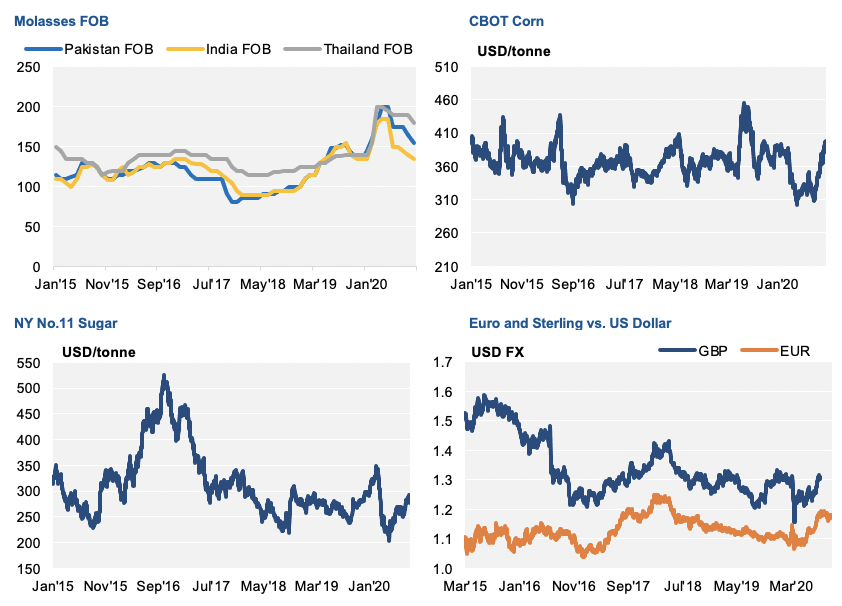

The cane molasses prices have been broadly uncompetitive against corn and wheat prices for the last five years, with the molasses price averaging $169/mt (CIF), compared to CBOT corn and wheat prices of $143/mt and $175/mt.

Molasses is still an important animal feed ingredient, with approximately 56% of the global molasses imports consumed in the feed sector. Traditionally, molasses was a low-value substrate with a useful energy content and pelleting properties. Since the expansion of fuel ethanol policies in the early 2000s, molasses prices have increased substantially and reduced the competitiveness of molasses in feed.

In theory, molasses needs to trade at a discount to alternative feed ingredients, which seen above has not really been the case, with molasses more expensive than US corn over the last years on average. There has been a discount to wheat, however, this has only been an average of $6/mt.

Current CBOT corn and wheat December prices are $153/mt and $219/mt respectively, with molasses at $195/mt. Therefore, molasses has regained some competitiveness against wheat, with a discount of $24/mt, although the recent rally in corn prices from $121/mt in July to $153/mt ($3.88/bu) has some way to go before it makes a real difference to the molasses market.

The same can be seen in the sugar market, with the sugar price recovering from the lows of under 10c/lb ($220/mt) in April, towards 14c/lb ($308/mt) at present.

In our last report, we said India would be a pivotal supplier of cane molasses and likely shape the direction of global prices later this year and into Q1’21. This is still holding true and the Indian supply picture looks positive at present, with over 700k tonnes of molasses available for export from the new crop beginning shortly. What will the impact be on prices? It will hopefully provide a ceiling for molasses prices, which could further assist with improving the competitiveness of molasses.

Of course, the next issue will be whether this increases the demand of molasses and the price rises as a direct consequence. At present, the price rises in the other commodities are not likely to be sufficient to move the needle on molasses demand. They more represent a relative return to normal prices after the low level, seen earlier in 2020 at the height of the global COVID-19 lockdowns.

Other Opinions You Might Be Interested In…