Insight Focus

- Chinese PET resin exports post another record year in terms of volume.

- South Korea exports experienced a seasonal decline; ADD against China investigation initiated.

- Thailand PET resin exports increased 13% in 2023, Japan and US remain key markets.

China’s Bottle-Grade PET Resin Market

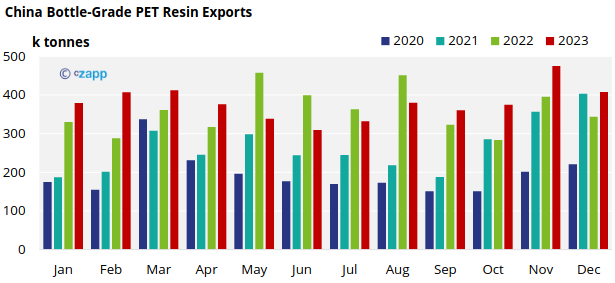

Monthly Exports

- Chinese bottle-grade PET exports (HS 39076110) fell to around 408k tonnes in December, decreasing 14% on the previous month, although 18% above levels seen a year earlier.

- These levels were in line with previous expectations, with fewer exports in the second half of December resulting from the Christmas slowdown and the Red Sea impact on freight rates.

- New order intake has increased in January to around 450k tonnes, despite elevated freight prices, with foreign buyers getting orders in ahead of Chinese New Year (10-17 Feb).

- Russia was the largest destination for Chinese PET resin exports in December, with over 22.1k tonnes, although month-on-month volumes fell by 23%.

- Exports to Russia typically see a seasonal increase late Q4/early Q1 in preparation for Spring restocking.

- Tanzania and Nigeria ranked 2nd and 3rd also recorded exports volumes over 20k tonnes. Exports to Tanzania leapt in December by over 190% and increased by 720% versus Dec’22.

- Exports to Nigeria have also shown sizeable increases in recent months, increasing 225% in December.

- · Wankai New Materials has recently announced plans to build a 300k tonne PET resin plant in Sagamu in the Nigerian state of Ogun.

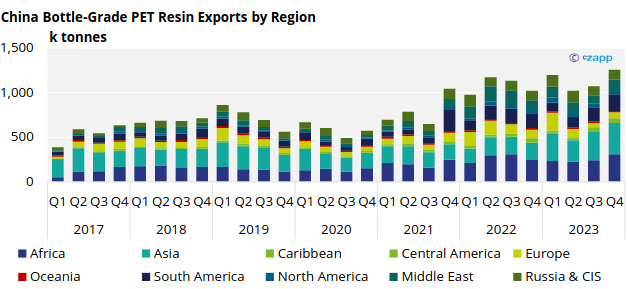

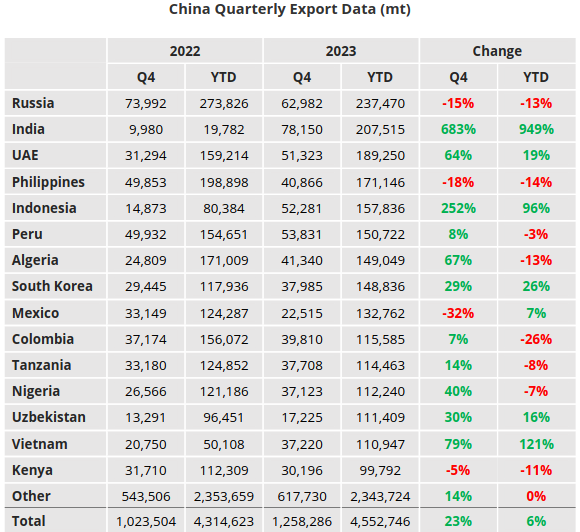

Quarterly Exports

- Looking at the latest full quarter, Chinese bottle-grade PET Resin exports totalled 1.26 million tonnes in Q4’23, up 17% versus Q3’23, and an increase of 23% compared to Q4’22.

- For the full year 2023, China exported around 4.6 million tonnes of bottle-grade PET resin, increasing 6% on 2022 levels, marking another record year for Chinese exports.

- With massive capacity expansion in 2023, and a continuing build program in 2024. Chinese exports are expected to continue to set new records in 2024.

- Overall, Russia, India, and the UAE were the top three destinations for FY’23, with 237k tonnes, 208k tonnes, and 189k tonnes respectively.

- Exports to India experienced a 949% increase on 2022 levels, whilst Indonesia and Vietnam also saw annual volumes balloon by 96% and 121%, to 158k tonnes and 111k tonnes respectively.

- By region, Asia was the largest destination last year, with around 27% of total Chinese PET resin exports, followed by Africa and 22%, and South America with 12%.

South Korea’s Bottle-Grade PET Resin Market

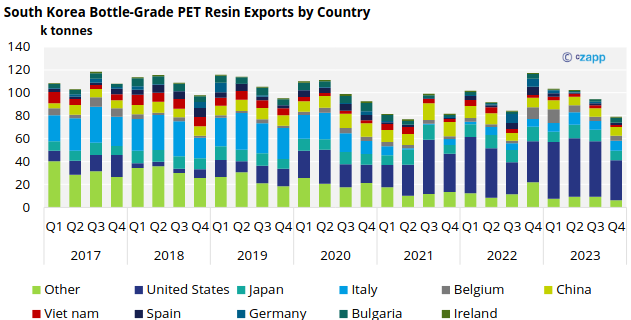

Quarterly Exports

- South Korean bottle-grade PET fell for a third consecutive quarter in Q4’23 to just over 79k tonnes, down 16% on the previous quarter and down by a third versus the same period a year earlier.

