Opinion Focus

- The world needs more clean and cheap energy.

- Brazilian biogas production reached 2.8 billion cubic meters in 2022.

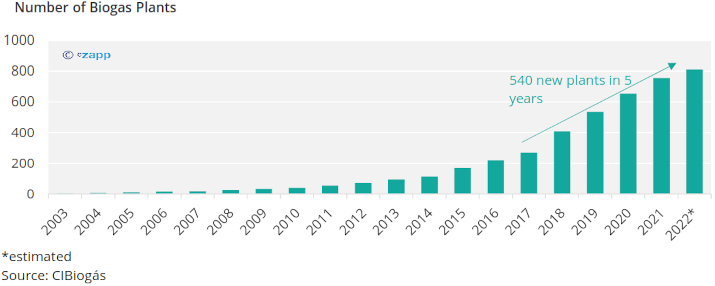

- 811 plants are operating, up 7.4% in a year.

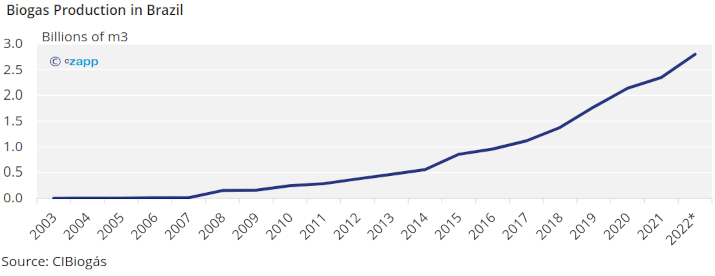

The year 2022 ended with good news for the biogas market in Brazil. The expectation is that production has reached 2.8 billion cubic meters, a growth of 21.3% compared to 2021 – compared to 2020, the increase reaches 33%. In 2022, at least 56 plants were installed or renovated, in addition to the 755 that already exist, according to CIBiogás, a reference center in renewable energies.

For comparison purposes, in 2017, the country had 271 plants. In 2021, that number had already reached 755, with an offer of 2.3 billion cubic meters of biogas. By 2030, 30 million cubic meters of renewable natural gas should be offered per day, equivalent to 11 billion cubic meters per year, according to estimates by CBIogás.

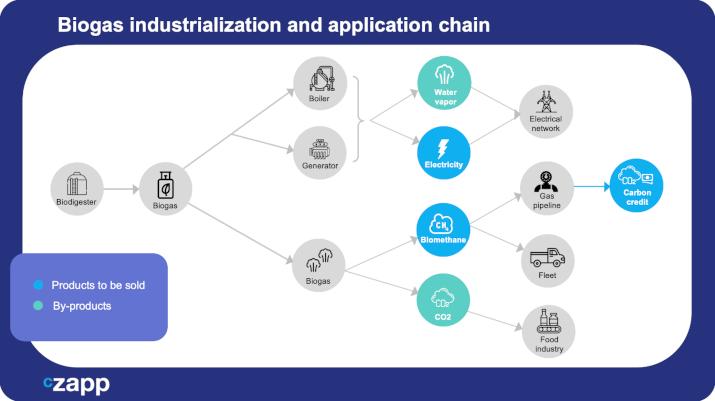

Biogas, produced from the decomposition of organic matter, is considered a clean energy source. In the form of biomethane (biogas with high levels of purity), it can replace diesel and natural gas. Renewable gas is also used to generate electricity. “The demand from companies that have used biogas in their production processes has been growing, largely due to the need to reduce the emission of greenhouse gases”, says Tamar Roitman, executive manager of the Brazilian Biogas Association (Abiogás).

With the heated market, investments continue to rise. Over the next five years, 40 plants should start operating, requiring investments of around R$ 8 billion, according to Abiogás. In recent years, the market moved about BRL 3 billion.

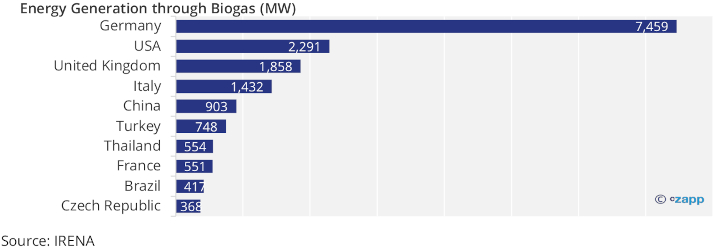

The proportion of biogas in the Brazilian energy matrix has also grown. In 2021, the last year with available data, it accounted for 1.4% of energy generation in the country , with an expansion of about 9.5% per year since 2019, according to the Energy Research Company (EPE), linked to the Ministry of Mines and Energy. Currently, Brazil has 422 power generation plants using biogas. Another five plants have already been authorized to start operating by the National Association of Petroleum, Natural Gas and Biofuels (ANP).

