Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

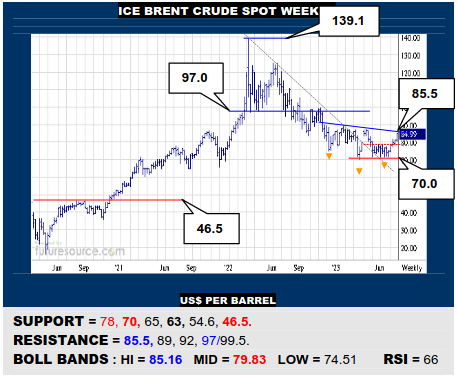

ICE BRENT CRUDE OIL SPOT WEEKLY

Pulling away from 2 months’ consolidation under 78 enhances the prior downtrend escape as Brent now seeks out the 85.5 neckline exit from a bigger inverse H&S, success lighting a path to triple digits. Be cautious if the Dollar vaulted 102 to sharpen its upturn though, then leery of being denied by 85.5 here and veering back under 78 to reveal 70 once more.

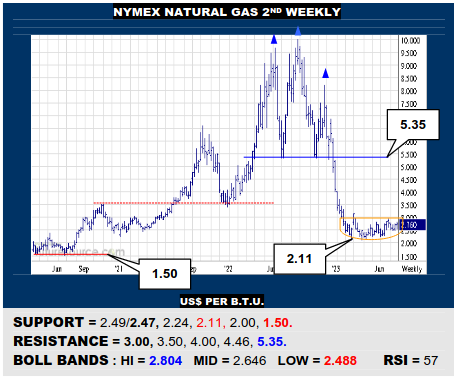

NYMEX NATURAL GAS 2ND WEEKLY

’23 remains a drawn out struggle to try to develop the leveling off in the 2’s into an actual saucer shaped base but, after several false starts, Nat Gas must now reach the 3’s to signal success and release the shackles for a reaction back up towards the huge H&S above 5.35. While still stumbling in the high 2’s, watch 2.47 as a trigger back down to 2.11.

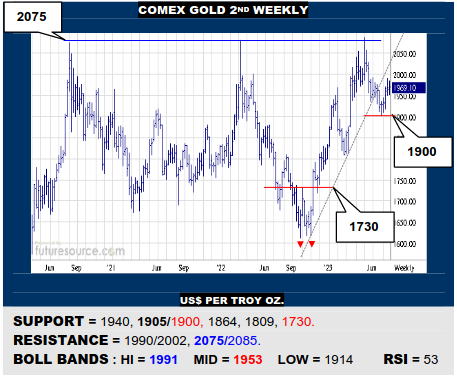

COMEX GOLD 2ND WEEKLY

Golds’ Q2 setback was stemmed by a smaller 38.2% Fib retracement (1905/1900) but the resulting upswing has since faded near 1990. If still able to hold aboard 1940 while the Dollar flinched, there could yet be a second wind to try to cross 2K. Alas, if the Dollar rallied further and 1940 gave way here, watch 1900 as a tripwire well down to 1730.

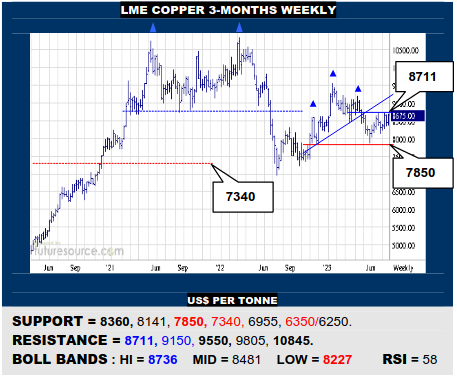

LME COPPER 3-MONTHS WEEKLY

Copper has seen several summer attempts to get back on the gas foiled at 8711 but it is still trying to rustle up another attempt. Ultimate success in breaking beyond while the Dollar broke 99 would install a useful triangle base to access a prior H&S neckline (9150) or better but do also mind 8360 as a stumbling block to veer back to 7850 instead.

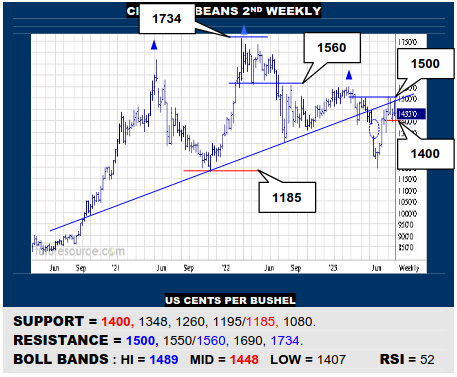

CBOT SOYBEANS 2ND WEEKLY

The summer rebound continues to be parried by the huge ‘21/’23 H&S neckline. To cast this aside Beans must pierce 1500, in which case presenting scope to 1734. Teetering awkwardly meantime so beware any exit from the 1400’s reaffirming the top blockade and instead warning of another sharp deviation south to the 1200 area or deeper.

