1,200 words / 6 minute reading time

- Sugar consumption is barely growing.

- Sugar cane and beet acreage is not decreasing in any major sugar-producing region.

- It’s hard to be positive on sugar prices across the next five years.

The Forecast

Consumption: In Reverse in 2020?

There is a high chance that sugar consumption around the world does not grow in 2020.

We mean in absolute terms. It’s inevitable that per capita sugar consumption will fall.

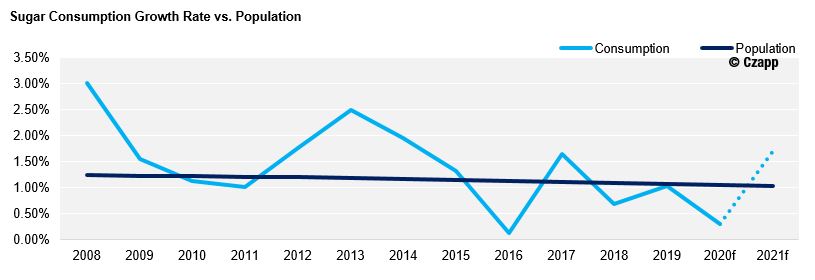

Sugar consumption growth rates have already been falling in recent years. We’ve explored why at length on Czapp: blame increased consumer awareness, taxation, reformulation, portion control or marketing. The spread of coronavirus around the world merely adds another problem.

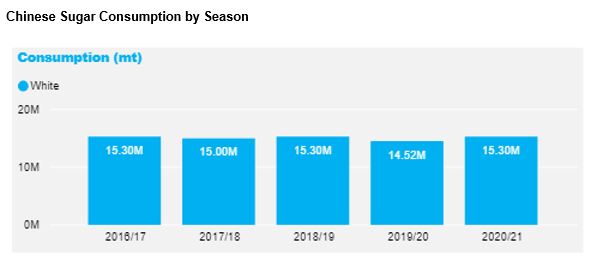

In China’s case, the effect of coronavirus on sugar consumption is easy to see.

Large-scale quarantine means that out-of-home sugar consumption has collapsed across the country. People under quarantine are likely to fall back on long-dated foods, and traditional “comfort” foods. In China’s case these are unlikely to be high in sugar. We think China’s sugar consumption will fall from 15.3m tonnes in 2019 to 14.5m tonnes in 2020.

Elsewhere, it’s hard to estimate what will happen. 2020 will not be a good year for tourism. However, if many other countries adopt quarantine measures, this could lead to an increase in in-home sugar consumption, outweighing the lost out-of-home consumption.

For example, Italy receives 65m tourists a year. Assuming they stay for 1 week on average, this is an “annualised” tourist population of 1.25m people. Any loss in tourist sugar consumption will be small in comparison to the 60m permanent population’s food habits.

At this stage it looks like the losses in sugar consumption due to coronavirus will come precisely from those markets which usually drive the most growth because sugar consumption is still not endemic: Sub-Saharan Africa and South East Asia.

To state the obvious, flat or falling consumption is not positive for sugar prices this year.

Once coronavirus fades, people won’t eat a month’s worth of sugar in a day to make up for a month of reduced consumption, but at least we might see a return to 1%-1.5% growth in 2021 onwards.

Production: Boom Times

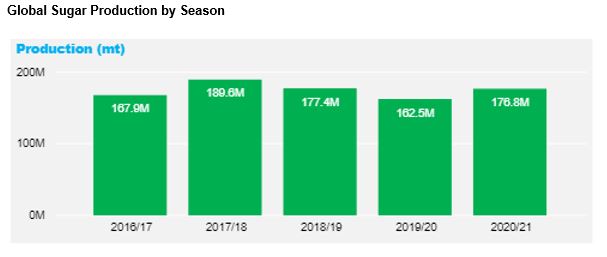

2020 is the second successive year of falling global sugar production.

This decline is almost entirely due to poor weather. We’ve not been able to identify a single major sugar-producing region where sugar cane or beet acreage has fallen due to recent low prices (with the possible exception of the EU).

