Opinion Focus

- Soybean prices discourage producers from selling.

- Grain sales are at their lowest levels for the past 5 years.

- How does this impact the export of other commodities?

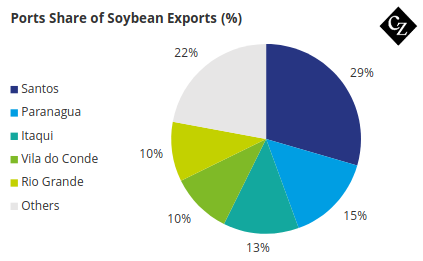

Mato-Grosso is the state with the highest volume of soybean production and exports in Brazil and ships 42% of its production through the port of Santos. This year, however, we are seeing a significant drop in soybean commercialization, which could imply changes in export logistics.

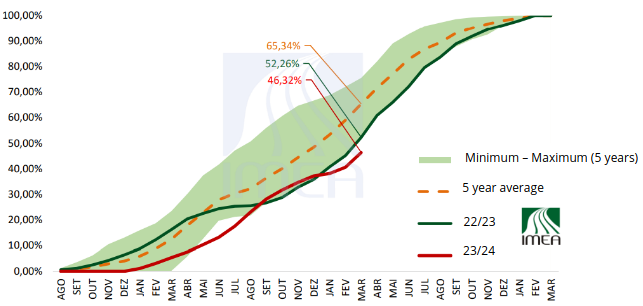

According to data from IMEA (Mato Grosso Institute of Agricultural Economics), soybean sales are at the lowest levels in the last 5 years for the period, with only 46% of production sold, against an average of 65%.

Source: IMEA

In the leading production state, the 2023/24 harvest is already 95.6%, levels slightly above the 5-year average for the same period.

Producers Refuse to Sell

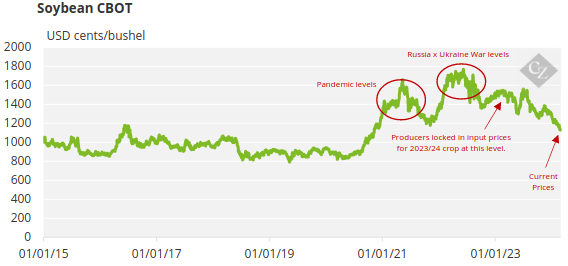

The main reason for the slow commercialization of the crop is explained by the disappointing price of soybeans, which is at its lowest level in the last 3 years.

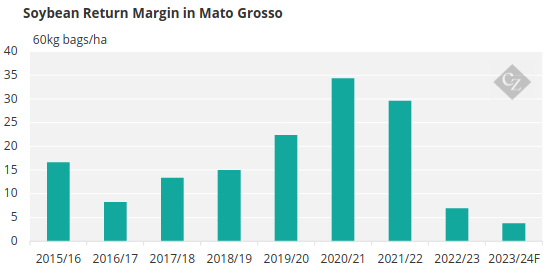

With high production costs and low prices, the producer’s return margin is being affected. Producers locked in input prices in March-May of the year before the harvest, when soybeans were close to levels seen at highs during the pandemic.

They had in mind a margin that is now no longer achievable.

Source: Bloomberg

This issue has been putting pressure on producers not to sell soybeans at current prices, holding back production in the hope of better margins.

But Is It Worth Holding on to That Soybean?

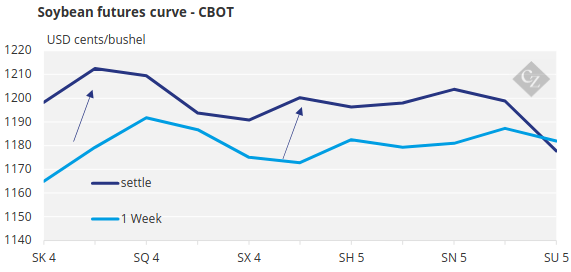

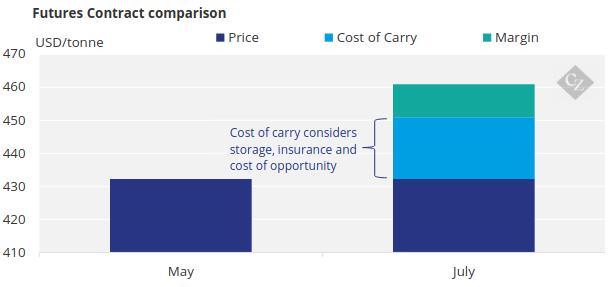

Looking at CBOT’s future curve from the producer’s perspective, some things must be taken into consideration.

Although the July (N) and August (Q) contracts have higher prices compared to the prompt contract (K), the carrying cost plays a major role in the decision.

The carrying cost is how much it costs the producer to “carry” this commodity into the future, storing soybeans in anticipation of better prices. Thus, warehouse costs, insurance, interest, and opportunity costs must be included in the account.

The curve for the next two contracts is in carry, when the later price is higher than the spot. This encourages the storing of soybeans as it indicates that, under the current contract, supply is greater than demand.

Source: Bloomberg

However, the cost of carry do not make this operation viable.

Considering the prices on the date we wrote this report (18/03), the cost of carrying soybeans from May to July is around USD 19/tonne. Even with the current price difference, short spreads between contracts do not guarantee a profit for the producer.

With the price of the May contract at USD 1198 cents/bu (USD 432.2/tonne, considering physical differential) and considering the cost of carry, the spread for the following contract should be at least USD 50 cents/bu (USD 28/tonne) to guarantee a return of USD 10/tonne for the producer.

Producers who are holding on to their soybeans believe that the price will rise, and that the increase will be enough to cover the cost of carry, as the current price remains insufficient to guarantee good margins of return.

As seen above, Mato Grosso’s margin fell to half last season, going from 6.97 to 3.8 bags/ha.

Logistics Impacts

Soybean is the highest volume product in Brazilian ports. For the 2023/24 harvest, we estimate an export of 90m tonnes of soybeans. And of this total, more than 27m tonnes will be exported through the port of Santos – a 2m tonne increase on last year.

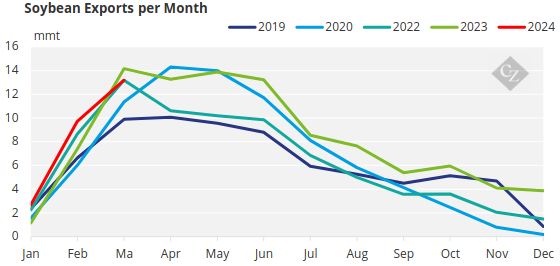

Despite the lower volume of soybeans for export this year, the delay in commercialization should be reflected in the export curve, affecting other commodities (such as corn and sugar).

Soybeans have not yet reached their export peak, and although, for now, they are at the level seen in recent harvests, we will only begin to see the effects of the delay in commercialization in the coming months.

Corn exports, estimated at 3m tonnes, should begin in June with peaks between July-October. If soybean exports are delayed (peaking in March-June), the grain may take part of the corn and sugar export window, creating logistical challenges and delays in vessels.