Insight Focus

- China’s soybean demand will track pork demand.

- Brazil, US will be most affected as the two main origins.

- China is not expected to use the new Vietnamese African swine fever vaccine.

Chinese soybean demand has been hit by a decrease in the sow herd, African swine fever (ASF) and low margins. Also, Shanghai’s lockdown has only just been lifted, so any recovery in demand will take some time. Although in the short term soybean demand will not strengthen significantly, it should grow in the long term.

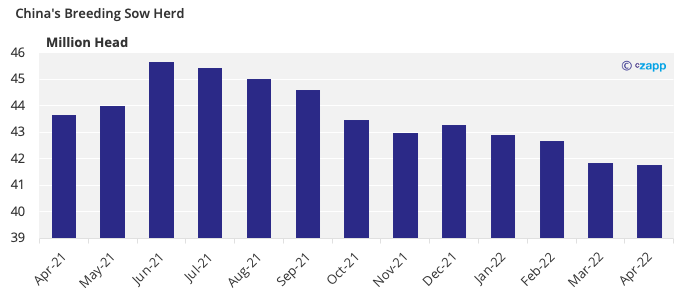

Sow Herd Decrease Month by Month in China

The number of sows in China had been on a downward trend for10 consecutive months. There were 41.77 million in April, a decrease of 80k from March.

In the second half of 2021, the drop in the number of breeding sows led to a slowdown in demand for soybean-based pig feed.

We think soybean demand will fall over the northern-hemisphere summer. In China, one of the customs of Dragon Boat Festival in early June is to eat pork dumplings. After this, demand for pork will drop. Pork is eaten at all Chinese festivals. However, with fewer festivals in the short term, we are entering a period of seasonally weak demand. In hot weather consumers move away from eating pork, which will also contribute to the seasonal fall in consumption.

In terms of the pig breeding cycle, the drop in pig numbers lags that in sows by 10-12 months. That means the fall in sow numbers in July-August last year will be reflected in pig numbers in May-August this year. Therefore, we expect soybean consumption to go down as well.

New Feed Rules Cut Soybean Content

Earlier this year, the Ministry of Agriculture set a national standard for compound feed to reduce average protein content.

To cut costs, low-protein feed has been promoted on large pig farms by adding soybean substitutes such as wheat and corn. If pig producers are following these rules, this too will mean lower demand for soybeans.

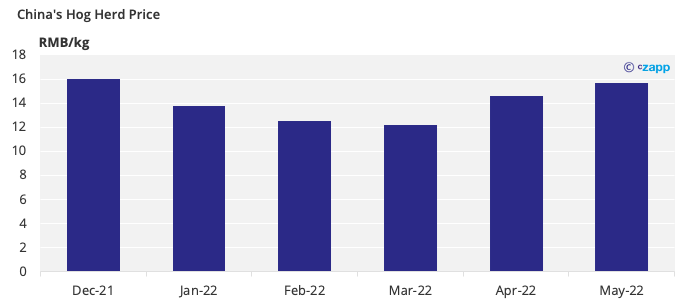

Pork Price Rebounding Will Increase Pig Margins

Meat consumption in China has been sluggish since early 2022. In addition, the COVID-19 pandemic caused farmers to sell their pigs. As a result, the pig market was oversupplied, the price fell, and rearing pigs became loss-making.

However, the pig price has recovered since March. In response to ASF outbreaks in several countries, some Chinese provinces banned the movement of pigs. For example, Guangdong province banned the entry of pigs from other provinces, which bolstered prices.

In the long term, the recovery in margins will encourage restocking in Q4, helping to increase feed consumption in early 2023 and in turn leading to stronger demand for soybeans.

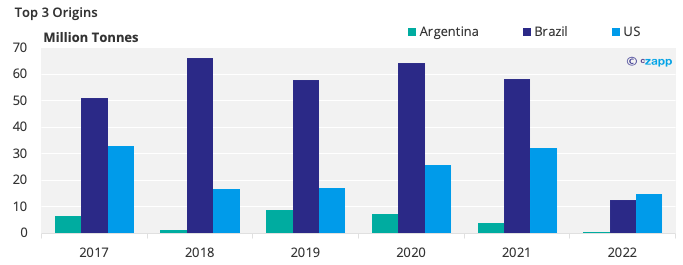

Soybean Imports from Brazil, US Affected

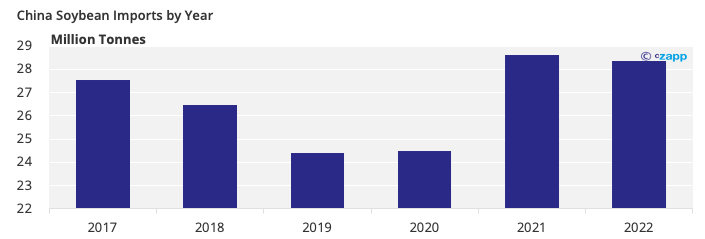

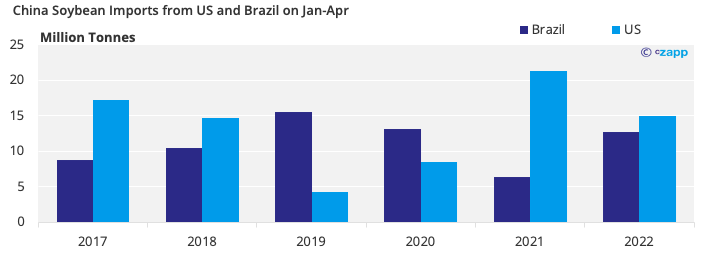

Over the past few years, China has imported large quantities of soybeans. The US and Brazil are the two main origins.

China imported 28.36 million tonnes of soybeans in January-April 2022, down 0.8% year on year.

Falling soybeans consumption in China in the short term will also lead to weaker demand for soybeans from Brazil and the US.

In January-April, China imported 15.04 million tonnes of soybeans from US, down 29% year on year. But why there was an increase in imports from Brazil? This was mainly due to adverse weather delaying the harvesting and export of Brazilian soybeans.

If Chinese demand picks up in early 2023, demand for soybeans from the US and Brazil will also increase. But from which country will demand be greater? Price is likely to be the decisive element. The drought in Brazil from the end of last year to the beginning of this reduced yields. However, the US had a bumper harvest and the price is relatively low. China will probably choose the more price-competitive origin.

Will Vietnamese Vaccines Affect China’s Pig Market?

Vietnam has developed a vaccine against ASF, but we do not think it will have a major impact on the Chinese pork market in the short term.

China has been conducting research into a vaccine since January 2019 However, China has not yet made a breakthrough despite clinical trials now being underway because it relies on imports for some of the key reagents needed. This makes it difficult for China to develop its own vaccine.

The ASF situation in China is less severe than in Vietnam, meaning it is not yet necessary to vaccinate pigs.

China is very strict about imports, especially in areas that could have significant economic and ecological implications. Therefore, it is not easy to import vaccines. However, if the ASF situation in China were to become serious, the Vietnamese vaccine might be considered.

Other Insights That May Be of Interest…