Currently, Brazil occupies the ninth place in the ranking of countries that produce the most energy through biogas, behind Thailand and France. Germany figures as the absolute leader, with the generation of 7,459 MWs per year. If the expansion of the sector is confirmed, in the next ten years the country should climb more positions in the ranking.

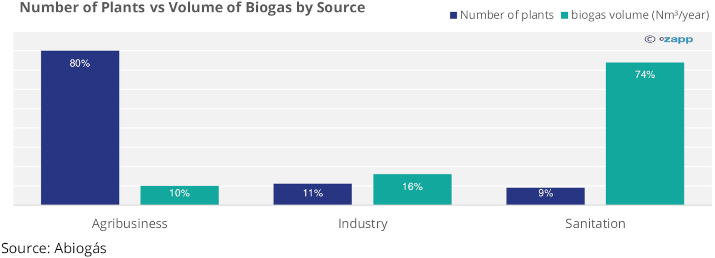

“The country has a significant potential for the production of biogas, especially due to the power of Brazilian agribusiness, the main source of raw material for this energy matrix”, says Roitman. Agricultural activity, with emphasis on livestock and the production of sugar and ethanol, accounts for 80% of the biogas plants in operation in the country. On the other hand, it produces 10% of the volume of biogas. The sanitation sector, with 9% of the plants in operation, produces 74% of the total offered. The good news is that there is great potential for expansion in the production of biogas by the sugar and alcohol sector.

The investment capacity of the plants has already been putting agribusiness at the forefront of biogas production in Brazil and should grow even more. With this, the expectation is for a greater gain of scale in the coming years, which should generate new impetus for the biogas market.

Large companies in the sugar and alcohol sector have been considerably increasing investments in the sector. Raízen should inaugurate its second biogas plant (and the first one totally dedicated to biomethane) this year, with investments of around BRL 300 million. Located in Piracicaba, in the interior of São Paulo, the factory should have the capacity to produce 26 million cubic meters of biogas per year. Production will be directed to two large customers, Yara and Volkswagen, which must use renewable natural gas in their production processes.

“We believe that the sugar and alcohol sector will be an important growth vector for biogas production. Each plant will have a specific solution according to its industrial situation. We have an ambitious investment plan starting with the inauguration of our first biogas plant in 2023”, says Christiano Forman, president of the independent energy producer Albioma in Brazil.

The market is also keeping an eye on an important by-product of biogas, CO2. The demand for carbon dioxide, used by the food and beverage industry, steelworks, and hospitals, among others, continues to rise. The issue is that the main sources of CO2 are petroleum derivatives, which are harmful to the environment. Biogas has emerged as an alternative to obtaining carbon dioxide. CO2 is released during the biogas purification process and can be stored for sale.

Projects related to the production of green hydrogen, considered the fuel of the future, are also starting to emerge. Rich in methane and carbon dioxide, biogas can be transformed into green hydrogen through treatment and purification processes.

Large business groups such as Engie, Fortescue Future Industries (FFI), Neoenergia, AES, EDP, Eneva , Nexway and Transhydrogen , have already announced their intention to invest in the manufacture of green hydrogen in the country, especially in the industrial centers of Camaçari, Bahia , Pecém, in Ceará, and Suape, in Pernambuco. Production of the new fuel should reach 13 million tons by 2040 in Brazil. In 20 years, this market could move US$ 200 billion globally, according to projections by McKinsey consultancy.

Challenges

Despite market growth and positive prospects for the coming years, there are challenges to be overcome. One concern flow and distribution. “Brazil has few gas pipelines, and most are located in the Southeast, which makes it difficult for the sector to expand more quickly”, says Roitman.

The lack of a comprehensive infrastructure, with a wider network of transport gas pipelines and processing units, represents another important gap, as it makes it difficult to gain scale.

The regulatory framework for gas, approved in 2021, made it possible to open up the market by prohibiting the same company from operating in all-natural gas production and distribution processes – until then, Petrobras controlled, for the most part, import and processing and about 80% of the distribution. As a result, new expectations were opened for increased competitiveness and the arrival of new players in the sector. In practice, there was a monopoly by Petrobras, which did not favour the private sector, in the view of the market.

The new law also introduced the authorization regime for the construction of gas pipelines, dispensing with the requirement for public bidding. However, there is still a need to promote harmonization between federal legislation and state legislation on gas transportation. “It is necessary to resolve infrastructure bottlenecks and legal issues so that the sector can conquer more significant leaps in growth”, says Roitman.

Do you want to know more about the biogas market? Please contact corporatefinance2@czarnikow.com.