Insight Focus

- Mexico is still on track to produce 4.7 million tonnes of sugar.

- Lower sugar production and high demand from the US keep domestic prices high.

- With lower sugar production, Mexico will have to continue to import sugar.

Mexico Production Still Estimated Sub Five Million Tonnes

We still project that Mexico will produce 4.7 million tonnes of sugar due to lower yields. This would be the lowest sugar production of the last 10 years.

Insight Focus

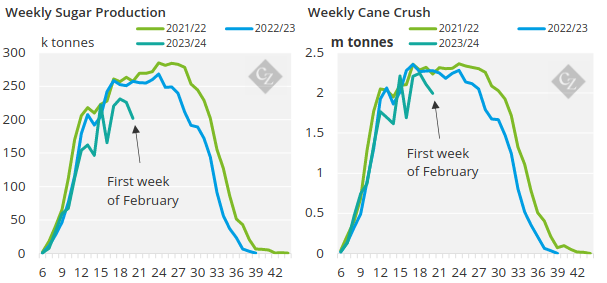

Sugar production to date (until first week of February) is 312k tonnes below what it was at this point last year and 520k tonnes below 2021/22. Similar to sugar production, cane crush is also lower than the past two seasons. This is due to low agricultural and industrial yields, and the trend is expected to continue. The weekly pace of sugar production is much lower than normal at this stage.

Source: CONADESUCA

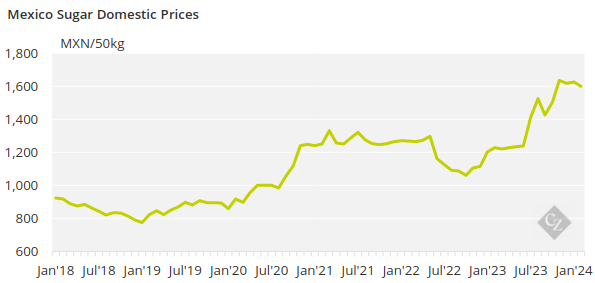

With lower production we have seen higher domestic prices for sugar.

Will High Domestic Prices Continue?

Mexico has been experiencing high domestic prices since 2021. Prices are now the highest in the past 6 years. The main drivers for high domestic prices in Mexico are lower production and continued US exports.

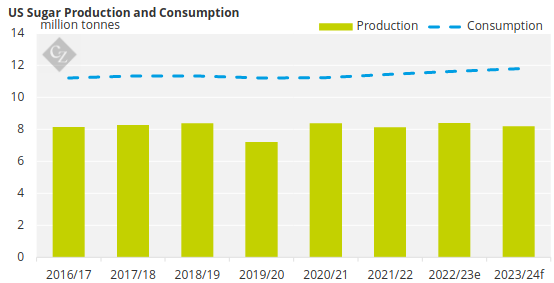

Since the US does not produce enough sugar to meet domestic demand, it has to import sugar. Most US sugar imports come from Mexico due to their close trading relationship and proximity in location. Mexico will always look to export sugar to the US.

444

444

Even with lower sugar production, Mexico will export as much sugar as possible into the US. This means that the combination of lower availability from Mexico as well as continued demand from the US puts pressure on domestic prices, causing them to increase. As this situation continues, domestic prices will remain elevated.

How Will Mexico Meet Its Sugar Shortfall?

With lower sugar production, Mexico will be looking for sugar from its neighbors to enable it to fulfill as much of its US quota as possible. Last season, most imports came from India, Central America and Brazil.

Given that India is unlikely to export due to lower production and Guatemala’s sugar production is expected to fall by 5%, we will see Mexico import sugar from regional trade partners in Central America and Brazil.