- Brazil approves fuel tax changes, that now goes to presidential sanctioning

- At the same time, Petrobras increased gasoline prices last Friday after more than 90 days without readjustments

- Could one offset the other in trying to reduce fuel prices for consumers?

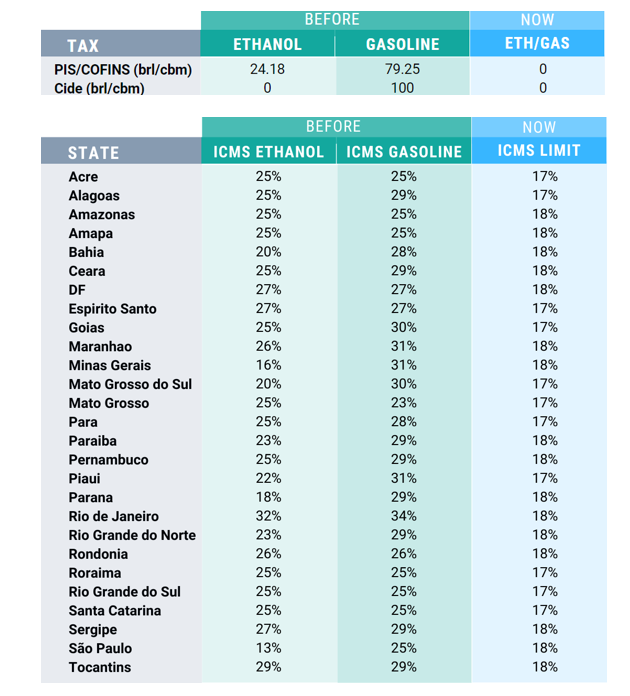

Last Wednesday, the Senate has approved the proposed changes in ICMS, PIS/COFINS and Cide.

The ICMS state tax for fuel will be limited to 17 and 18%, depending on the state, and the federal taxes PIS/Cofins will be zeroed for gasoline and ethanol until 31st of December.

We mentioned in our first report of the series , that we believed there was a risk of an increase in ethanol ICMS (specially in Sao Paulo state) as a way of compensating the losses with tax revenues.

However, a Constitutional Amendment (PEC) has been drafted to maintain the ethanol tax competitiveness. It has been approved in the Senate and will go on for approval in the House of Representatives.

If approved, it makes the ethanol price outlook less bearish.

Narrowing Down the Scenarios

Throughout this turmoil of tax proposals, we ran countless scenarios uncertain of which would prevail. And so far, we have at least 2 things certain: ICMS tax reduction for gasoline and federal taxes (CIDE and PIS/COFINS) zeroed until the end of the year.

What is the impact for ethanol prices?

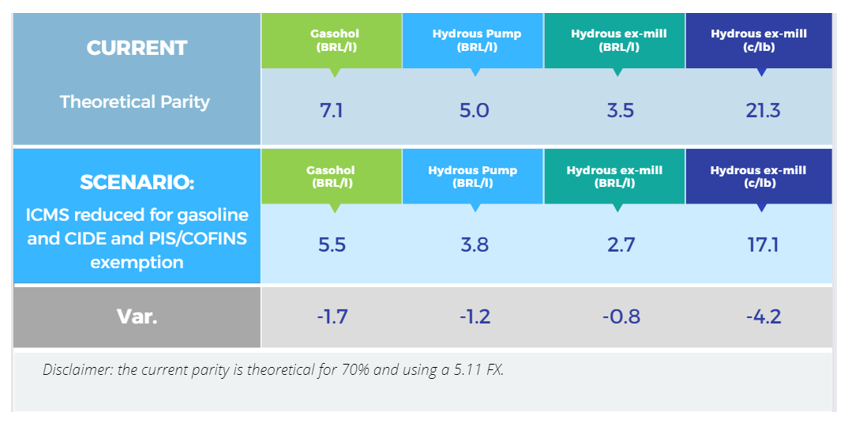

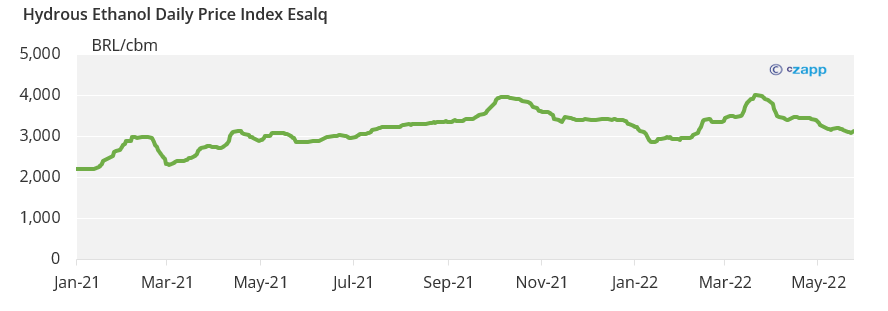

If the ethanol PEC is not approved, (i.e., if ethanol ICMS taxes are maintained as they are), then ethanol prices on a No.11 basis would need to fall around 400pts to keep its competitiveness against gasoline.

