- Strong start of the new season in CS, with 22mmt of cane crushed.

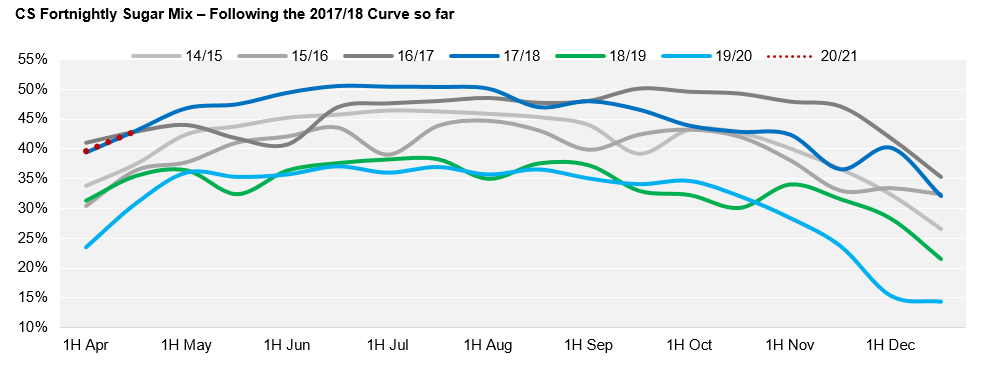

- As expected, mills are maximizing sugar output.

- Sugar produced in the 1H totalled 0.95mmt – the highest volume since 2016/17.

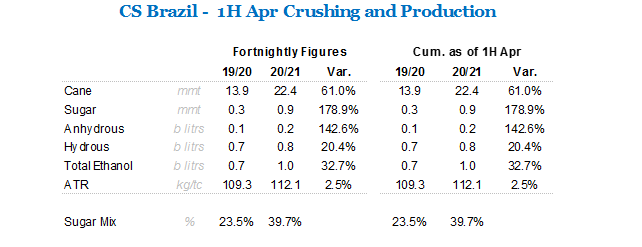

Summary Table 1H April

Strong Start

- Crush totalled 22mmt in the 1H of April – 61% higher yoy.

- This is the strongest start of the season since 2016/17.

- Mills in operation totalled 172 vs.157 last season.

- While UNICA mentions that around 20 mills have postponed the start of the season due to uncertainties, it is not the standard of the CS region.

- Producers are taking extra precautions in order to protect its employees and make sure that operations carry out normally.

- So far, all mills are crushing without problems.

- As for product output, as expected mills are maximizing sugar production.

- Sugar mix registered in 1H of April was 39.7% – the highest since 2017/18 – resulting in a sugar production of 0.95mmt.

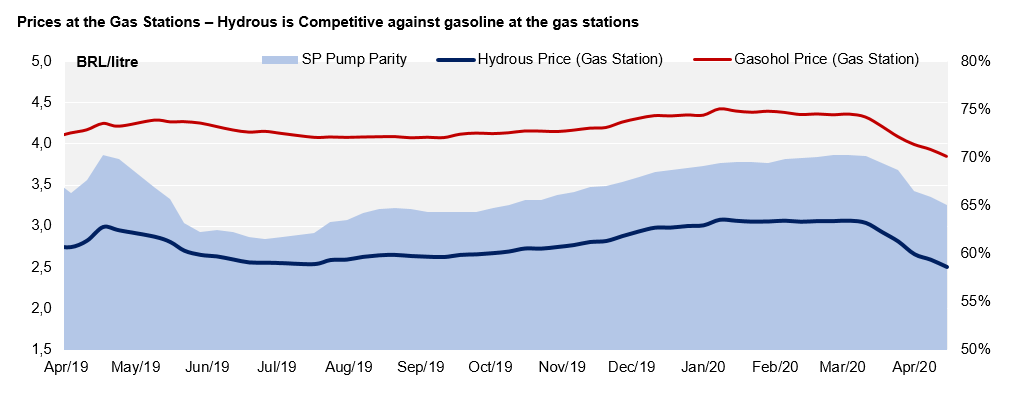

Ethanol Market

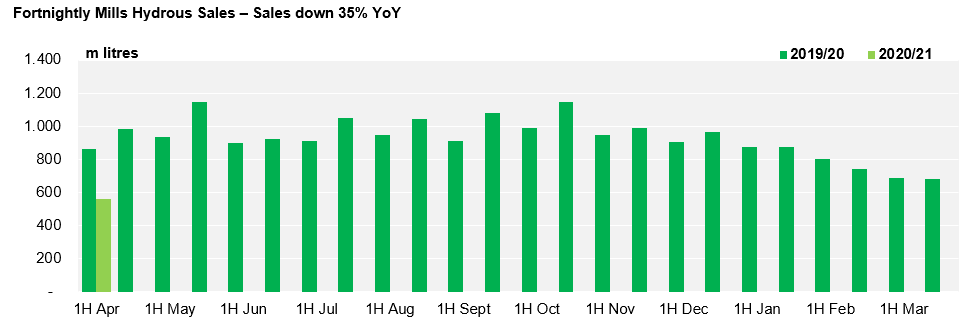

- As expected, hydrous sales fell during the 1H of April.

- The volume sold by mills totalled 560mi litres.

- Fall in sales reflects the coronavirus lockdown measures, and not a fall of hydrous competitiveness of the biofuel.

- Fuel prices have fallen significantly at the gas stations, and hydrous parity reached 65% last week.