Insight Focus

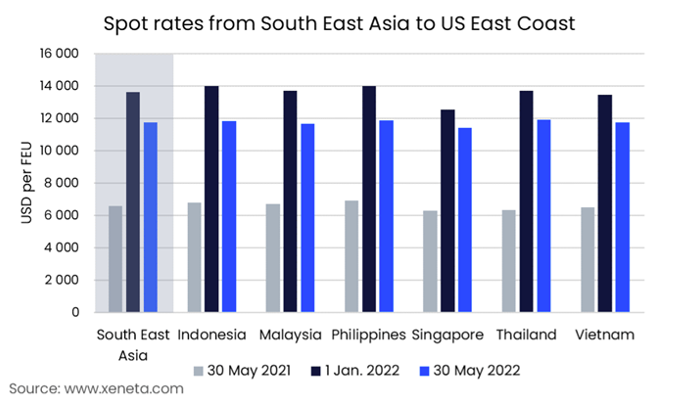

- Container rate differentials between SE Asian origins narrow.

- Rates still higher than a year earlier despite fall since start of 2022.

- Spot rates on SE Asia US East Coast route still above long-term rates.

This is Xeneta’s latest weekly container rate update. https://www.xeneta.com/blog/weekly-container-rate-update-week-22-2022

In line with what we have seen on other major trades since the start of the year, spot rates from South East Asia to the US East Coast have fallen by 13.8% as of end May. Average rates on this trade have fallen to USD 11 770 per forty-foot equivalent unit (FEU) from USD 13,650/FEU while still being USD 5,000 more expensive than on 30th May 2021.

Digging further into the various origin countries, the biggest drop in spot rates since the start of the year came between Indonesia and the US East Coast. Here spot rates have fallen by 15.5%, though having started as the most expensive origin of the trade at the start of the year, it is still around USD 100/FEU higher than the average for the whole trade.

Overtaking Indonesia as the most expensive origin is Thailand, where the average spot rate stands at USD 11 930/FEU, USD 150 above the average rate for the whole region. This is a reversal from a year earlier when Thailand was one of the origins offering the lowest spot rates on this trade.

Singapore has been the cheapest country of origin for those looking to ship from Southeast Asia to the US East Coast all through 2022. However, it has also experienced the smallest drop in rates since the start of the year, falling by 9% to USD 11,440/FEU at end-May from USD 12,550 on 1st January. This has seen the discount offered by Singapore compared to the market average drop to USD 330/FEU from USD 1,100.

Along with being the cheapest origin, Singapore also marks itself as the only transhipment hub, whereas others are direct-export origins.

This falling difference in rates between origins is happening across the board in South East Asia to US East Coast trade. At the start of the year, there was a USD 1,500/FEU difference between the highest rate (from Indonesia) and the lowest rate (from Singapore).

As of end May, the difference had fallen to a third of that, a USD 500/FEU difference in rates from Thailand and Singapore, reducing shippers’ incentives to adjust their supply chains by using feeder ships to move their cargo to a cheaper port ahead of the main journey.

Despite falling since the start of the year, spot rates from South East Asia to the US East Coast remain above those on the long-term market, albeit only just at USD 500/FEU.

As of end May, the average long-term contract within the past three months stands at USD 11,300/FEU, up from USD 7,900 at the start of the year and USD 3,750 at this time last year. However, it is down from a peak of USD 13 400/FEU in April 2022, when the long-term rates were briefly higher than those on the spot market.

Note:

The Weekly Container Rates blog analysis is derived directly from the Xeneta platform, and in some instances, it may diverge from the public rates available on the XSI ®-C (Xeneta Shipping Index by Compass, xsi.xeneta.com. Both indices are based on the same Xeneta data set and data quality procedures, however, they differ in their aggregation methodologies. Xeneta Platform Methodology here XSI ®-C Methodology here

Want to learn more?

With a possible global recession on the brink, shipping and supply chains will be put under further pressure.

Schedule a personalized demo of the Xeneta platform and learn how on-demand freight rate and market insight data will help you navigate through the current climate and identify potential savings in your freight spend.

Weekly Container Rate Update: Week 14, 2022

Weekly Container Rate Update: Week 15, 2022