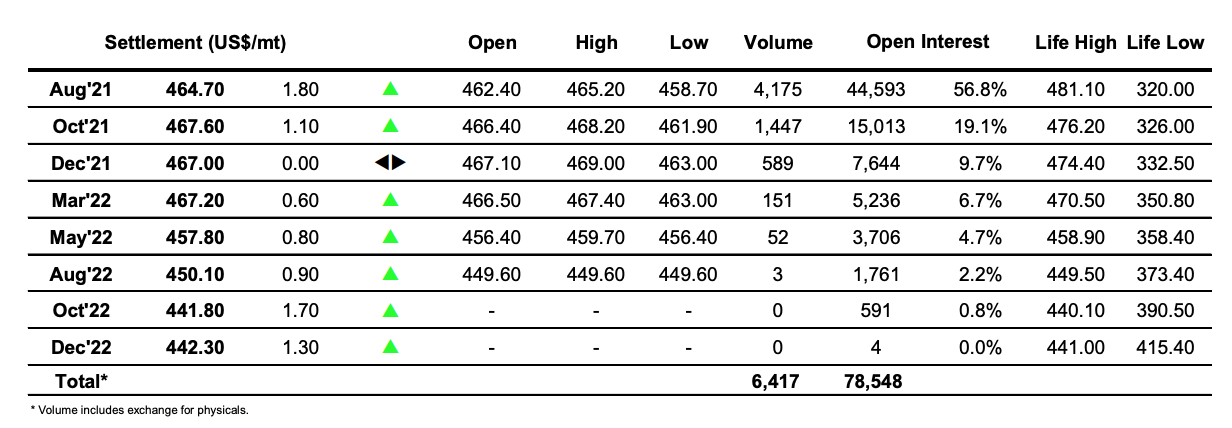

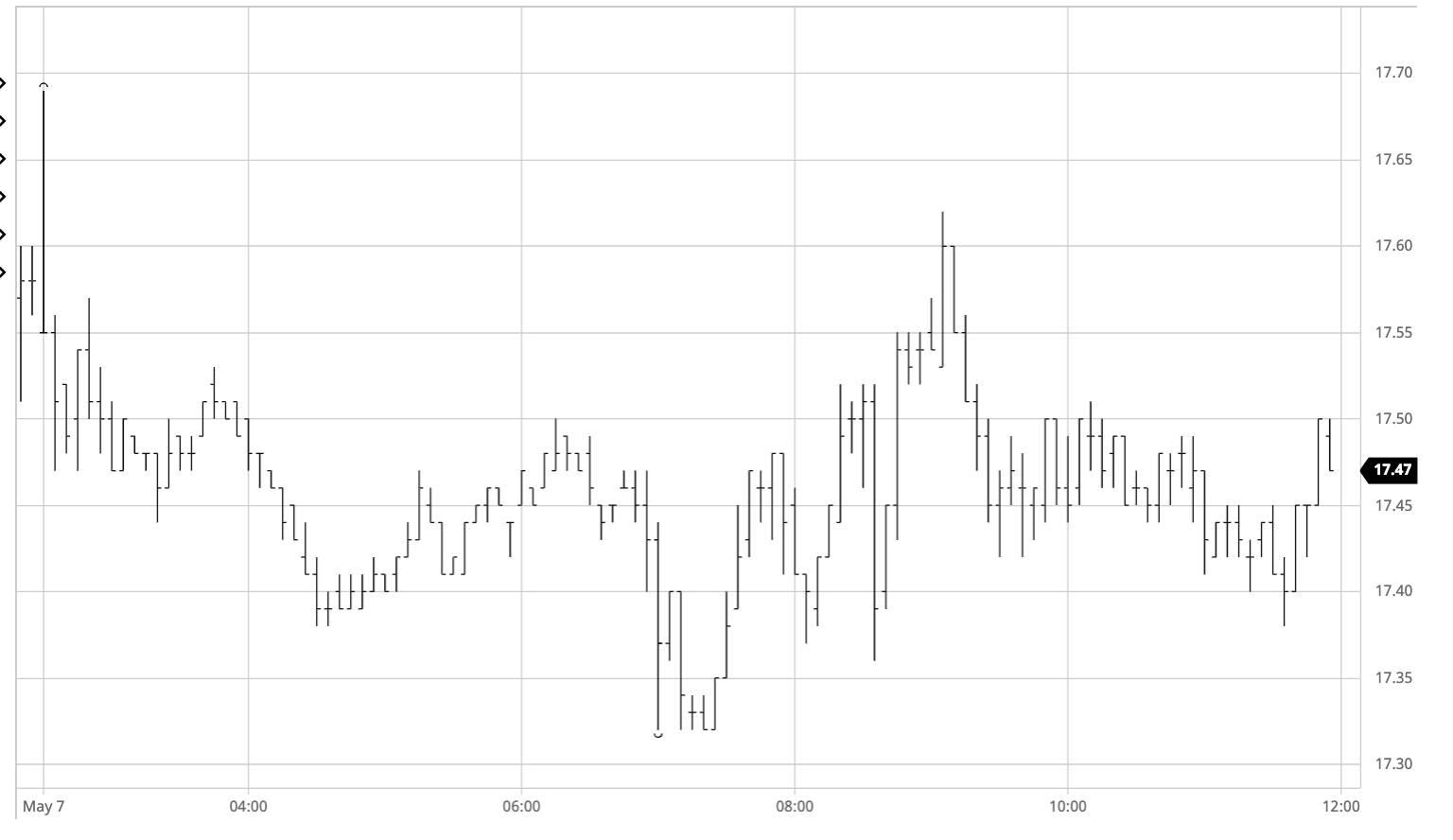

Sugar #11 Jul’21

There was initial buying which attempted to start the day on a positive footing and the first few minutes saw Jul’21 trading up to 17.68 before equally quickly falling back to unchanged levels. While we did not continue far lower the odd nature of the opening spike higher seemed to have undermined some confidence, leading to the slow nature of activity throughout the morning. The arrival of the US specs drew out a little more selling that sent Jul’21 down to 17.32 but the lower end didn’t not gather any more momentum and prices again returned quietly into the range. Prices continued to see-saw within the established parameters throughout the afternoon and though volume picked up at no stage did we threaten to break out to either end with the longs content to maintain the status quo. The contrarian spread factor meanwhile continued to be seen with Jul/Oct’21 slipping further to -0.08 points discount, action which if maintained suggests the flat price has a limited upside. The final couple of hours were rather slow and though there was a little movement during the closing stages it left us heading into the weekend only marginally lower with Jul’21 settling at 17.49.

