A Common Shock Gives Rise to Differential Responses

We expected greater than normal market volatility in the last quarter of 2020. It is ladened with geo-political milestones – a US Presidential Election, agreement of a post-Brexit trade deal and early insights about China’s next five-year plan.

Against this background, President Trump’s positive COVID-19 test and need to quarantine, ahead of a closely watched election is likely to push up on market volatility.

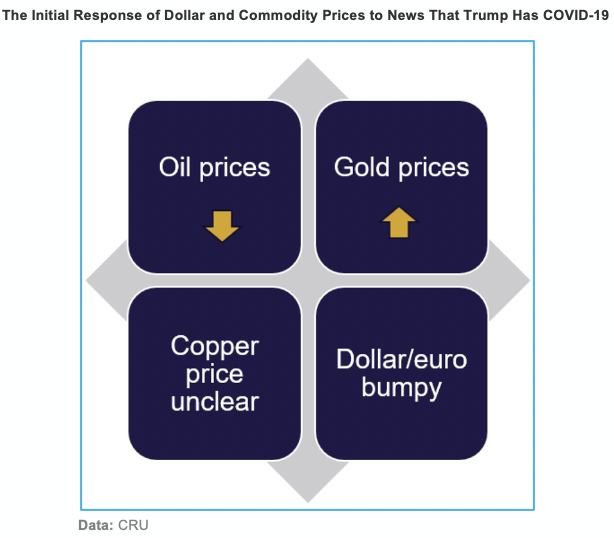

Equity markets fell on the news, as did oil prices. Markets in China were closed today (2nd October), due to the Golden week holiday. Copper prices started falling at midday on the 3rd October and virtually all the decline happened by the time Trump tweeted about his test (at 4.54 GMT).

This makes it hard to distinguish the marginal impact it had on Copper. In contrast, gold prices rose, reflecting its safe-haven status. Headline steel prices, such as the US Midwest sheet steel prices, are only available weekly, meaning the impact on a wider set of commodity prices will only be available next week.

Safe-Haven Commodities Rallied Before Losing Momentum

On the 2nd October, gold rallied by approximately $25/oz to $1,915/oz as a wave of risk-aversion hit global markets following the news. It prompted investors to seek refuge in safe-haven assets such as gold. As a sell-off in stock markets intensified, gold began to lose its bullish momentum, pressured lower by forced selling from cash strapped investors in need of meeting margin calls on their positions, or covering their losses elsewhere.

Looking at a broader precious metals complex, silver, another precious metal with safe credentials, rallied on gold’s coat tails. In contrast, prices of both platinum and palladium, which are more industrial at their core, corrected lower.

Copper and Oil Prices Fell

Responding to the news, the brent crude price fell 3% on intraday trading. Sentiment in the oil market was already bearish as weak demand data and rising COVID-19 cases signalled the economic recovery was waning. The latest news has further ignited concerns that growth momentum will slow further.

Copper is second to gold in being the second-most financially traded metal. The copper selloff began at roughly midday on 1st October and virtually all the decline happened before Trump tweeted about his positive test. The reasons for the copper sell are probably several-fold, including over 90k tonnes t of deliveries into London Metal Exchange warehouses in the prior three days is one possibility, along with improving copper mine supply and a pause in China cathode buying. Some correction in price for over-optimism in financial markets over the past six months may also have been a factor – in other words ‘Risks catching up with reward’.

Dollar and Euro to Remain Volatile for the Rest of 2020

On the 2nd October, the Dollar and Euro initially fell by 0.2%, probably reflecting concerns about the US outlook before rebounding on intraday trading. As US markets opened, there was also news about payrolls employment, which came in weaker than analyst expectations.

Moves in the Dollar and Euro are generally explained by three pillars – interest rate and growth rate expectations in the US relative to the EU, as well as markets’ desire for safe-haven assets. Dollar volatility today and in recent weeks is a function of news driving the pillars in opposing directions, making it hard to decipher the overall impact, particularly in the near term.

Volatility is King

The 2nd October was a volatile day in financial markets. Commodity prices moved to reflect this. The moves differed across markets reflecting a range of market factors – some unrelated to the news about Trump testing positive for COVID-19.

The story is not over, indeed it has only just begun. Expect markets to remain volatile as we get updates on the President’s health, among other things.

Looking ahead, one thing is for certain – market volatility will remain high through the end of 2020. News and developments about the election, the Brexit trade deal, and China will continue to buffet financial markets, including the price of highly traded commodities, such as oil, gold, and copper.

Find out how the global fertilizer prices were affected by the news in Interactive Data section.