- For the full-year 2023, South Korean PET resin exports totalled 379k tonnes, down 4% compared to the previous year.

- South Korea’s largest export market is the United States, which accounted for around 35k tonnes in Q4’23, and around 48% of total exports for the year.

- Therefore, much of the overall drop in volume came here, with exports to the US declining by 27% versus Q3’23.

- Weaker seasonal demand was the key driver; overall exports to the US were up 18% for the FY.

- Exports to Japan and Vietnam also fell sharply last quarter, down 18% and 26%.

- However, volumes to Belgium and Italy grew by around 15% each, in part in response to provisional anti-dumping duties on Chinese resin into the EU.

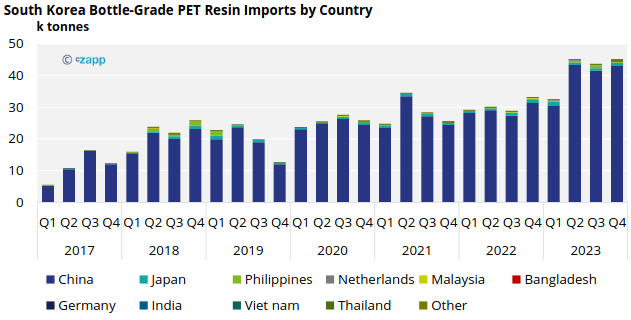

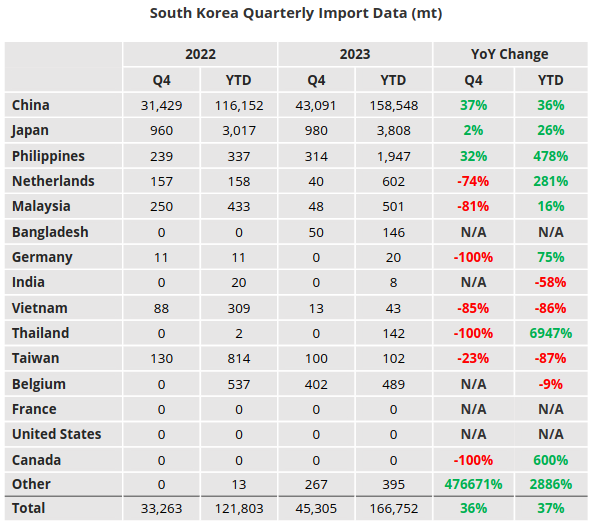

Quarterly Imports

- South Korea’s bottle-grade PET resin imports on the other hand continued to swell, totalling 45k tonnes in Q4’23, a 3.5% increase versus the previous quarter, and up 36% versus Q3’22.

- China remained South Korea’s main resin supplier, supplying over 95% of Korea PET resin imports, over 43k tonnes in Q4’22.

- As a result, South Korea has recently initiated an anti-dumping investigation on several main Chinese PET resin suppliers, including Yisheng and CRC.

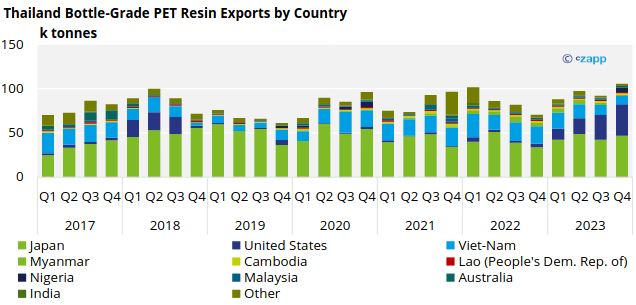

Thailand Bottle-Grade PET Resin Market

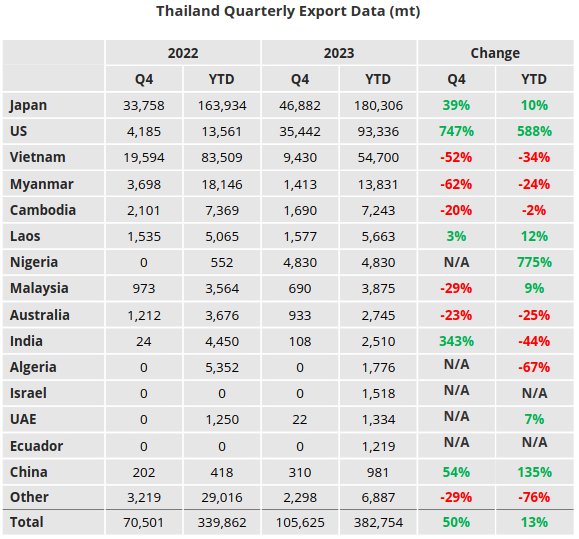

Quarterly Exports

- According to Thai Customs, Thailand exported a total of 106k tonnes of PET resin (HS 390761) in Q4’23.

- The top three countries captured around 87% of total Q4 exports, these included Japan, the US, and Vietnam, with 46.9k tonnes, 35.4k tonnes, and 9.4k tonnes respectively.

- For the full-year 2023, Thai PET resin exports totalled 383k tonnes, up 12.6% compared to the previous year.

- Exports to Japan increased around 11% versus Q3’23, to just under 47k tonnes; FY 2023, exports to Japan reached 180.3k tonnes, a 10% increase on the previous year.

- Exports to the US also continued to rise strongly, with a 28% quarterly increase to 35k tonnes: totalling of 93k tonnes for FY 2023, a massive 588% annual increase.

- Despite losing ground to Chinese resin in key markets such as Vietnam, Thai exports experienced large volume gains into other markets, including Nigeria.

- Thai exports to Nigeria experienced FY 2023 volumes increases of 775%, albeit it from a low base to around 4.8k tonnes.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.