Insight Focus

- Chinese PET exports post record Sept levels, sales pressure comes from new over-capacity.

- Chinese exports to face increased scrutiny and potential new trade barriers.

- US imports buck the recent downward trend, economic recovery strengthens demand.

China’s Bottle-Grade PET Resin Market

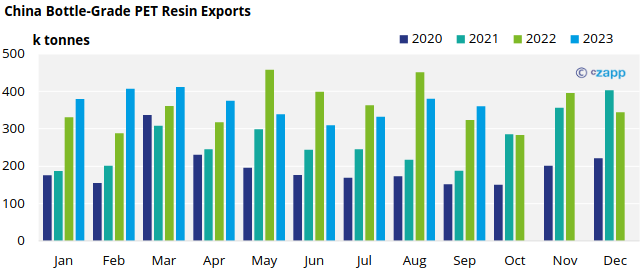

Monthly Exports

- Chinese bottle-grade PET exports (HS 39076110) remained relatively steady at over 360k tonnes in September, down just 5% on the late summer surge seen the previous month.

- Over the first nine-months of the year monthly exports volumes have averaged only slightly higher at 366k tonnes with much less seasonality seen in previous years.

- The main difference of course is the additional 4 million tonnes of new capacity that has been added in China since March, inflating total export volume even into the off-season.

- Peru was the largest destination market in September joining several other Latin American destinations to make the Top 10, with around 18.1k tonnes, a monthly increase of 16% ahead of the summer season in the Southern Hemisphere.

- Colombia also experienced large volume increases as an end market, up 77% on the month to over 15k tonnes.

- Despite anti-dumping measures against Chinese resin, India was once again the second largest destination in September, with around 17.4k tonnes.

- This is attributed to the one Chinese PET resin producer on the lowest duty structure.

- The recent surge of Chinese PET resin into India has already resulted in domestic producers lowering operating rates.

- Southeast Asia also continued to a be a sink for new Chinese volume, with exports to Indonesia and Vietnam ranking 4th and 5th in the monthly destination list.

- Whilst monthly exports to Indonesia fell 17% on the month and were down 9% versus a year earlier, volumes to Vietnam continue to steadily increase.

- Exports to Vietnam increased 7% in September to around 13.6k tonnes, and 224% compared to last year.

- With Southeast Asia expected to become a prime target for new Chinese production, domestic producers in several of these countries are already discussing fresh petitions for new trade barriers against Chinese resin.

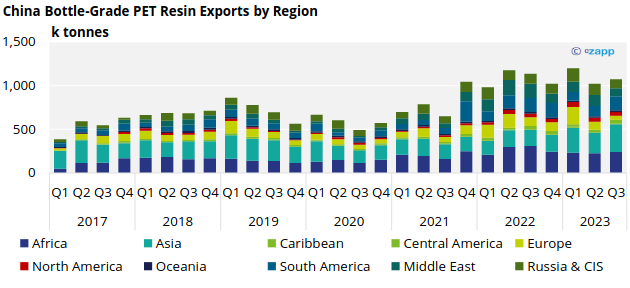

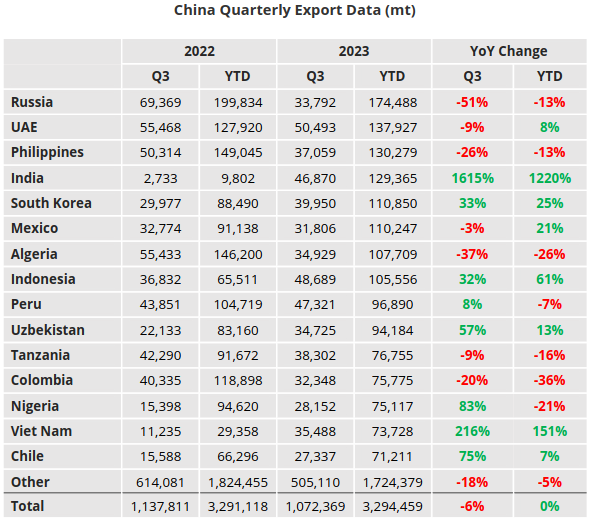

Quarterly Exports

- Looking at the latest full quarter, Chinese bottle-grade PET Resin exports totalled 1.07 million tonnes, up 4.8% versus the previous quarter, yet still 6% down on the same period a year earlier.

