Insight Focus

- Cane crush has gained strength with more mills in operation in the second fortnight of April

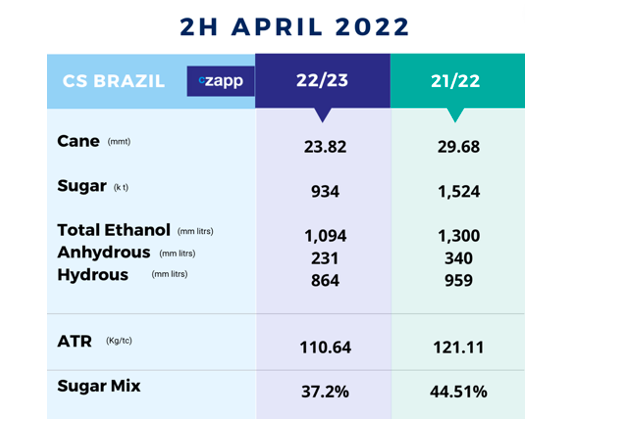

- The mills crushed 23.82 m tonnes of cane, with sugar and ethanol production at 934k tonnes and 1094 m liters respectively.

- The pace should continue, with 57 more units coming into operation at the CS in the first half of May

The Pace is Starting to Gain Strength

- The beginning of the crop was marked by the delay of the crushing in the wait for the better development of the sugarcane fields, but it is catching up now.

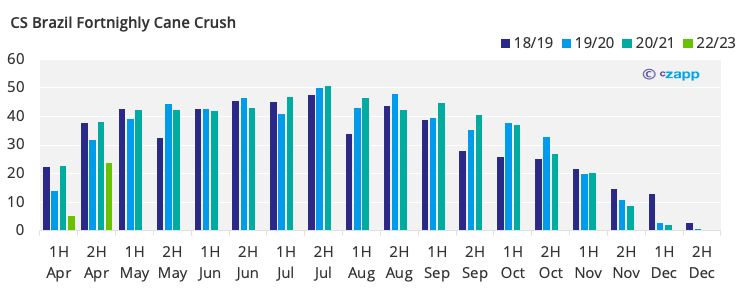

- The amount of cane processed rose to 23.82mmt, a significant improvement alongside 1H April

- But still lagged about the same period last year – a retraction of 19.72%.

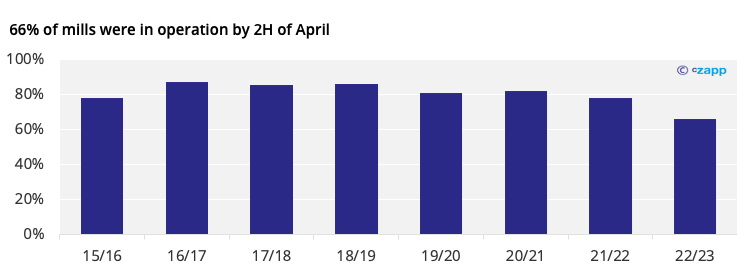

- This decline can be explained by the lower number of mills in operation at the beginning of the crop – 180 units were in operation compared to 207 in the same period last year.

- A further 57 units are expected to start operating at CS in the first half of May, supporting the operation.

- The quality of raw material had a slight improvement concerning the beginning of the crop, from 98.66 kg/tc to 108.46 kg/tc. Even so, it represents a retraction of 7.31% compared to 2021.

- This drop can be explained by the rain at the beginning of the year and the later start of the 22/23 crop.

- With the approach of dry period, rains are more spaced throughout the CS region. As a result, mills operated smoothly – no operation day was lost on 2h April.

Ethanol Sales

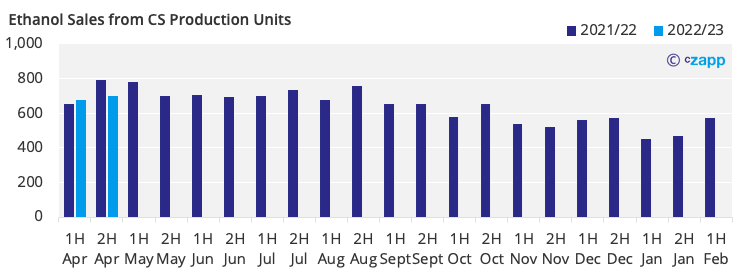

- In the second half of April, a retraction was seen in the commercialization of ethanol

- 1.16 billion liters of ethanol were sold in the CS region – a decline of almost 0.85%compared to the same month of the last year

- The production unites in CS registered 696.17 million liters sales of ethanol in 2H 2022, representing 12.58% retraction to 2H 2021.

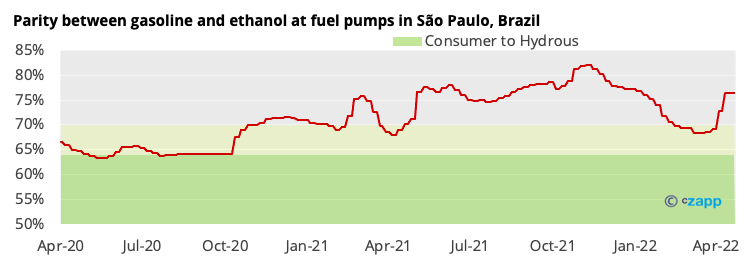

- The decline in the domestic market reflects the loss in the competitiveness of ethanol compared to gasoline as of the second half of April.

- Thus, domestic sales of anhydrous increased 15.34% compared to April 2021 – totaling 735.63 million liters in the month.

Closing April 2022

- The pace of cane crush and sugar production is advancing, and it is expected to continue.

- Sugar and ethanol production in April totaled 1.06mmt and 1.49 billion liters respectively.

- April domestic market hydrous sales were 1.37 billion liters – a drop of 5.52% compared to 2021.

- The fall reflects the loss of competitiveness of ethanol against gasoline (parity above 70%)

- The scenario is volatile, this Tuesday (10th May, 22) the price of diesel was readjusted by Petrobras

- The price of gasoline has not yet been notified, but it is not out of the question.

- Now, there is a gap of around -9% between the domestic and international markets.

- Any readjustment in the price of domestic gasoline could affect this delicate situation.

Click here to read the report on our 2022/23 crop estimates.

Other Insights That May Be of Interest…

How the Brazilian Fuel Price Adjustment Hits Sugar and Ethanol

Explainers That May Be of Interest…

Czapp Explains: The Brazilian Ethanol Industry