Insight Focus

- ICMS fuel taxes in Brazil could be reduced, lowering gasoline prices.

- To remain competitive, ethanol prices would need to come down.

- Depending on the change, ethanol could fall 300-440 points in sugar terms.

Brazil, like many other countries, has been grappling with high commodity prices – especially energy. Supply shocks, the COVID pandemic and the war in Ukraine, have all contributed to keeping Brent crude oil prices above USD100/barrel.

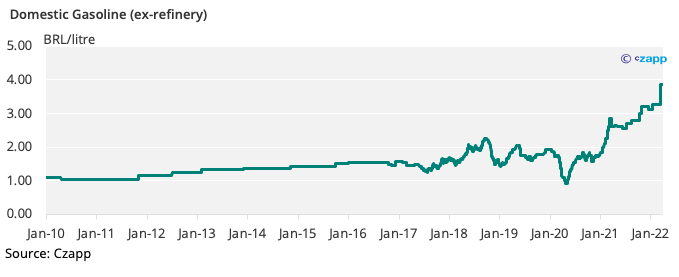

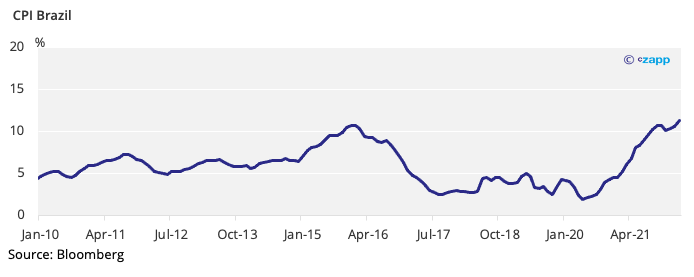

As a result, gasoline prices in Brazil have risen 48% in the past year to record highs.

This has played a major role in pushing the consumer price index to its highest in 6 years.

There have been many proposals over the past year on how to combat this surge in prices particularly because in an election year, high inflation is not a vote-winner.

The following policies have been put forward to combat the rise in fuel prices: change Petrobras’ CEO zeroing the import tax on ethanol creating a fuel price range, mechanism. And now the latest has been a direct attack on the ICMS tax on fuel.

Why ICMS?

The ICMS is a tax on all goods and services in Brazil. Depending on what the good or service, the rate varies and is set by each state because it is not a federal tax.

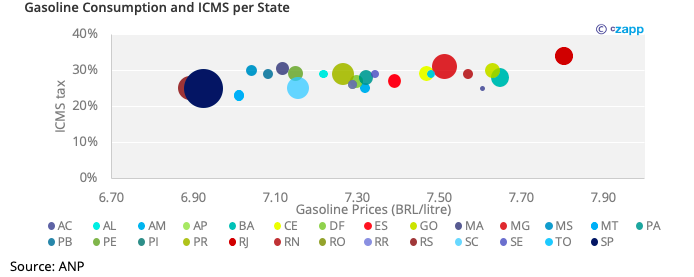

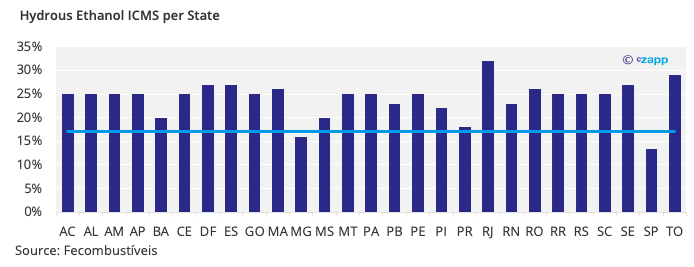

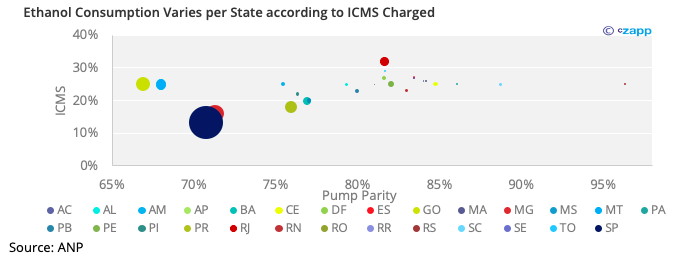

The ICMS on fuel varies enormously from state to state, and from fuel to fuel.

For instance, in Sao Paulo the ICMS is 25% on gasoline and 13% on ethanol. In Rio de Janeiro it is 34% on gasoline and 32% on ethanol.

The latest proposal is to cap the ICMS on motor fuel at 17%. A draft law on this has been approved in the House of Representatives and now will go on to the Senate.

While this might benefit consumers, it will affect states’ revenues – which is why many have already sought to have the vote in the Senate delayed. The loss in revenue is estimated around BRL 83b (USD 17.5b).

Compensating for Lost Revenue Could Affect Ethanol

Only two states have an ICMS on ethanol below 17% – Sao Paulo and Minas Gerais, which are also the two largest fuel ethanol consuming states.

A lower ICMS tax on ethanol results in cheaper fuel at the gas station, thus incentivizing consumption.

If the cap on the ICMS is approved, it will mean that every state will need to cut its ICMS on fuel to 17%. Reducing the ICMS on both gasoline and ethanol could make ethanol less competitive at the pump.

Bringing Ethanol Prices Lower

Let’s take a look at the effect on ethanol of an ICMS cut in Sao Paulo state. We are taking São Paulo as an example because it is the state with the largest fuel ethanol consumption of 8.4 b litres a year. It also consumes 8.8b litres/year of gasoline.

Its ICMS tax on gasoline is 25% and 13,3% on ethanol. The loss in ICMS revenue from gasoline is estimated at around BRL2b. It would therefore be reasonable to assume the government would look into raising the ICMS on ethanol to offset part of this loss.

The problem is that by raising the ICMS on ethanol, ex-mill ethanol prices would need to come down to offset the higher tax rate.

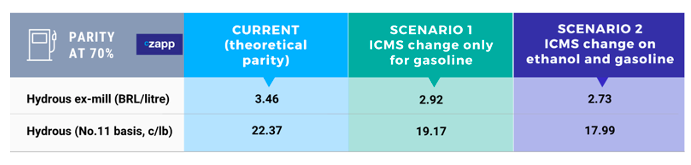

We ran two scenarios, one where only the ICMS on gasoline comes down to 17% from 25% and another where the ICMS on ethanol is raised to 17%.

Assuming the change in ICMS, hydrous prices on a No.11 basis would need to fall between 300 to 440 points to keep it at 70% of the gasoline price. This creates a new and lower cap for ethanol prices, which could mean a new perspective on the sugar market support level.

Other Insights That May Be of Interest…

What Would a Brazilian Fuel Price Hike Mean for Sugar?

How the Brazilian Fuel Price Adjustment Hits Sugar and Ethanol

Ask the Analyst: The Impact on Brazil’s Ethanol Import Tariff Removal

Explainers That May Be of Interest…