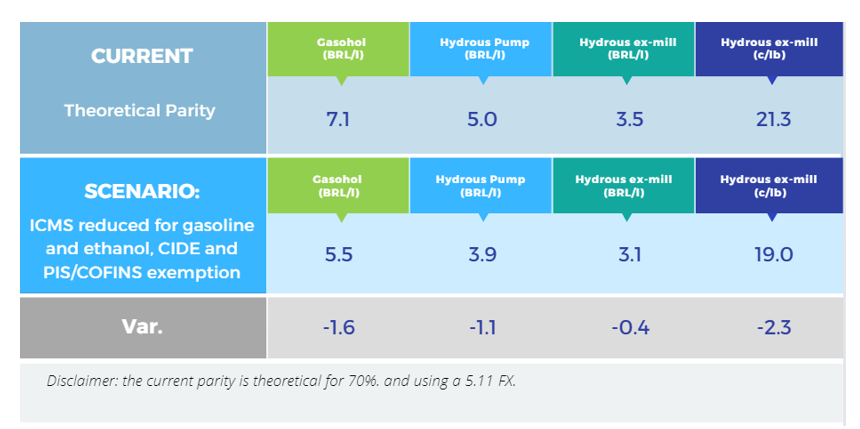

On the other hand, if the ethanol PEC is approved, and ethanol ICMS taxes are reduced, then we don’t need for ethanol prices to fall that much. In this case, we see a downside of 200pts for ethanol prices when compared to the theoretical parity.

All of the scenarios above already consider the gasoline price increase of 5.18% announced last Friday.

The ICMS tax reduction and PIS/COFINS exemption should come to effect on 1st of July.

Adding Fuel to the Fire

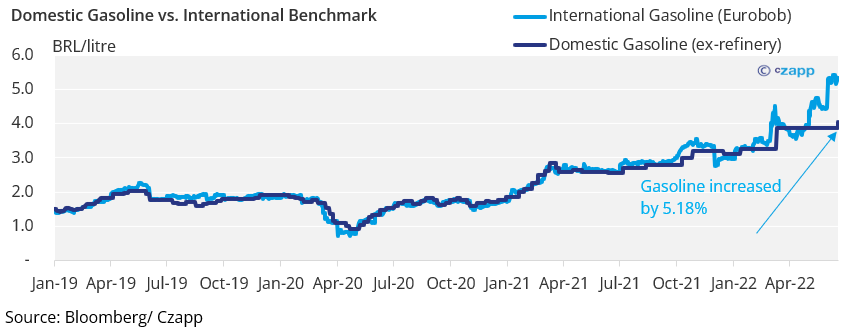

Like mentioned in our previous report , domestic gasoline prices were 26% lower than the international benchmark and without readjustment since March.

We anticipated that Petrobras was waiting for the fuel tax proposals to be approved before making any changes in the domestic fuel prices.

And lo and behold they did.

As of Saturday, gasoline prices at the refinery rose 5.18% to BRL4.06/litre. This change alone represents a 90pts upside for ethanol (in a No.11 basis) or a BRL0.15/litre– assuming a 70% parity and FX at 5.11.

This price increase does not offset the fuel tax reductions. Once tax changes are implemented, consumers will still benefit with a price reduction at the pumps.

However, this small increase in gasoline prices was not enough to close the gap against the international benchmark. If the BRL weakens further, and the oil market outlook stays positive, bigger readjustments will need to be made in order to maintain Petrobras price policy – which is already being questioned.

The decision to increase fuel prices served only to enrage the Brazilian Government and cause the resignation of yet another Petrobras CEO – Specially after all the political ammunition spent on approving an ICMS tax reduction.

Discussions have been in place to freeze fuel prices over the next 45 days to come up with a better international fuel price parity formula.

With elections coming up, we don’t see any additional strength in the oil market being passed on to ethanol…

Other Insights That May Be of Interest…

- Why Brazil’s ICMS Tax Matters to the Ethanol, Sugar Markets

- New Brazil Tax Proposals Could Be Bearish for Ethanol, Sugar

Explainers That May Be of Interest…