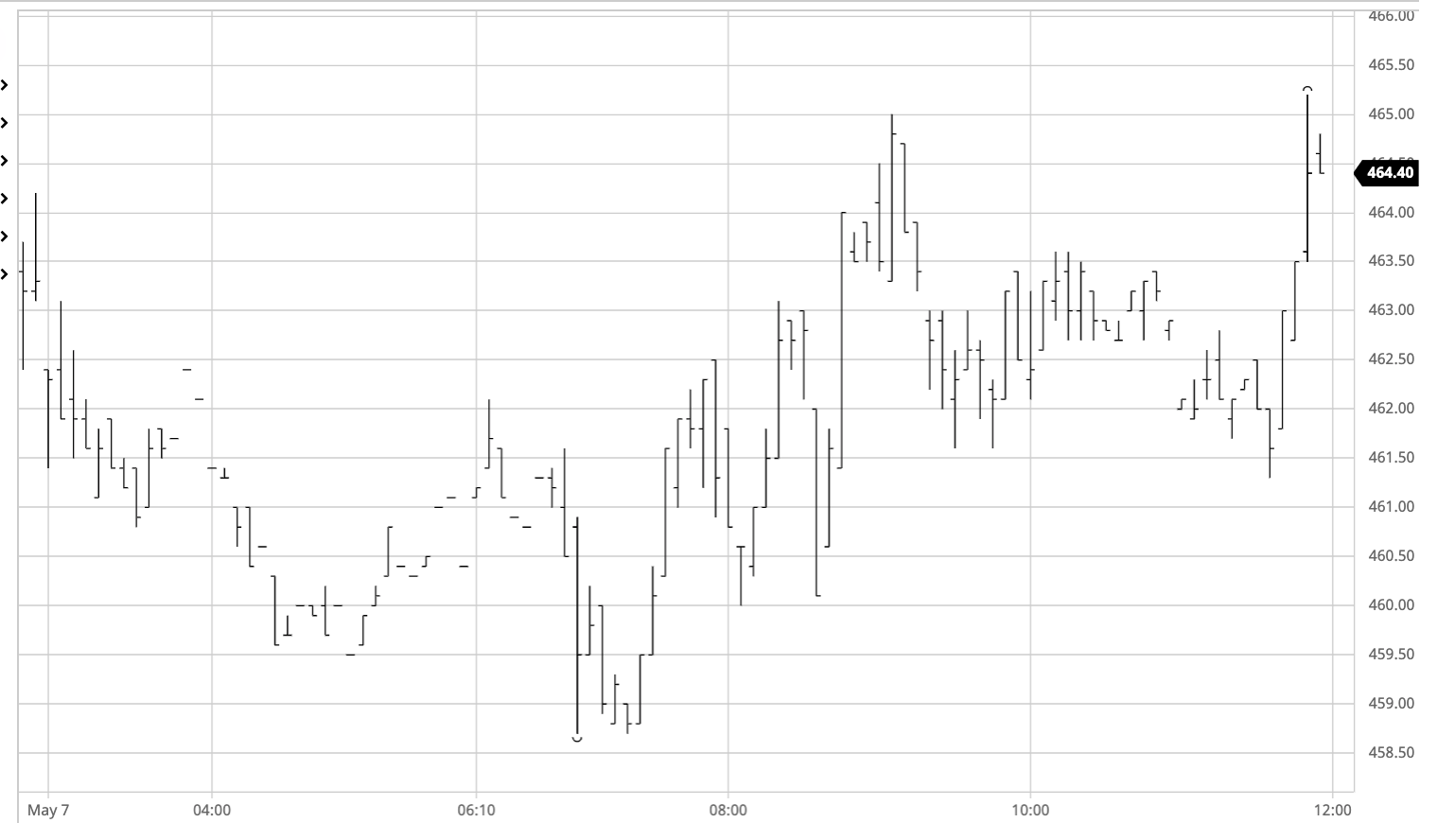

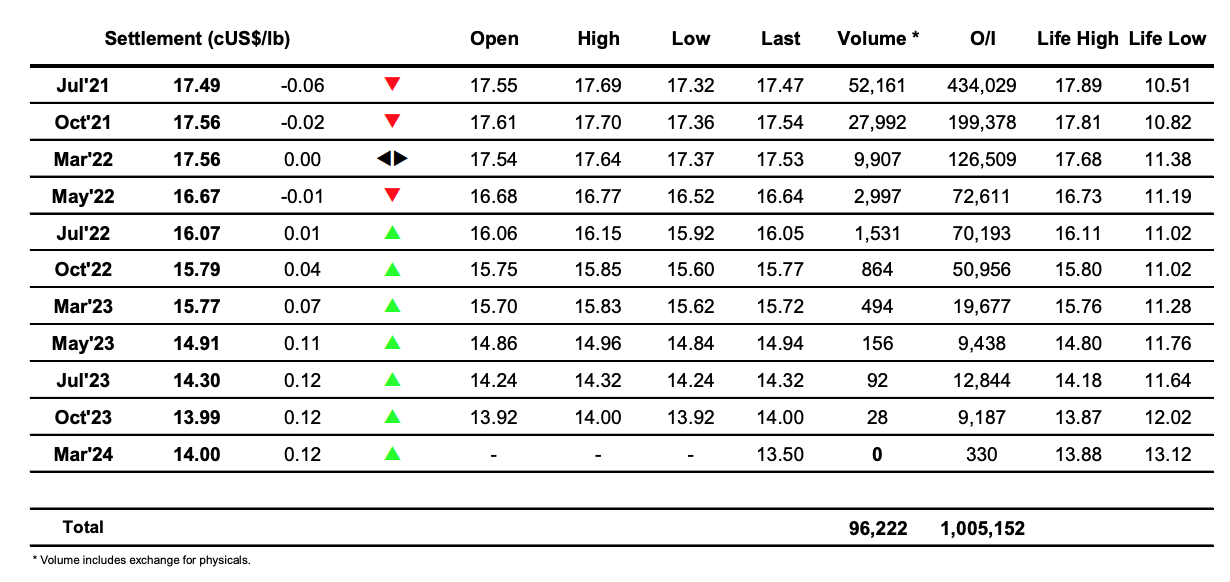

Sugar #5 Aug’21

We started the day marginally lower and continued in this way through the early stages. Volume soon dropped to very low levels leading to dots and gaps in the intra-day chart as can be seen below and in such conditions we followed the general rule that slow markets drift lower as Aug’21 slipped to the $460 area. Interest increased as we moved into the afternoon and initially we found selling take us to a new low at $458.70 before defensive buying emerged to pull values back up into the range. Recent days have seen the Aug/Jul’21 white premium return to favour and regain some lost ground and this path was maintained with support increasing for both it and the Aug’21 outright through the afternoon. Slowly but surely the value increased as the whites outperformed nearby No.11 values despite the predominantly sideways conditions, and with the boost of late MOC buying the premium extended above $79 to be more than $9 above the recent lows. An otherwise featureless day ended with Aug’21 settling positively at $464.70 and though the Aug/Oct’21 spread closed a touch firmer at -$2.90 its continuing struggle to recover recent losses continues to send a contrarian signal which may hinder the recovery of the flat price.

As mentioned closing white premium values showed gains with Aug/Jul’21 at $79.00, Oct/Oct’21 at $80.50 and also for March/March’22 at $80.00.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract