads remain volatile due to dramatic swings in feedstock costs.

However, an upward trend in the raw material spread has formed since late March, partly due to improved fundamentals and robust export demand through Q1.

Latest Chinese customs export data shows record PET resin export volumes for March and for the Q1’24 total.

Since the end of 2023, new export order intake has averaged around 450k tonnes, around 50% higher than a year earlier; price stability through Q1 has also been buyer friendly.

Whilst total export sales have risen sharply because of massive, and on-going, capacity expansion seen within China, there is still ample availably for prompt shipment from most producers.

Further new capacity due in Q2 and Q3, will continue to constrain the physical differential; new trade barriers across EU, India, Mexico, and South Korea, are also expected to impact future Chinese export demand.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.