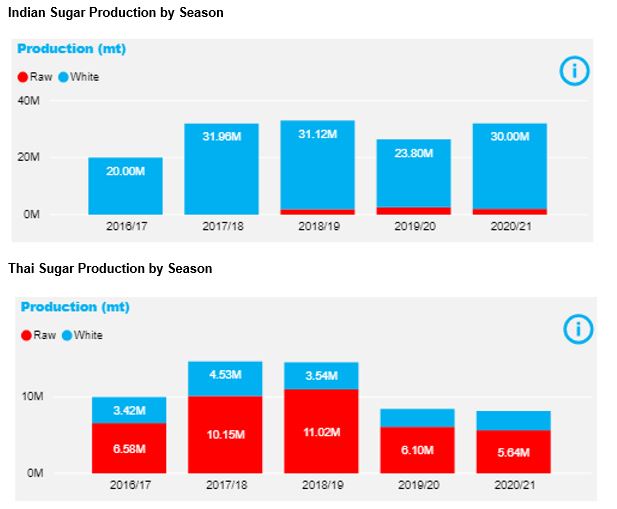

The two major contributors to the fall in production have been India (no water for irrigation followed by flooding in the South West) and Thailand (worst drought in 40 years).

Now that the sugar market has rallied away from multi-year lows, we think sugar production will rebound in 2021 onwards.

One further contributing factor is the strength in the US Dollar. For major sugar exporters, sugar returns are close to 3-year highs in home currencies. The price signal to farmers is clear.

Source: Refinitiv Eikon

In the short to medium term we therefore expect sugar cane and beet acreage to sustain, meaning sugar production each year should be between 170-190m tonnes. When combined with slow consumption growth, there’s no obvious reason why global sugar stocks should fall significantly.

As a result, apart from poor weather it’s hard to see a trigger for higher sugar prices across the next five years.

Other Uses for Cane & Sucrose

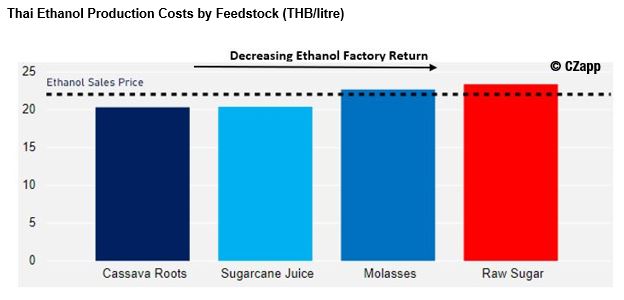

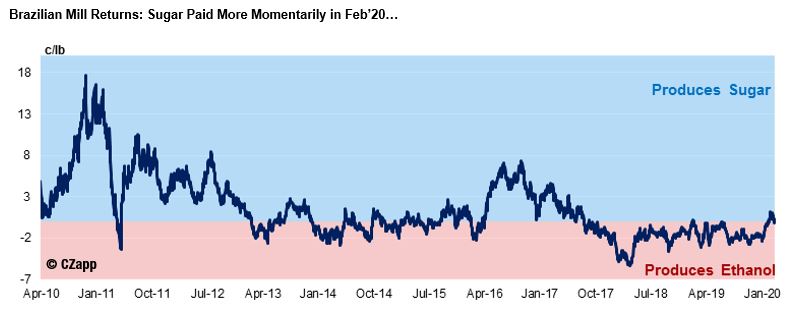

For many countries, the Brazilian model of flexing between sugar and ethanol according to relative returns was widely cited as an answer to low sugar prices.

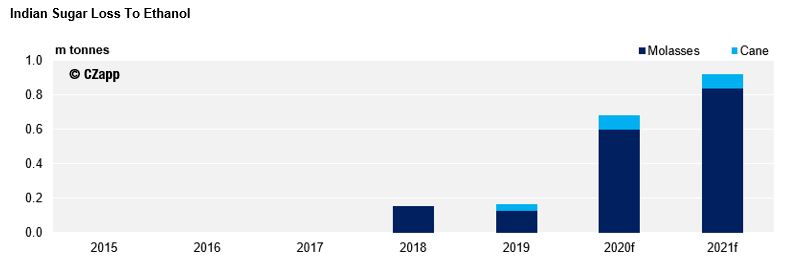

The shortfall in sucrose production in India and Thailand, combined with a recovery in sugar prices and a fall in crude oil prices has now dampened some of this enthusiasm.

Thailand is set to abandon its E10 gasoline blend in favour of E20, potentially doubling ethanol demand. But Thai cane availability has fallen from 131m tonnes in 2019 to 75m tonnes this year. We don’t forecast a recovery in 2021. Further ethanol will need to come from cassava-fed factories or from imports.