- Total year-to-date volume sits at around 3.3 million tonnes, on par with the first nine-months of 2022.

- Of the major importing regions, Central America, South America, and Asia experienced the largest quarterly gains, up 153%, 34.9%, and 32.4% respectively.

- Whilst volumes to Europe plummeted by 50.8% in Q3, to just over 45k tonnes, ahead of the now announced provisional anti-dumping duties.

- Looking forward despite current weakness in export sales, the addition of new capacity in China is expected to result in an overall increase in exports in the later part of this year and in 2024.

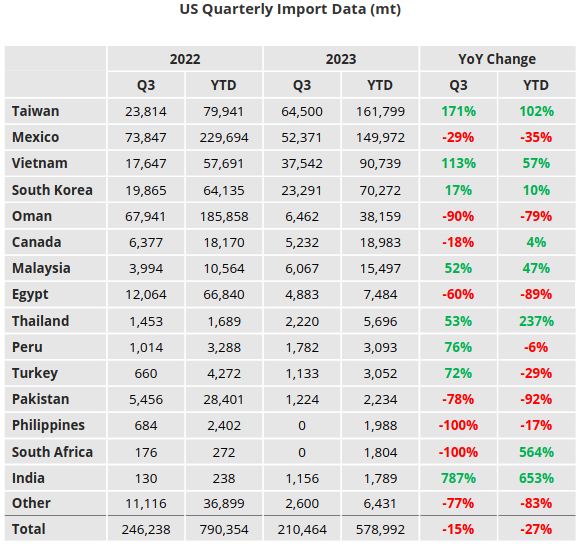

US Bottle-Grade PET Resin Market

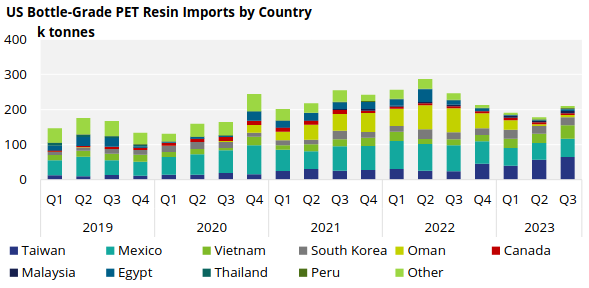

Quarterly Imports

- As anticipated in the last report, a late summer demand surge in the US resulted in a Q3 rebound for imports.

- US bottle-grade PET imports totalled 210k tonnes in Q3’23, rebounding 18.8% on the previous quarter. Although still 15% below the same period a year earlier.

- Year-to-date imports remained substantially below levels seen the previous year, down 27% over the 9-month period versus 2022.

- However, Q3 does mark a break in four consecutive quarterly declines, as domestic demand regains a stronger footing amid early signs of an economic recovery.

- Origins with the greatest volumes in Q3’23, include Taiwan, Mexico, Vietnam, and South Korea.

- Whilst Taiwanese resin accounted for the largest share of total imports by volume, with 64.5k tonnes in Q3. Imports from Vietnam grew the most over the third quarter, increasing over 40% to 37.5k tonnes.

- Mexican imports also partially rebounded, increasing 11% on Q2. However, compared to the previous year, imports from Mexico were down by 29% in Q3’23 due to the strength in the Mexican domestic market as well as production issues limiting supply.

- However, imports from Oman continued to wither up, dropping to a little under 6.5k tonnes in Q3, down 90% from levels seen a year earlier.

