Insight Focus

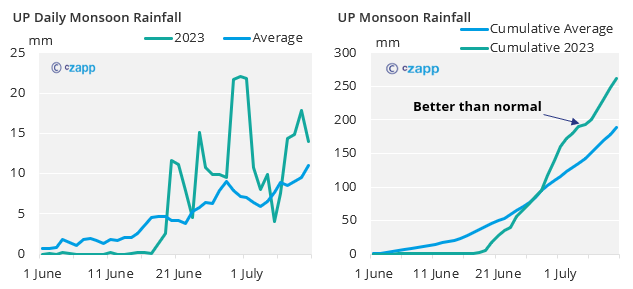

- Monsoon rains are now better than normal in Uttar Pradesh.

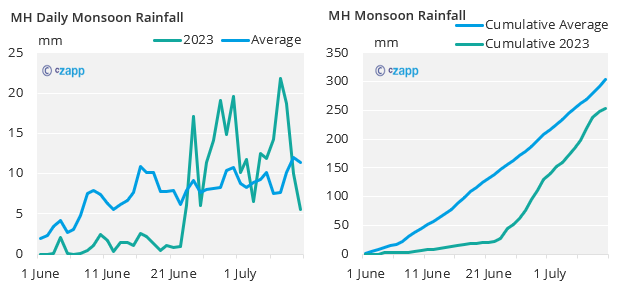

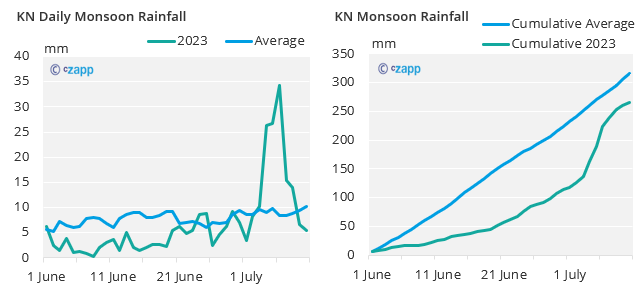

- Rainfall in Maharashtra and parts of Karnataka is still below average.

- How could this impact sugar production?

Catching Up After A Slow Start

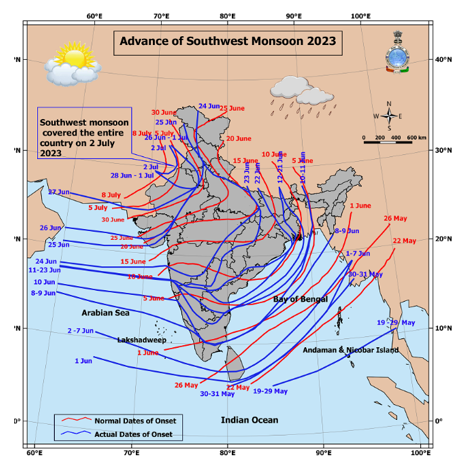

By the start of July, Monsoon rains had spanned across all of India. This was 6 days earlier than average despite first reaching the South East of India a week later than normal.

Source: IMD

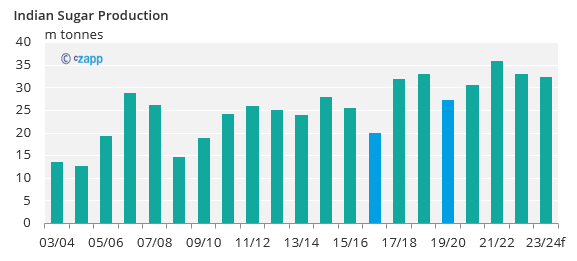

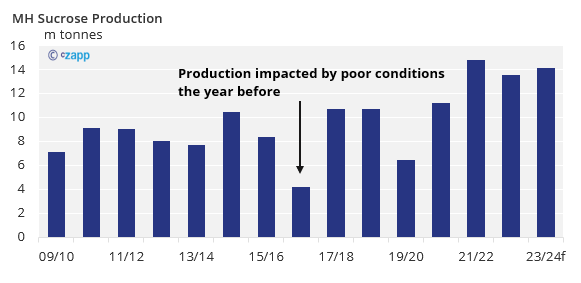

Rainfall over the monsoon period is important for many crops across India (including soybeans, corn, cotton and rice) not to mention the millions of farmers whose incomes and livelihoods depend on agriculture. For sugar, production can fall significantly in years where there is not enough rainfall. The most recent occurrences of this were the 2016/17 and 2019/20 season.