India is also trying to increase its domestic cane-to-ethanol industry. However, disbursement of government funds for building new distilleries has been slow. India also doesn’t have a large oversupply of sugar this year; production will be roughly in line with consumption. In the future we do expect sucrose production to rebound back above 30m tonnes, leading to a sucrose surplus. But without distillation capacity, this sucrose will be made into sugar.

The country with the main ability to respond to sugar and energy prices and allocate cane juice accordingly remains Brazil. For the last 2 seasons, mills have maximised ethanol production at the expense of sugar. But this will change in 2020.

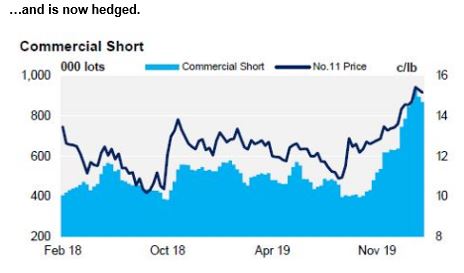

The recent strength in sugar prices in BRL terms means we expect more allocation of cane juice to sugar. This sugar is now hedged and committed to the trade, meaning it’s going to be hard to reverse the decision to produce it.

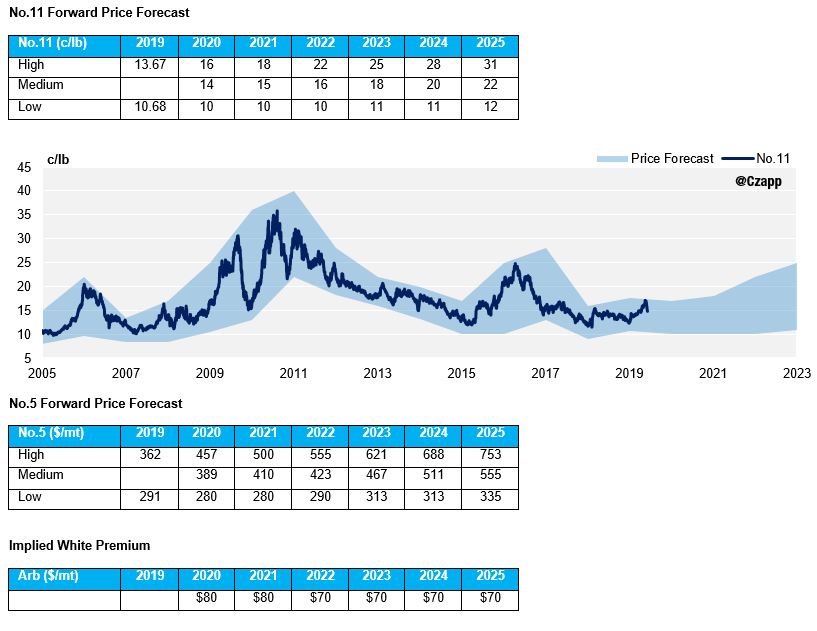

For this reason, we think it will be hard for raw sugar prices to break 16c this year. The upside for sugar prices in subsequent years will be influenced by global crude oil markets and the USD/BRL rate. We are not hugely positive.

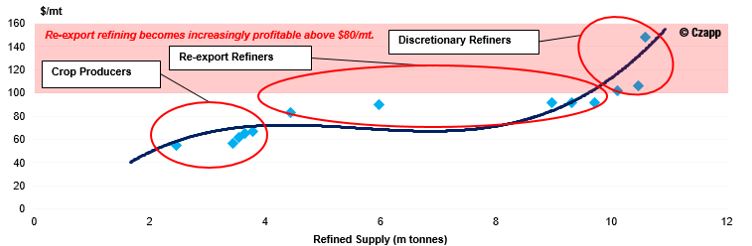

Re-Export Refiners: Everyone’s Friend Again

The refined sugar market is dominated by three major producers: Thailand, the EU and re-export refiners.

Two of these three producers will have low availability for the world market in 2020 and 2021. Thailand’s ongoing drought will limit refined exports across both years.

Meanwhile European beet farmers need to see stronger beet prices to encourage an increase in plantings to enable large-scale exports like we saw in 2017/18. This won’t happen in 2020, but may occur in 2021.

Until that time, re-export refiners are the dominant suppliers of refined sugar to the world market. These refiners typically seek $100/mt over the No.11 market for their sugar, meaning we are positive for the white premium in 2020 and 2021. Thereafter, we expect Thai (and perhaps European) world market availability to improve once more, reducing white premium levels.