Insight Focus

- Asian countries continue to pivot towards food-grade rPET.

- Recycling capacity steadily expands in North America; demand set to out-strip growth.

- Faerch and Indorama separately announce breakthroughs in tray-2-tray recycling technologies.

This Month’s Top Trends

1. rPET Rapidly Gaining Acceptance in Food Contact Applications Across Asia

Following on from last October’s article Changing Regulations Trigger RPET Boom in Asia, there have been several important developments relating to the increasing acceptance of recycled plastics in food contact materials within Asia.

This month Thailand announced revised food-contact regulations for plastics. Following a draft proposal in March, the Thai Food and Drug Administration will now permit the use of plastic food packaging made from rPET. The conditions are that the recycled material is obtained from a secondary recycling source, which has been evaluated for safety and shows that contaminants are reduced or eliminated.

In May, the Taiwan Food and Drug Administration (TFDA) also launched a proposal for the use of recycled rPET chips and flakes in food containers and packaging manufacturing. If approved by TFDA, rPET materials could be used in the manufacture of food utensils, containers, and packaging. The TFDA also said that future rPET material should comply with the safety assessment principles developed by the EU or the US.

In January, the Food Safety and Standards Authority of India (FSSAI) amended India’s Food Safety and Standards (Packaging) Regulations 2018, allowing the use of recycled plastics in food contact materials. More recently in June, the FSSAI issued a draft of the new Food Safety and Standards (Packaging) Amendment Regulations, 2022, including new standards and guidelines of the use of plastics in food contact applications.

Regulations surrounding the use of recycled plastic in food contact applications are beginning to change rapidly right across Asia. This is expected to continue snowballing over the coming year across other Asian countries, particularly within Southeast Asia.

All eyes are of course also on China, as the world’s largest consumer of PET materials. However, acceptance and use of rPET within FCM may still be some way off.

2. North America Seeks to Rapidly Expand Recycling Capacity

Future increases in Asian food-grade recycled plastic demand are expected to reduce the flow of exports to other regions, such as North America and Europe.

The US in particular looks set to feel the squeeze, with a growing number of recycled-content mandates at state level and an ever-shortening timeframe for ambitious brand commitments set to boost demand.

Over the last month, several key announcements were made to help raise future recycled plastic supplies:

- PolyQuest announced new investment in its PET recycling operation in Darlington, South Carolina. Since 2006, Polyquest has produced rPET resins at the Darlington facility, including FDA-approved food contact material. The new investment plans call for at least one additional FDA-compliant rPET resin line in Darlington, scheduled to begin operation in the third quarter of next year.

- Closed Loop Partner announced that its Closed Loop Infrastructure Fund and Closed Loop Circular Plastics Fund committed USD 5 million to help establish a flexible film recycling plant in Minnesota for South African-based recycler Myplas. The facility is targeted to begin operation in spring 2023 and will produce recycled low-density polyethylene pellets and food-grade, high-density polyethylene pellets.

- Earlier this year, the Colorado legislature also passed a measure that puts private-sector producers in charge of paying for and running a state-wide recycling system aimed at creating a circular economy for recyclable materials.

3. US Plastic-Free Movement Intensifies

Despite a steady stream of announcements from the US recycling industry, states also continue to push ahead with more bans and clamp downs on single-use plastics.

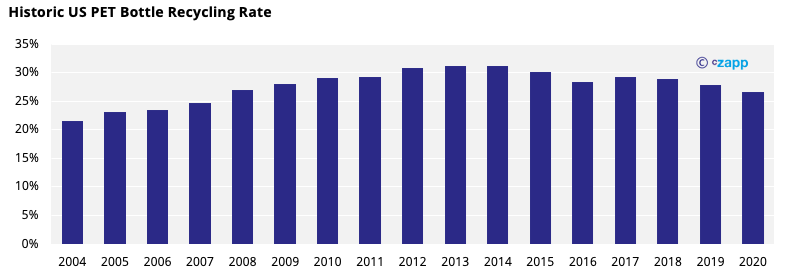

Whilst collection volumes have continued to increase, driven by growth in consumption of packaged goods, the US has experienced a decade long decline in PET bottle recycling rates.

In response, earlier this month, US Secretary of the Interior Deb Haaland issued an order to phase out single-use plastic products at national parks and on federal land by 2032.

The order aims at phasing out the purchase, sale, and distribution of single-use plastic products and packaging on federally managed lands by 2032. Instead, the department will investigate switching to “environmentally preferrable” alternatives, such as compostable or biodegradable materials, or 100% recycled materials.

Other new anti-plastic bills also continue to be submitted in states, such as California.

The latest of which is an ambitious Californian proposal, which aims to reduce the production of single-use plastic products such as shampoo bottles and food wrappers by 25% over the next decade.

The proposal would require recycling rates for a raft of products, from laundry detergent, toothpaste, and food wrappings, to e-commerce packaging, to be above a 20% threshold for use within the state. Water and other beverage bottles are excluded from the proposal and regulated under different recycling laws.

Whilst many similar proposals have been submitted in recent years, very few have won quick passage, and far fewer have become law. Nevertheless, continued momentum is evident.

Elsewhere in California, Carlsbad City Council recently passed a policy banning plastic bottles at both public and private events sponsored by the city.

4. Tray-2-Tray Breakthrough May Unlock Supply

Having previously highlighted the need for improved tray-2-tray recycling (see article here) to help tackle global rPET shortages, this month saw several breakthrough announcements in this area.

Faerch, a manufacturer of food packaging, announced that it had integrated recycled post-consumer PET household pots, tubs and trays into its tray production process.

The company has been trialling sorting, washing, and recycling post-consumer trays at its own recycling plant in the Netherlands, 4PET, using EREMA’s VACUREMA recycling process.

Faerch has now integrated the tray flake and pellet coming from this unit into its own food-grade tray production as part of a closed loop.

Indorama Ventures, VALORPLAST, Klöckner Pentaplast and CITEO have also been collaborating on new commercial PET tray-to-tray recycling technology.

Having carried out testing over the last 6 years, Indorama announced in June that it has successfully developed a commercially feasible recycling solution for monolayer PET trays in collaboration with Klöckner-Pentaplast. The companies are planning to further scale up the technology with the goal of processing 10k tonnes of tray flake in 2022.

Other Insights That May Interest You…

Plastics and Sustainability Trends in May 2022

Plastics and Sustainability Trends in April 2022

Plastics and Sustainability Trends in March 2022

Explainers That May Interest You…