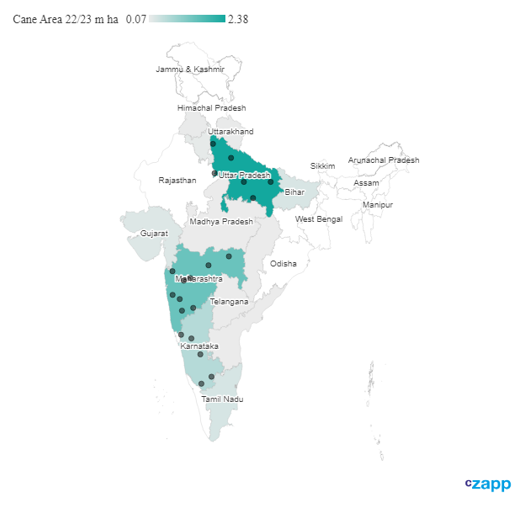

Let’s look at how the monsoon has progressed over the key sugarcane growing states of Uttar Pradesh (UP), Maharashtra (MH) and Karnataka (KN) which grow almost 80% of India’s cane.

India’s Sugarcane Regions (Dots Represent Weather Locations)

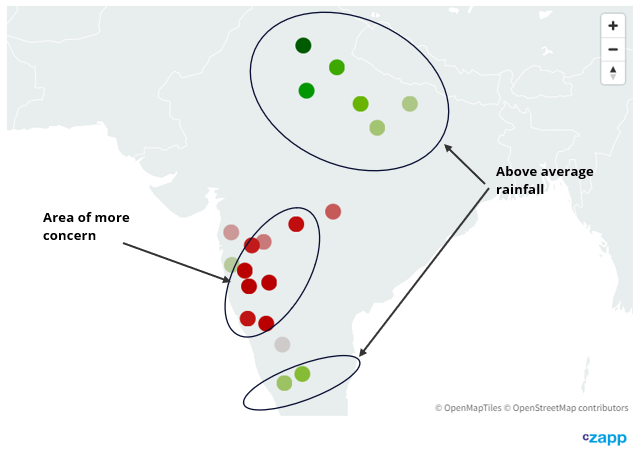

Total rainfall since the start of the monsoon season (June 1st) has been better than average in UP and the South of KN. Parts of MH have not had as much rainfall as usual. The worse affected locations have only had half the rainfall they would normally expect.

Rainfall June To Present (Green = Above Average; Red = Below Average)

The following charts are based on an average (mean) of several locations in the state (shown above) that were selected to represent

areas with the most cane.

This confirms that UP has had the best rainfall out of the key sugarcane growing states so far: Since mid-June rainfall has been much better than average in Uttar Pradesh. So much so that overall rainfall since June started is about 70mm (30%) than the average since 1990.

There has been much more rainfall in MH in recent weeks but so far this has not done enough for total rainfall to catch up to the long-term average. As shown above there are certain areas in the state which are more of a concern.

KN follows a very similar pattern to MH in that there has been lots of rainfall in July but so far this has not been enough to make up for the below normal rains in June.

A Good Starting Position

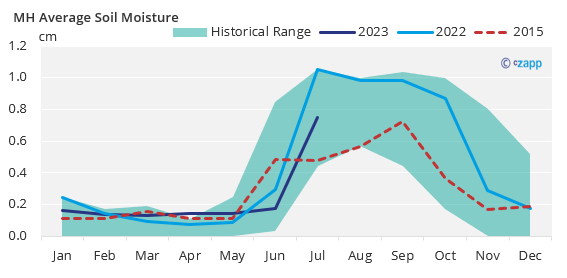

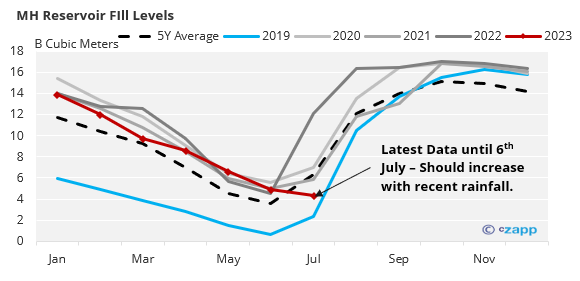

Clearly there is some concern about the rainfall in KN and MH but we are not too worried at this stage about the impact on sugar output. Soil moisture in MH, which is usually the key swing state in sugar production started from a good level before the monsoon season. Halfway through July soil moisture is already significantly better than in previous poor years such as 2015.

We want to highlight that the biggest impact on sugar production isn’t usually seen until the year after any dry conditions. For example, the low soil moisture in 2015 caused a significant fall in sugar production the season following (2016/17).

Therefore, we would expect the biggest risk to sugar production to be for the crop after next – 2024/25 -rather than the upcoming 2023/24 campaign. Reservoir levels across the country and in MH also started from an above average level before the monsoon season and should be filling quickly now that the rainfall has started. This may help make up for below average rainfall in June.

Ultimately, the rain needs to keep falling consistently over the next month to ensure that water availability isn’t a problem for the next 2 sugarcane crops. This means that by the end of July, we should have a much clearer picture about how water availability will impact the next 2 sugar crops in India.