1,020 words / 5 minute reading time

- Chinese sugar consumption marginally improved in March, after being at a near standstill in February.

- This came as people started returning to work and the lockdown measures were lifted.

- As the country reopens, sugar consumption should slowly return to ‘normal’ levels, with the return of restaurants and such like helping this.

Sugar Consumption Was Weak in Q1’20

- After very low sugar consumption in Q1’20, we still believe Chinese sugar consumption will fall by 800k tonnes in 2020.

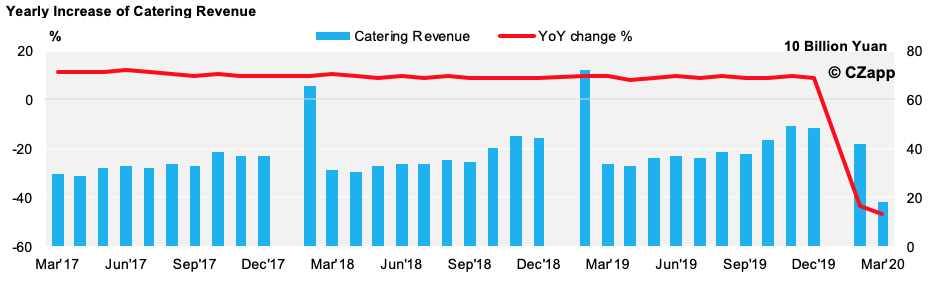

- The catering industry’s revenue in March was down 46.8% YoY, and its total revenue in Q1’20 was 43.4% lower YoY.

- The situation is worse still, because small businesses, which are discounted in the revenue number, may have closed down during the outbreak.

*In order to eliminate the influence of irregular factors caused by the Spring Festival holiday and enhance the comparability of data, from January 2012, the data for January and February will be investigated and released together.

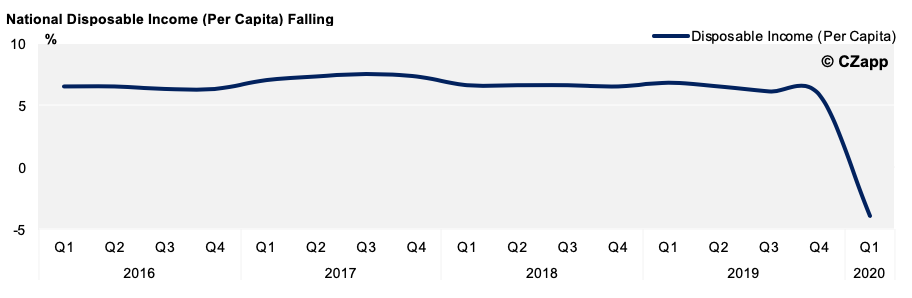

- The weakening economy also means people are getting paid less, and lower disposable income has a knock-on effect on sugar consumption.

- The national disposable income per capita was 8,561 yuan per quarter; this is a 3.9%decrease YoY.

- Despite this, food prices increased by 18.3% in March, and by 0.7% for non-food products.

- This means consumers are having to spend more on the same products because prices have risen rapidly.

- When consumers have to spend more money on essential products, they are more likely to cut their budget for non-essentials.

Sugar Consumption Rebounds After Country Reopens

- The good news is that industries are rebounding now the country is open again and people are returning to work.

- As of the 17th March, 98% of the large companies, and 60% of the small- to medium-sized companies were back at work.

- By the 30th March, the latter number had increased to 76.8%.

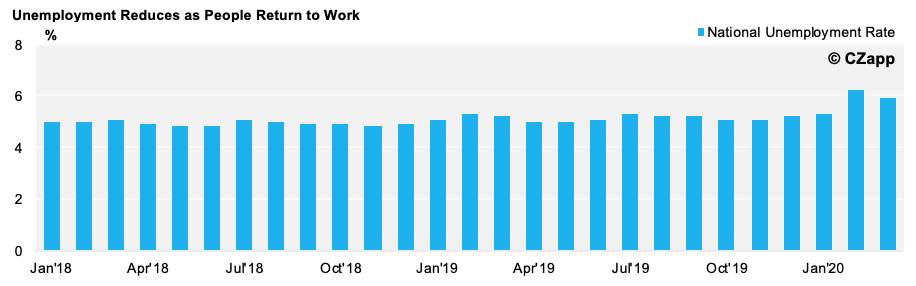

- In March, China’s rate of unemployment fell from 6.2% to 5.9%.

- This is positive for sugar consumption, as more people will soon have larger disposable incomes to spend on non-essentials.

