Insight Focus

- Fixed income securities used to finance agriculture are in record demand.

- Issuance increased by more than 500% between 2018 and 2023.

- FIAGROs have also grown.

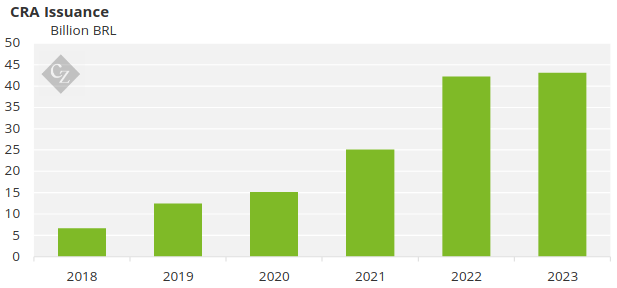

In recent years, there has been significant growth in the issuance of agribusiness receivables certificates (CRA), a fixed income security on the Brazilian market created to finance agribusiness activities. Between 2018 and 2023, the increase in CRA issuance exceeded 500%, reaching BRL 43.1 billion last year. In January of this year alone, CRA offers generated BRL 1.5 billion, according to the Brazilian Association of Financial and Capital Market Entities (Anbima).

Source: Anbima.

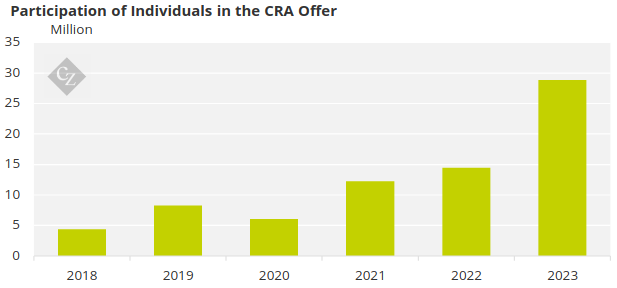

For the agribusiness market, this is great news. The CRA, after all, represents one of the sector’s main financing instruments. Launched in 2004, it offers good profitability and exemption from income tax collection for individuals. No wonder, in 2023, individuals represented the largest CRA investors.

Source: Anbima.

With the new law on taxation of exclusive funds (investment funds with a single shareholder, generally sought after by high-income investors), approved in January this year, the expectation is that there will be a greater demand for financial market instruments such as the CRA, exempt from income tax. Under the new rule, exclusive funds will be taxed. Tax rates can reach 20%.

At the same time, a resolution from the National Monetary Council established a new rule on CRA issuances. Now, they can only be done by companies that operate directly in the agribusiness sector. Until then, companies from other segments indirectly related to agribusiness, such as fast-food chains, could issue this type of title.

The organization of the market and the decision to tax exclusive funds should positively impact the demand for CRA, generating healthy competition with financial institutions. Banks are already beginning to observe a greater willingness to offer more competitive conditions when granting credit.

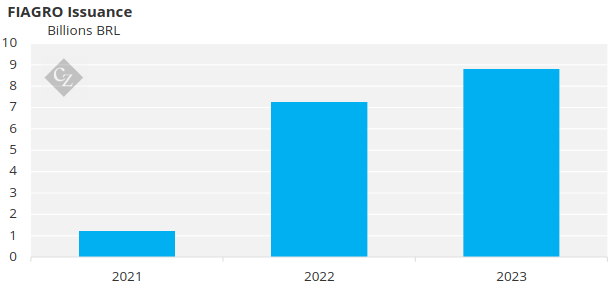

It is worth remembering that since 2021, agribusiness financing has had another ally, the Investment Funds in Agroindustrial Production Chains (Fiagros), which have also grown. Fiagros aim to raise funds from individuals or companies interested in investing in agribusiness. The funds invest in a wide range of assets, including equity interests in companies in the sector, rural properties and CRAs.

Source: Anbima.

Sugar sector

These instruments have been allowing greater access to capital for agribusiness companies and, of course, the sugar and ethanol sector. FIAGROs and the greater demand for CRA have been opening the doors of the financial market to agribusiness companies, including medium-sized ones that had greater difficulty in obtaining this type of financing.

Furthermore, new forms of sector financing and regulations have been attracting the attention of already consolidated companies, in a virtuous circle of greater access to the capital market and better credit conditions.

Last year, for example, Raízen announced the issuance of around BRL 1 billion in agribusiness receivable certificates. One of the objectives is to finance projects such as the construction of its second-generation ethanol plants.

Agribusiness financing. Source: iStock.

Sugar mills have also been looking with increasing interest at this fundraising instrument. ACP Bioenergia, one of the largest sugarcane producers in the country, issued around BRL 150 million CRA in 2022 and BRL 80 million last year. The objective is to finance the long-term expansion plan for sugarcane and grain production.

Coruripe is another good example. The company announced the issuance of more than BRL 156 million in 2022. The resources were used to support the company’s partner rural producers, in the Cerrado, who follow sustainable agriculture principles.

In other regions of the country, fundraising with certificates receivable from agribusiness has also grown. The JB Group, operating in the sugar and bioenergy sector in the Northeast, raised BRL 150 million with the issuance of CRA last year. This is a trend that is here to stay.