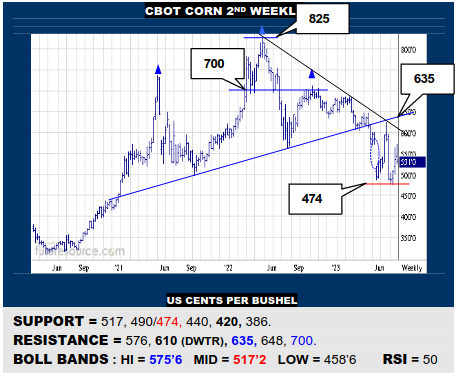

CBOT CORN 2ND WEEKLY

A second dive into the upper 400’s has been warded off but Corn still faces an obstacle course in the 610-635 region if it is to bust into the prior big H&S top and so create more enduring upside scope. If denied access to the 600’s, stay wary of the threat of pressing on through the 490-474 troughs into broader monthly support between 440 and 420.

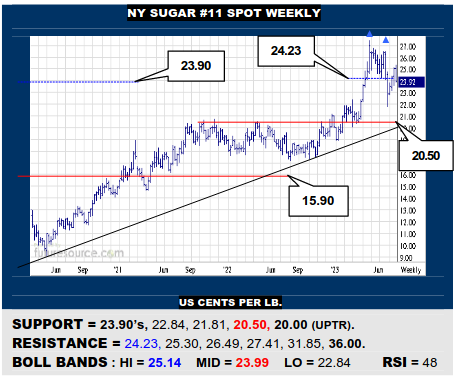

NY SUGAR #11 SPOT WEEKLY

Though stabbing into the top over 24.23, Sugar was blocked at a Fib retracement (25.27) of the prior Q2 dive before being steered back to the mid band (23.99). If this became a clearer ousting from the 24’s, it would reassure the former top and pose a new threat down to 20.50. Must hold near 24₵ to regroup and still have a shot at the 27’s again.

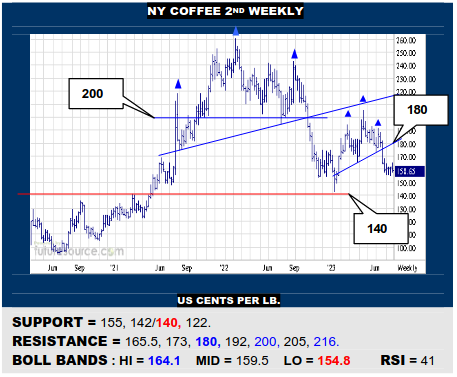

NY COFFEE 2ND WEEKLY

Coffee’s bid to veer higher has been blocked in the 165’s this week as the Dollar regained altitude. Thus Jly now just looks like an exhale after the Jun dive from the first half ’23 H&S and could become a bear flag if 155 gave way, in that case paving the way down to the bigger 140 shelf. Must punch cleanly over 165.5 to otherwise galvanize the upside case.

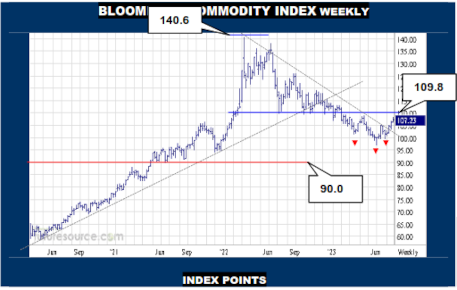

BLOOMBERG COMMODITY INDEX WEEKLY

Undoubtedly a hopeful start to Q3 for the B-Berg as it shook off the downtrend of the past year and a quarter to present ’23 in the light of a slightly distorted inverse H&S, action generally echoed by the two Crude markets. Even so, with the Dollar seemingly at a pivotal stage, there is plainly the need for the commodity index to pop that hefty next resistance cordon draped across 109.8 to shore up its basing claim and open a broader path into the mid 120’s. If the greenback meantime bust clear of the 101.60’s former gap area and swatted the B-Berg away from 109.8 back under its mid band (104.5), the promise of Jly would fizzle and shift context to just that of a failing mid-year correction.

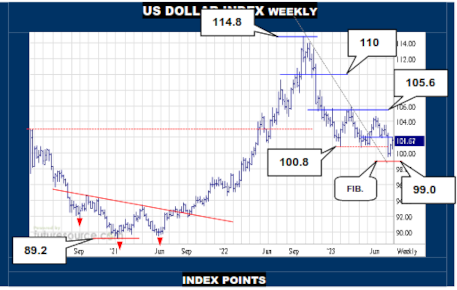

US DOLLAR INDEX WEEKLY

The Dollar managed a May downtrend escape of its own but fumbled and has lately delved down to a brief look at the 99’s. This got close to an actual Fib retracement of the big ‘21/’22 advance (99) before rebounding in the past fortnight to the tiny 101.60’s gap. If this reflex were now promptly suppressed, it would later look like just a quick gap-fill correction and loss of the 99’s would pave a more extensive decline into the bulk of a previous inverse H&S lying under 93. For now though the Fib catch sounds a warning for commodities and if able to cleanly escape across the 101.60’s gap into the 102’s, it would signal a pivotal shift in the broader macro detrimental to the B-Berg.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2023 Technical Commentary.