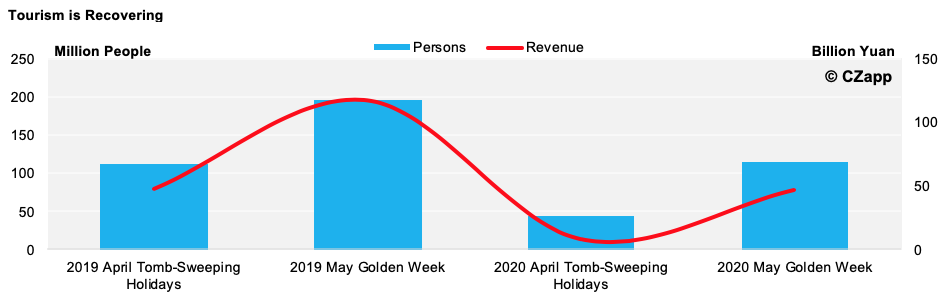

- The country reopening also means the tourism industry is too.

- This is a key contributor to sugar consumption by way of catering.

- On the 1st May for Golden Week, the amount of tourists was 115 million, 2.66 times of the Tomb-Sweeping holiday in early April; and the tourism revenue was 47.56 billion yuan, 5.76 times of the Tomb-Sweeping holiday.

Bubble Team Booms Again!

- Bubble tea is more popular than coffee in China (worth approximately 10 billion Yuan).

- So, since the lockdown has been lifted, people have been drinking large amounts of it.

- In the first week people went back to work (10th February), Shanghainese residents placed 160,000 online orders for bubble tea. This number soon broke through 330,000 three weeks later.

- It was not only the number of orders that increased, but the size of them. Some consumers switched from placing orders of 500ml to 5000ml!

- HeyTea and Nayuki, the top two players in the bubble tea market, have around 900 tea shops in China.

- So, the reopening of their shops is good for sugar consumption in general, as a 750ml bottle of bubble tea contains up to 13.2% sugar, which is the equivalent to 20 sachets of sugar.

Some Industries Are Still Under Pressure

- It’s not all good news, however, as some industries are still under pressure now the country has reopened.

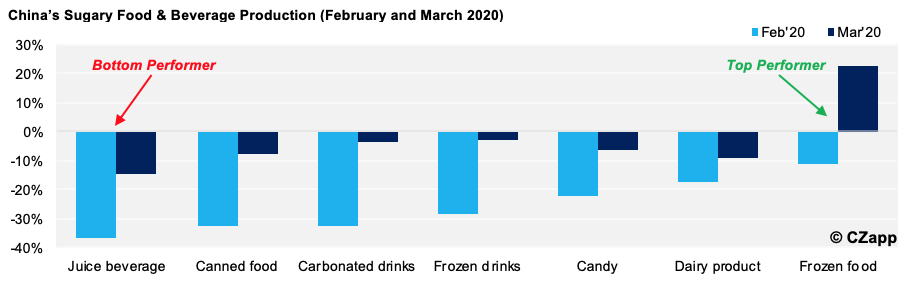

- During the first quarter of 2020, the production of sugary products was down significantly YoY.

- This is because sugar (the main feedstock) was stuck in the warehouses waiting for factories to reopen.

- And in March, all food and beverage producers were producing at a slower rate, apart from frozen food manufactures.

Frozen Food

Frozen food production was up 23% YoY in March. This includes products such as ready meals, steamed buns, dumplings, etc.

This strong production pace makes sense, as more people were dining more at home during quarantine. People will have also deliberately purchased products that could be stored for extended periods of time, so to avoid regular social interaction at supermarkets.

Juice

Juice production was the poorest performer through February and March this year. This comes down to logistical issues and transportation shortages, making it harder to deliver fruit between cities.

Dairy

Some dairy farmers had to pour out milk in February because they had limited transportation for delivery and the dairy factories were closed.

From a sales perspective, liquid milk sales were down in February because of its shorter shelf life than long-life products. Milk powder sales increased, however, as people stockpiled long-lasting milk, due to its convenience, health benefits and everyday use.

School closures amid the outbreak also hit the dairy industry hard. Empty schools means a lot of unused milk in China, as the Central Government’s School Milk Program distributes 18.5 million cartons of milk to schools across the country. As schools start to open up in China, the demand for milk should pick up again.

Candy

Wedding ceremonies are still banned in many Chinese cities. This measure has been taken to avoid large social gatherings. However, wedding banquets are a key contributor to China’s candy sales, so until this ban is lifted, this area of the industry will remain under pressure.

Carbonated Drinks

Carbonated drinks and frozen drinks are not the most competitive products during a pandemic because they are neither essential, nor good for your immune system. Their production rate has recovered in March, however, as the weather has started to warm up.

Canned Food

It is perhaps surprising that canned foods were not so popular in China during the coronavirus outbreak. Despite their long storability, people chose others instant and frozen foods instead.

However, people outside China seem to be stockpiling canned food during the pandemic. As China is a key exporter of canned food, exporting around 3m tonnes of canned food per year, this could be the silver lining for the industry with the increased demand coming from overseas.