- The main source of energy in Brazil comes from water, around 70% of the matrix.

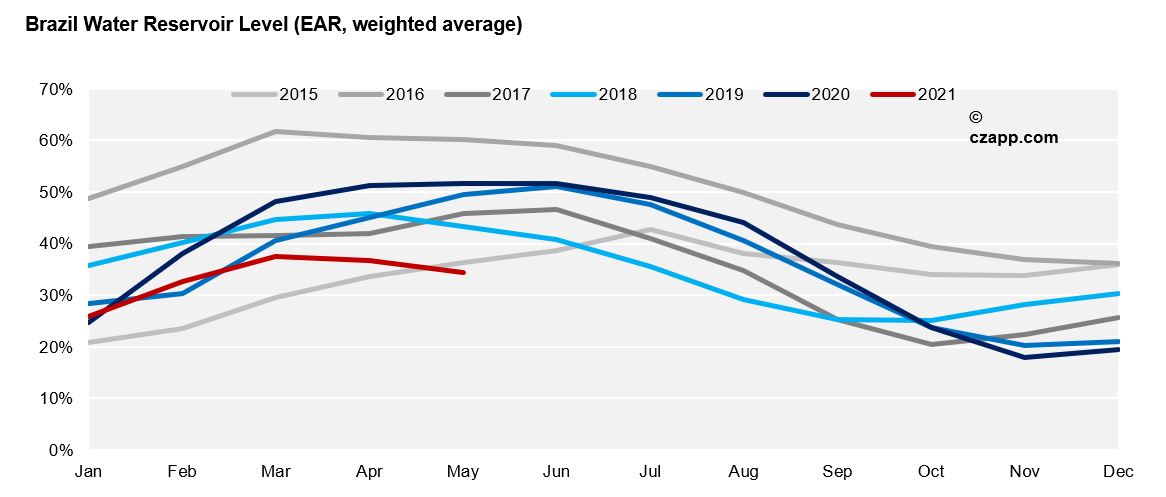

- With consecutive months of rains below average, water reservoirs are at critical levels.

- Market is concerned with the possibility of blackouts in 2H of 2021.

Alert: Whatis the Concern?

- The country is going through a dry spell, with consecutive months of rains below average.

- As a result, the SNM (National Weather Agency) has released a water emergency note calling attention to the scarcity of rain in the Paraná basin, that supplies water to Itaipu, the largest hydro powerplant in the country.

- This basin represents 76% of all storage in the Southeast.

- The dry spell is reflected in the level of water reservoirs and raises awareness of possible risks of electrical rationing and/or even water rationing in some cities.

- With the CS entering the dry (winter) season, the trend is that by September the reservoirs should be at the lowest level recorded in the last 20 years.

Reflection on Prices

- Less availability of energy from hydroelectric plants means that the country is forced to rely on additional energy from other sources such as thermoelectric.

- Thermo powerplants have a more expensive cost of operations.

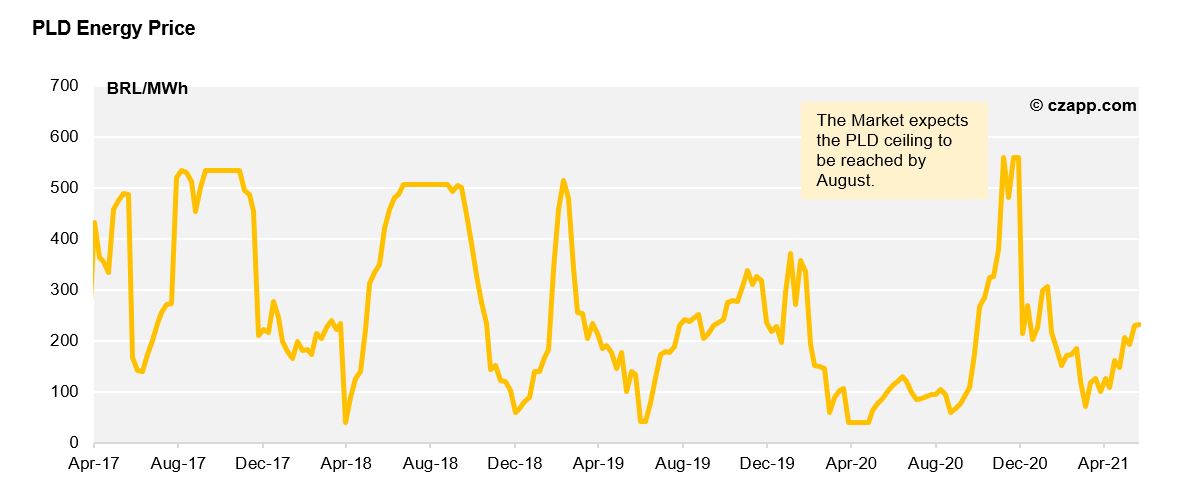

- This is reflected in the spot price of energy (the PLD), which has been rising since March – when reservoir levels began to fall, and the expectation of little rain was being priced.

- Market estimates indicate that by August the price should hit the PLD ceiling – stipulated at BRL583.88 for this year.

- With the conditions for the generation of energy less favourable, the bill for consumers also becomes more expensive.

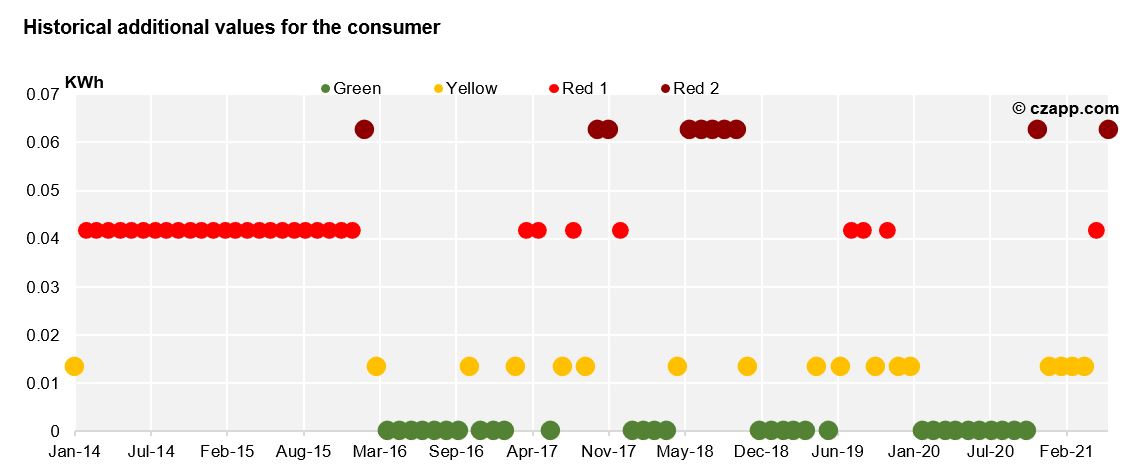

- Currently, the energy bill is under red flag 2, which means that there is an extra amount to pay for the energy used as the country will have to use thermo powerplants.

- More specifically, under red flag 2 it is added BRL0.06243 for every kWh used.

- To spare the water reservoirs, the government has allowed the use of the thermoelectric of different sources other than gas (more expensive).

- The signal for consumers is clear: reduce the consumption of energy, otherwise there is a real risk of blackouts in the 2H of the year.

In case you are interested in the impacts for the sugarcane sector, read: