This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Increased enquiries from sugar buyers for 23/24 season.

- However, buyers continue to balk at current price offers.

- Pricing indications for 23/24 are steady, at a little over 50c/lb.

The spot sugar market was quiet during the week ended Feb. 3, while inquiries for 2023-24 increased. Sales for the next marketing year were expected to jump as the International Sweetener Colloquium scheduled for Feb. 26-March 1 nears.

Traders noted a recent increase in inquiries from buyers for 2023-24, which mostly will be for January-September 2024 or calendar 2024 as most October-December 2023 buying has been completed. Some beet processors said offers and/or replies to inquiries so far had yielded limited new business, but they expected some increase in sales before the Colloquium. Most, however, expect sales to take a jump shortly after face-to-face meetings at the Colloquium.

Most expect early contracting of beet sugar and to some extent of cane sugar for 2023-24, although some sellers are approaching contracting a bit more cautiously than in the past couple of years due to uncertainty about supply, especially on the beet side after two separate force majeures by beet processors in 2022. Buyers appear interested in contracting early but continue to balk at current price offers.

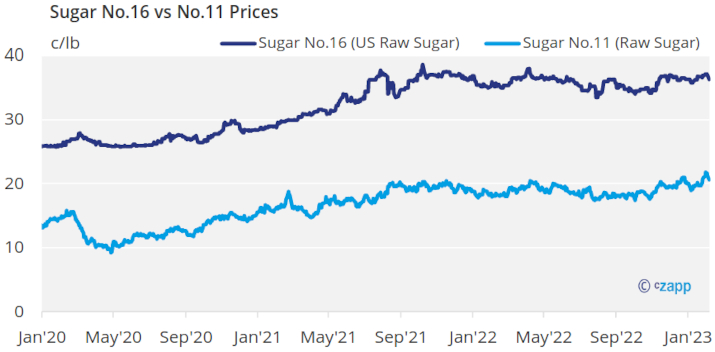

Pricing indications for 2023-24 were steady. Beet sugar was offered at 51¢ a lb f.o.b. Midwest and cane sugar was offered at 52.50¢ a lb f.o.b. Southeast by one refiner. Large users were said to be able to buy sugar below those levels. Some beet processors indicated they would come into the market above 51¢ a lb f.o.b. Some cane refiners indicated they may enter the market in the 52¢ to 54¢ a lb range (f.o.b. Gulf), with final offers yet to be determined. With spot supplies tight, uncertainty about Mexico’s ability to fulfill its US export limit in 2022-23 and the 2023 beet crop still to be planted, most sellers were firm in their offers with none below 50¢ a lb.

Sales for the current marketing year were quiet as most business was completed except for unplanned spot needs. Prices were unchanged. Limited quantities of sugar were offered at around 60¢ a lb f.o.b. with most processors out of the market. Cane sugar mainly was available from one major refiner at 62¢ a lb f.o.b. at all locations.

Florida’s US Department of Agriculture state office noted in its Jan. 30 crop update that younger sugar cane plants were exhibiting injury from prior freeze damage but planting and harvesting progressed well in January. The Louisiana state USDA office said sugar cane yields continued to drop after a late December freeze. Sources noted there was lower sugar content in cane processed after the freeze, but since only about 15% of the crop still was in the field when the freeze hit, the overall impact was minimal.

New corn sweetener contracts were in effect at prices up 20% to 40% or more from 2022 contracted levels. Numerous buyers still had needs to cover with limited options. Some high-fructose supply was available from distributors, but glucose and dextrose were short.