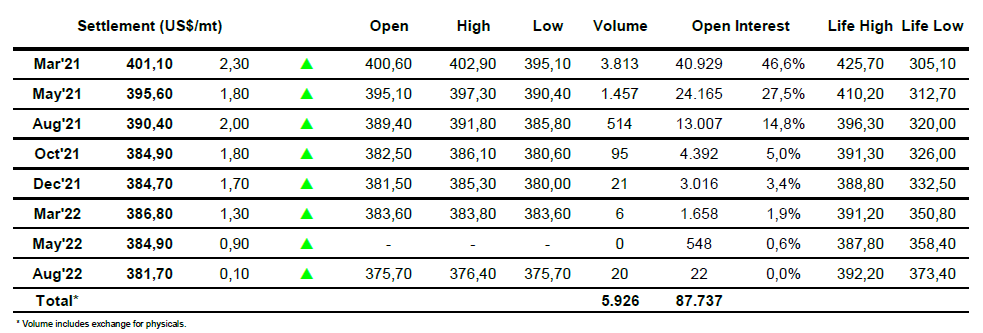

Mar 21 – Sugar No.11

For a long time today we simply continued the recent trend and slowly and boringly eased downward to levels not seen since the first week of November with March’21 reaching 14.33 during the early afternoon. With no fresh news it seemed that this was to be the story of the day however the final few hours saw some buying return to the fore with brokers attributing the slight recovery to continuing chatter over the lack of Indian subsidy. Following the heavy recent losses there was some additional support gleaned from the March/May’21 spread which recouped a large part of yesterdays move by returning to an intra-day high mark of 0.67 points, while the flat price reached the low 14.70’s before running out of steam. The subsequent pullback into the range and March’21 close at 14.60 marked a positive close of modest net gains, however with the charts showing another lower high/lower low it seems more substantial news will be required if we are to turn around and end the current directionless drift.

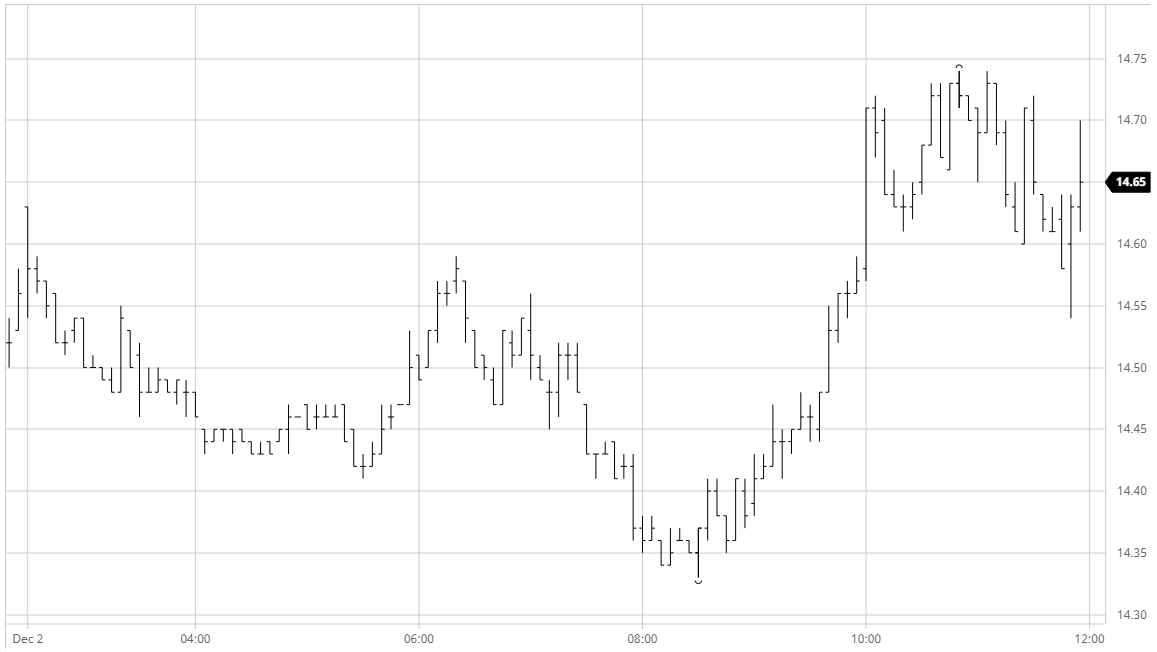

March 21 – Sugar No. 5

The latest in a series of slow mornings saw values holding the upper $390’s basis March’21 but with very little volume changing hands. News was non-existent and it felt as though the failure to climb yesterday afternoon has consigned us to an extension of the current malaise, particularly with the Christmas holiday period drawing closer. A brief push up to the $400 area around noon failed to gain any traction and the resultant pull back sent March’21 down to a new recent low at $395.10, though with no reaction from the spec longs we soon flipped back up once more. This time the market found some better buying to make a clean beak of $400 and though news remained quiet the chatter was that it was Indian talk again providing the motivation for the buyers. Spreads too found a modicum of support for the first time in a while on the move with March/May’21 back to $5.80 while the March’21 gained a couple of dollars to move back above $79. A mixed close saw March’21 settle at $401.10 to at least show gains although little else as the status quo appears set to continue.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract