This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

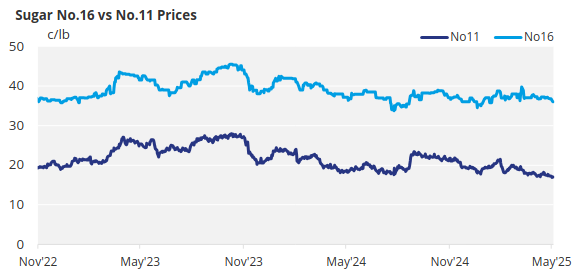

Bulk refined sugar sales slowed last week amid weak demand. Sugar beet and cane crops are developing well, with strong condition ratings reported. Raw sugar futures dropped to near four-year lows as global supply prospects improved.

Bulk Sugar Sales Slow Amid Weak Demand

Sales of bulk refined sugar for 2025-26 progressed slowly during the week ending May 30, amid steady prices but a weak tone. Sugar beet crops were developing well, with the cane crop improving in Louisiana.

Bulk beet and refined cane sugar prices for 2025-26 were unchanged, but some sources noted general weakness and sales below values posted by sellers. One distributor noted that ample beet sugar supplies were dragging the market down, with sales in the mid-30c/lb area in some cases.

Sales of domestic 50lb bags of cane sugar were noted around 48c/lb in the South, which would equate to a bulk FOB price around 45c/lb, well below refiners’ quoted levels for refined cane sugar.

Forward sales have been occurring, with some noting a pickup in contract signings over the past three or four weeks, but it’s far from a rush. Neither buyers nor sellers appear in a hurry this year, with sales volumes for the date well behind those of the past couple of years. Estimates of processors’ sales of prospective 2025-26 sugar production ranged from 50% to 75%, with some suggesting an average around 60%.

Only one processor was well enough sold to recently raise 2025-26 pricing. Others said they expect to be selling 2025-26 sugar through the end of the year. Despite recent sales, a sizeable amount of sugar remains to be booked for 2025-26, including by some large users. In some cases, buyers are only partially covering 2025-26 needs and may opt for increased activity in the spot market later this year or next.

The major impediment to buyers concluding forward purchases appears to be uncertainty about demand for their own manufactured food products amid tariffs and consumer economic concerns. Buyers see little reason to rush into contracts amid ample spot and expected ample forward sugar supplies.

Some sellers contend prices have bottomed, even if weakness persists from the supply side. Reluctance to drop prices further—which in many cases may be below the cost of production—has contributed to the slow pace of sales from both sides of the market.

Crop Ratings Rise While Spot Activity Falls

Sugar beet planting was basically complete, with some replanting expected in a few areas due to weather, although not above average levels. Sugar beet crop condition ratings (from states issuing data) ranged from about 70% to above 90% good-to-excellent. The sugar cane crop in Louisiana was rated by the USDA State Office at 64% good-to-excellent as of May 25, a jump from 56% a week earlier—the highest rating for the season to date and above the year-ago level for the first time.

Spot market activity remained limited. A few sales continued at quoted levels or below. Most processors still have some 2024-25 crop sugar to sell, with only one said to be sold out. Buying interest has been limited in the spot market as some users have excess supplies due to slow sales of their own manufactured products.

CE Futures US nearby No. 11 raw sugar futures sank to near four-year lows as global supply prospects improved.

Corn sweetener markets were quiet.