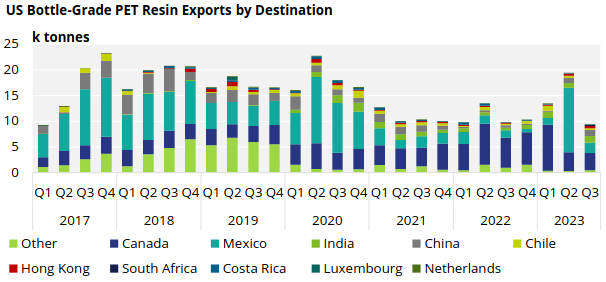

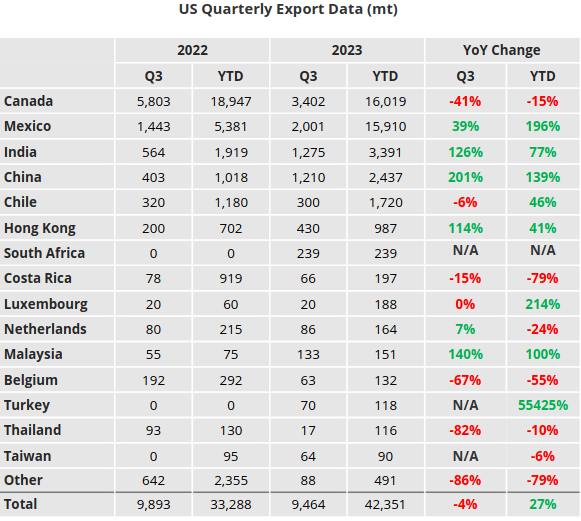

Quarterly Exports

- US bottle-grade PET exports totalled 9.4k tonnes in Q3’23, down by over half versus the previous quarter, and 4% below the Q3’22 level.

- Although Mexico and Canada continued to take most US PET resin exports, share of total volume dropped from 83% to 57% in Q3.

- US exports were unaffected by the recent sharp increase in Mexican import Tariffs on PET resin from a range of Asia origins.

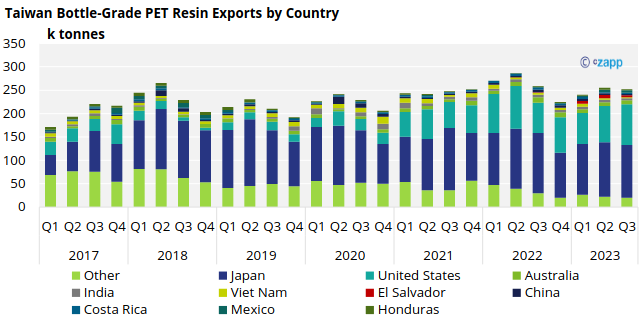

Taiwan Bottle-Grade PET Resin Market

Quarterly Exports

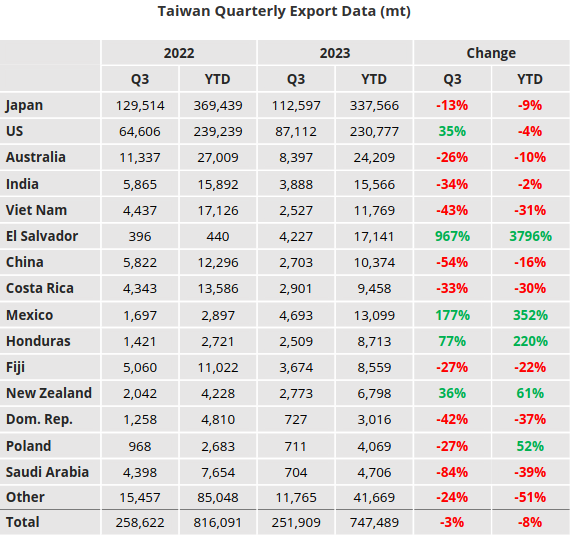

- Taiwanese PET resin exports totalled 252k tonnes in Q3’23, slightly down by around 1.3% on the previous quarter and 3% year-on-year.

- Japan remained the largest destination for Taiwanese resin recording around 113k tonnes in Q3 and representing around 45% of total exports.

- However, volume to Japan was down 3.4% on Q2’23, and 13% lower than the volume seen over the same period a year earlier.

- Instead exports to the United States increased sharply in Q3, up over 12.6% on the previous quarter, reaching 87k tonnes.

- However, year-to-date total export volume to the US was still down around 4% on the previous year.

- US share of total Taiwanese PET resin exports also increase to around 35% in Q3’23.

- Amongst other smaller export destinations, Australia, Costa Rica, and Fiji saw some of the largest volume increases.

- Q3’23 volumes to Australia gained 8.5% on the previous quarter, increasing to 8.4k tonnes, although this was markedly down from a year earlier, a decrease of 26% on Q3’22.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.